What Happens to Unpaid Credit Card Debt After 7 Years?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about your unpaid credit card debt? This article will help you understand what happens after not paying this debt for 7 years.

In simple words, we’ll answer important questions that may be on your mind:

- Does my debt become unenforceable after 7 years?

- Can I write off some of my debt?

- What can a creditor do if my debt has become statute-barred?

- How does this affect my credit score?

- Where can I get free, honest advice?

You’re not alone; loads of people have these worries. In fact, over 170,000 people visit our website each month for guidance on debt solutions.

We understand how dealing with unpaid credit card debt can be tough. But, we’re here to help you understand your situation better and find ways to manage it.

Will My Debt Become Unenforceable After 7 Years?

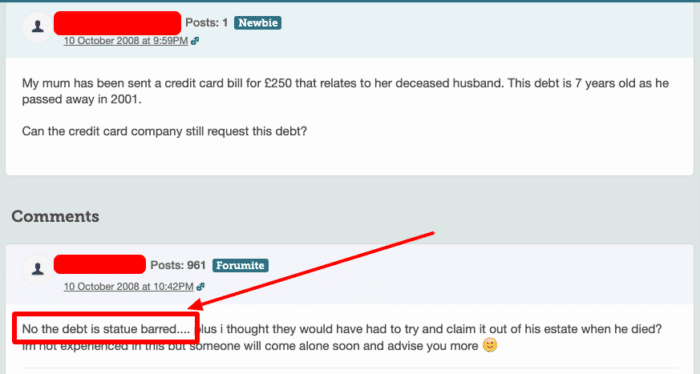

I get a lot of questions about what happens to debt after seven years and consumers legal rights regarding credit card debt. It’s a misconception that your debt becomes unenforceable after seven years, as this is how long it takes for certain negative credit items to disappear from your credit report in other major countries such as the USA and Canada.

In the UK, however, a debt becomes unenforceable after only six years.

A debt becomes statute-barred or unenforceable if the creditor waits too long to pursue you for it. This ‘limitation period’ or statute of limitations is six years.

Keep in mind that for a limitation period to be valid, the following conditions need to be met:

- You have not made a written acknowledgement of your debt in six years.

- You have not made a payment towards your debt in six years.

- The credit has not taken use of court action against you for six years after the date you defaulted.

Remember that all these conditions must be met for your debt to be statute-barred.

If these conditions are unmet, your limitation period will not be complete. For the first two conditions, the limitation period will restart; for the last condition, your limitation period will be irrelevant. Here’s why:

» TAKE ACTION NOW: Fill out the short debt form

If your creditor has been contacting you regarding your debt, but you haven’t been acknowledging and making payments towards it, your account will eventually default.

When this happens, you will usually be sent a default notice warning you to pay the debt and keep your account up to date. Debt collectors may even contact you from a debt collection agency that the creditor may have hired – hopefully following legal debt collection practices.

You have about 14 days to respond to the default notice. After these 14 days, the creditor has the right to pursue court action against you by taking out a CCJ.

When a CCJ is taken out against you, your debt can never become statute-barred. There is no limitation period on a CCJ. Thus, you will be obligated to make payments to your creditor.

If you still refuse to do so, the creditor may try to make you go bankrupt, and/or bailiffs may be sent to your house to collect your possessions to secure the debt.

If you get lucky by some circumstance and your creditor decides not to pursue court action against you for six years after your default date, your debt will be statute-barred.

Thus, if, for example, you defaulted on the 1st of January 2020, your debt would become statute-barred according to the statute of limitations on the 1st of January 2026. This would be assuming the first two conditions are met as well, of course.

The Debt I Owed has Become Statute-Barred. What Should I Do?

If you’re sure that it has become unenforceable and your creditor isn’t contacting you about it, you don’t need to do anything.

If you’re sure it has become unenforceable, your creditor is contacting you and asking you for payment. You can write to them and inform them that it isn’t enforceable anymore and you don’t have to pay it back to them.

If they refuse to accept your statement, ask them for proof that the debt is enforceable.

Always remember that it’s not your burden to prove that the debt is unenforceable; it’s your creditor’s burden to prove that the debt is enforceable.

If your creditor keeps contacting you regarding the unenforceable debt without sending you any proof, you can report them to the FCA.

It’s very common and understandable for you not to be sure whether it’s unenforceable. Remembering the exact dates from five or six years ago is difficult.

If this is the case with you, I suggest getting a hold of your credit report. Mentions of your debts stay on your credit report for six years, and they can give you a clear idea of whether you still owe your creditor. You can also sift through old bank statements to get a clearer idea.

If you are still unsure about when you last acknowledged your debt, or when you made your last payment, you have two options:

- Contact your creditor and ask them if your debt is unenforceable or not. If they state that it’s still enforceable, ask them for proof. If they do indeed send over proof, you’ll need to start paying it back.

- Don’t contact your creditor and hope the limitation period will pass on its own. This is something I do NOT recommend at all. If you have not been in contact with your creditors in a long time, there’s a great chance they will take court action against you just before the limitation period ends.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Is There Anything My Creditor can Do if My Debt has become Statute-Barred?

Your creditor is not left with many options if your debt becomes statute-barred. An old debt that has become unenforceable can’t even be restarted if you make a payment to it.

The Financial Conduct Authority is clear that it’s unfair to pursue a debtor for a debt that has become statute-barred. If your creditor keeps asking you for it even though it has become unenforceable, you can tell them to back off. You can report them to the FCA if they refuse to do so.

Once it becomes unenforceable, your creditors cannot take out a CCJ against you.

Remember that while your debt has become unenforceable, it still technically exists. Creditors that don’t operate under the FCA take advantage of this. These creditors can still contact you and ask you to pay your debts.

Some other creditors can still ask you for payment without needing to go to court, depending on the type of debt. However, credit card debt does not fall under this, so you don’t need to worry.