What Happens if You Don’t Pay Klarna?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you unsure about what happens if you can’t pay your Klarna debt? You’re in the right place. Every month, more than 170,000 people visit our website to understand debt solutions.

In this simple guide, we’ll answer your questions:

- What happens if you miss Klarna payments?

- Can you write off some Klarna debt?

- What if Klarna can’t get hold of you?

- Can you delay a payment to Klarna?

- Can Klarna affect your credit score?

In 2022, arrears on household bills increased by 68% from £1,739 to £2,9201. So, it’s common for people to struggle with debt. If you find yourself in this situation, don’t worry.

We’re here to help you find the answers you need and guide you through your Klarna debt. Let’s get started.

How does Klarna Deal with Missed Payments?

If you can’t make a payment on the due date, Klarna tries to collect the money a couple of days later. After this, if payment is not collected the process is as follows:

- Klarna sends a statement detailing the amount owed

- You have 15 days to pay

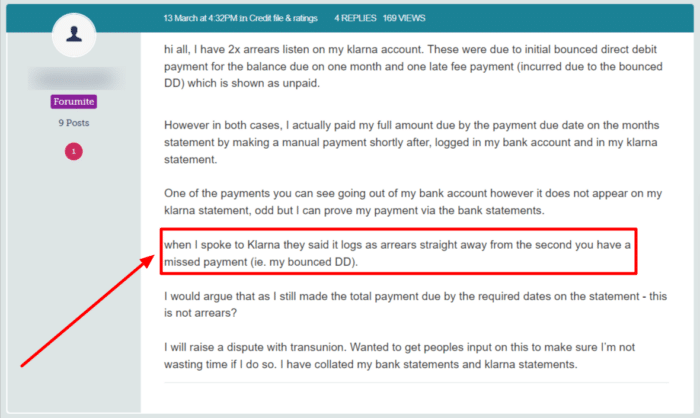

- Your account is marked “in arrears” until you pay

If Klarna cannot reach you after a few months, a debt collection agency might chase you for the money owed.

You can pay the debt collection agency in full or you may be able to return the goods you purchased. However, this is up to Klarna but the company that you bought the goods from so they may not accept.

If you manage to return the goods, Klarna will inform the debt collection agency and withdraw the claim. Klarna doesn’t sell the debt to collection agencies on their Pay in 30 and Instalment products.

It is very important that you stay on top of your Klarna payments!

Accidentally missing just one can land you in some hot water! Any arrears on your credit file can make it harder for you to get credit in the future.

Being as organised as possible with your finances is the easiest way to avoid this!

Budget Advice

Understanding the repercussions of missing a payment is crucial, but equally important is taking proactive steps to avoid such situations.

So, to keep you on track and avoid missed payments, I’ve put together this table that provides ten budgeting tips.

| Budgeting Advice | How You Can Lower Your Expenses |

|---|---|

| Arrange a Debt Repayment Plan | To negotiate, contact your creditors via phone, email, or letter to explain your financial situation, and offer to pay an amount you can afford. |

| Save on Utility Bills | Compare energy providers to find a cheaper deal. Use energy-efficient appliances. Reduce water usage with low-flow fixtures. |

| Save on Groceries | Shop with a list to avoid impulse buys. Buy store brands instead of name brands. Look for sales and use coupons. |

| Cut Back on Non-Essentials | This includes dining out, entertainment, subscriptions, and luxury items. Look for free or low-cost entertainment options and cook meals at home. |

| Transportation Costs | If possible, use public transportation, carpool, or consider biking to work. If you own a car, maintain it regularly to avoid costly repairs. |

| Negotiate Bills | Contact service providers (like phone, internet, and cable) to negotiate a lower rate or switch to a cheaper plan. |

| Consolidate Debts | If you have multiple debts, consider a debt consolidation loan or a balance transfer credit card (with caution) to lower interest rates. |

| Sell a Financed Car | When you sell a financed vehicle, the proceeds can be used to pay off the remaining loan balance. |

| Use Cash Instead of Credit | To avoid accumulating more debt, use cash or a debit card for your purchases. |

| Seek Professional Advice | If you’re struggling, consider contacting a debt advice service like StepChange or National Debtline. They offer free, confidential advice. |

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can I Delay a Payment?

Yes, you can but only for 10 days.

This option applies to the Pay in 3 Instalments and the Pay in 30 Days products.

If you are having a temporary financial blip, you could use the Klarna Payment Snooze feature. This lets you delay your payment but you must do this before the due date. You can also only snooze a payment once per order.

Klarna UK does not charge a late payment fee, and you won’t pay interest when you opted for the Pay in 30 days option.

Also, your credit score is not affected when you choose Klarna ‘Pay Later’ products.

Missed and late Karna financing payments get reported to credit reference agencies. This could impact your credit score and your chances of obtaining credit later on.

What Happens if Klarna Can’t Get Hold of You?

You won’t be able to use the Klarna service. This will remain in place until you pay the amount owed. But your access could remain blocked for 12 months after this.

» TAKE ACTION NOW: Fill out the short debt form

Once Klarna lifts the block, it doesn’t automatically mean you can use the service. It’s unfortunately not that simple!

Klarna’s underwriting model will look into your case and determine if you are still a ‘high-risk’ customer who is likely to miss payments again. Unless your finances stand up to scrutiny the block could stay.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Klarna Contact Details

| Website: | https://www.klarna.com/uk/ |

| Phone number: | 0203 005 0833 (Local rate) |

| 0808 189 3333 (Freephone) | |

| 0203 005 0834 (COVID 19 related) | |

| Operating hours: | Mon to Sat 9 am – 6 pm Closed on public holidays. |