What Happens if You Don’t Pay Your Water Bill?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you unsure about what happens if you don’t pay your water bill? You’ve come to the right place for answers. Each month, over 170,000 people visit our website to get guidance on debt solutions.

In this article, we’ll explain:

- What steps water companies take if you don’t pay your bill.

- Who is responsible for the water bill.

- How you might avoid paying your bill.

- How to reduce your debt.

- What to do if you can’t afford to pay your water bill.

We understand that dealing with debt can be stressful. Our team has experience with these issues, and we’re here to help you.

We’ll provide clear and easy-to-understand advice to help you manage your situation. Let’s start finding solutions to your water bill worries!

What happens if you don’t pay a water bill?

Although the company will not disconnect your water, they can chase you for non-payment of water bills. The process typically follows these stages:

1. Reminder

You will receive a letter from the company at your home address stating that you have not paid your bill or could not collect the money using direct debit.

If you receive this letter, make a payment immediately or contact them using the phone number included in the letter to discuss your options.

They may allow you to spread payments over a longer period through a payment plan.

2. Final reminder

If you ignore the first letter, they can send a final notice to your address giving you seven days to pay.

Failing to pay or communicate with their customer service team about your financial situation will result in further action.

3. Telephone calls

At the same time as the previous two stages, you may receive calls from their customer service seeking to discuss the debt on your account.

They may be able to help you spread the cost of your debt or enquire to see if you qualify for any schemes or water bill payment assistance.

If you know you can’t afford to clear your bill, you should start a conversation with the water company early.

Most of these providers can tell you about many schemes available to help spread the cost of their bills.

WaterSure is one scheme readily available for people who receive benefits.

Your water company may also suggest other options for paying your water bill, such as:

- A payment break for water bills or payment holiday

- Adjusting your payment plan to cope with a drop in your income

- Stopping new court applications on unpaid bills and enforcement action

- Directing you to water bill charitable grants that you may qualify for

Another solution is to install a water meter in your home, so you only pay for what you use, rather than fixed amounts which can cost more.

Most properties can have a meter installed, but the meter may not be allowed to be uninstalled in the future.

» TAKE ACTION NOW: Fill out the short debt form

4. Debt collection agencies

Water companies tend to pass the responsibility of chasing you for the debt to a debt collection agency.

These people will contact you multiple times asking for payment, but they are not bailiffs and should never imply they have the same powers.

If you agree to a repayment arrangement with the debt collection agency, they will probably take a fee from it. This means that it’s best to agree on a repayment arrangement directly with the water provider before it escalates to this stage.

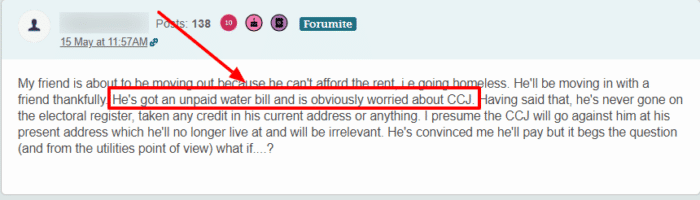

5. County Court Judgment (CCJ)

If you have avoided making any payments towards the debt, the water company may try to recover the arrears using the courts.

They can apply to a judge and ask for a CCJ to be issued, which is a legal decision that makes you responsible for paying.

If the CCJ has been issued, you will have the opportunity to make an offer for payments to clear the arrears based on your income.

If this is not an option, the water supplier may be able to recover payments from any DWP benefits you receive, such as income support.

Or they may use other methods to enforce the debt, like asking the court for bailiff intervention.

If you’re unable to clear unpaid water bills, urgently contact your water supplier and ask for their hardship team. Many water companies have a payment matching scheme that can help you pay your bills.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can they send bailiffs?

Water companies can employ registered bailiffs to come to your address and enforce the debt after a CCJ has been issued.

The bailiffs will give you further opportunities to pay – possibly using a repayment plan secured against your assets – or they may take control of your goods and sell them to pay back the supplier.

Be aware that there are related bailiff costs you will have to pay at this stage, which can be hundreds of pounds.

If your arrears were worth more than £600, they will be dealt with by the High Court using High Court enforcement officers.

This is because water debts are not covered by the Consumer Credit Act.

High court enforcement for water debts is usually quicker, and the bailiffs can charge you more for their work. The courts may even add statutory interest to your debt.

What to do if you can’t pay

If you can’t cover your water bills, always call the supplier and explain your financial situation.

They could offer a payment plan, so you contribute towards your bill and any previous arrears accumulated.

They could also provide you with additional tips for dealing with water bill arrears, like how to reduce your water consumption to save money in the future.

In addition, you may want to get help and advice from a charity like StepChange or National Debtline.

They can help you manage your finances to avoid future debts, and they can help assess you to see if you qualify for schemes and financial support.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can you get the debt written off?

In limited situations, it may be possible to have your water debts written off.

These include:

- Written off water debts by the supplier

- Written off through the Statutory Barred law after six years (technically, it becomes unenforceable, but you can then ask for it to be written off)

- Written off through a debt solution

One example of a debt solution that could write off your water debts eventually is a Debt Relief Order (DRO).

To qualify for a DRO, you must not own a home or valuable assets, and your total debts must be valued below £30,000. Also, you must only have £75 or less disposable income each month.

It’s commonly used by people receiving benefits.

Phone a debt charity registered in England and Wales for advice on unpaid water bills, or read our DRO guide to learn more about this debt solution.

How far back can a water company bill you?

Water suppliers can send you backdated water bills within the last six years.

However, if the reason for the delayed bill is their fault, you may be able to call them and negotiate. You may want to claim that paying these arrears is unreasonable, and they might reduce the amount you owe.