What Is a Compliance Officer in DWP? How Best to Prepare

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you ever heard of a DWP Compliance Officer? They are people who work for the Department of Work and Pensions (DWP) in the UK. Their job is to check if everything is right with your benefits or pension payments.

We understand that it can be worrying if you have to talk to a DWP Compliance Officer, but you’re in the right place. Each month, over 170,000 people visit our website to find answers to their questions about debt and credit.

In this article, we’ll explain:

- What the Department of Work and Pensions is.

- The role of a DWP Compliance Officer.

- Why a DWP Compliance Officer might visit your home.

- How to handle a visit from a DWP Compliance Officer.

- The possible questions you might be asked during a DWP Compliance interview.

Navigating financial difficulties can be challenging, and it’s common to feel unsure about seeking help. In fact, Citizens Advice revealed that 60% of adults facing financial difficulties hesitate to seek assistance.1

If that’s your case, don’t worry – you’re not alone. We’re here to help you.

What is the Department of Work and Pensions?

The DWP has many responsibilities, many of which relate to child maintenance, pension and the welfare system (the UK social security system).

It administers the UK state pension and all disability and health benefits for some 20 million people. Its underlying remit is based on the following principles:

- Dealing with the causes of poverty in the UK.

- Ensuring those that are capable of working do so.

- Encouraging people who are registered as disabled to return to work if possible.

- Disbursing the state pension to people of retirement age.

- Following up on complaints of benefit fraud.

- Working alongside the Health and Safety Executive to increase workplace safety.

What is a DWP Compliance Officer?

A DWP compliance officer is responsible for following up on investigations for the DWP.

They conduct benefits investigations and benefits anomaly checks.

In general, they work on the basis of being fact-finders, and are not empowered to issue any form of punishment. They are simply the long arm of the DWP, and are sent to check on potential anomalies with benefits or pension payments.

You will receive a DWP compliance interview if the DWP have reason to suspect that you are claiming a benefit that you are not entitled to.

In other cases, the purpose of the visit could be due to failure to notify them that your personal circumstances have changed.

Whatever the reason is, you will be informed why the interview is happening.

There is a common misconception that the DWP investigates only the people who have committed benefits fraud or are openly scamming the system.

While the DWP does act on tips from the public, it also has its own way of detecting when something fishy might be happening. As I see it, anyone receiving benefits from the DWP could be visited by a compliance officer.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Why Would a DWP Officer Visit Your Home?

A compliance officer will visit your home to find out if there has been some form of a mistake made with benefits or state pension, such as overpayments.

I should point out that a compliance officer isn’t just looking for fraudulent activity in relation to government payments. There are many reasons why a compliance officer might visit your home, as listed below.

- To check your welfare payments are correct (welfare payment verification)

- To collect information that can be added to national statistics.

- To find out if there have been overpayments or fraud in relation to the following types of benefits as part of DWP’s benefit fraud prevention efforts:

» TAKE ACTION NOW: Fill out the short debt form

Dealing with a DWP Home Visit

It is likely that your first interaction with a DWP compliance officer will be a telephone interview.

You will be sent a letter telling you when this interview is going to take place. These are often simply spot-checks and are not the result of any suspicion of fraudulent activity related to your benefits.

In some cases, it may be that the DWP has received an anonymous telephone call, as there is a special benefit fraud reporting number to do this.

If you are suspected of benefit fraud, you will be informed that you are going to be interviewed under caution. The compliance officer will ask you several questions aimed at trying to work out whether you have committed benefit fraud or not.

If you are invited to an interview under caution, you are entitled to have a lawyer present. This is crucial to avoid incriminating yourself.

A DWP compliance home visit will come after the telephone interview.

Based on my experience, this only occurs if the compliance officer cannot resolve the problem on the phone. Nevertheless, you could also be invited to attend the DWP’s offices.

If somebody comes to your door telling you they are a DWP compliance officer, you should ask to check their photo ID. You can then call DWP support and check whether this person is actually a compliance officer or not.

From experience, compliance officers are generally very understanding and will consider all matters before making a decision. Don’t panic when they visit your home. They may just be checking up on a few facts regarding your personal circumstances and nothing more sinister.

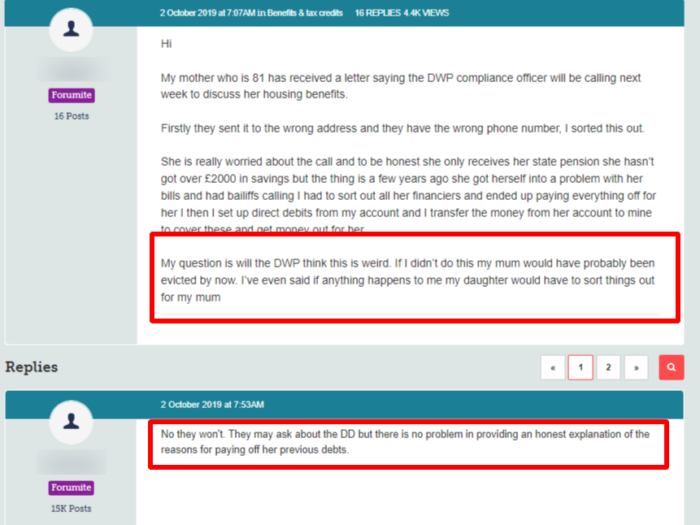

A DWP telephone interview may be stressful or frightening enough, as this forum user found out.

However, with some knowledge about DWP compliance, you can act as normally as possible while an interview is underway.

What Questions Are Asked During the Interview?

Based on personal experience, a DWP compliance interview procedure typically goes like this.

It begins with an introduction, with the compliance officer revealing their badge or ID. You are then asked to bring a document that shows your name and address (e.g. identity card, rental agreement, driving licence, etc).

After confirming your identity, the officer will let you know the purpose of the interview.

Next, you will be asked questions relating to your circumstances. DWP compliance interview questions should be “robust and challenging” and are meant to dig out the truth and assess whether you understand your claim to the benefit.

For example, you could be asked questions like:

- Are you currently working, and when did your work begin?

- Who are you currently living with, and what do they do?

- Do you currently receive financial support from someone else? If so, how much money are they giving you and how long has this been going on?

It is always a good idea to be truthful with the DWP.

You may be asked to present documentary evidence, like bank statements, to support your answers. The DWP compliance offer may also want to know if you knew you should report any change in your circumstances.

If, for some reason, you admit that you knowingly gave false information, you will be asked to give a statement (known as an MF47 statement).

The DWP may investigate you for the following benefit fraud offences:

- Faking an illness or injury to get unemployment or disability benefits

- Failing to report income from a business or employment to make your income seem lower than it actually is

- You’re living with someone who contributes to the household income, but you fail to declare it

- Falsifying accounts to make it seem like you have less money than you say you do

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What are My Rights at an Interview with the Department of Work and Pensions?

Understanding your legal rights at DWP interview is vital.

This is because the responses you give could be used as a basis to refer your case to the fraud team, worse, being criminally prosecuted.

At a compliance interview with the DWP officer, you have the right to:

- Request for a friend, relative, or social worker to be present to provide moral support or help you understand the interview better.

- Rearrange the interview if an appropriate adult person is not present.

- Request an interpreter if you feel this will improve your understanding of the interview.

- Record the interview, though you must ask the DWP compliance officer for permission.

- Ask the DWP officer to leave your home if you feel uncomfortable or do not wish to continue with the interview.

What Happens if You Owe Money?

If a DWP compliance officer does decide that you have been overpaid for benefits for some reason, you will need to pay this back. Some of these overpayments may occur due to the following:

- Clerical errors on DWP’s side

- Your circumstances have changed

- You gave the DWP incorrect information.

Don’t expect to be able to hide from this debt for 6 years until it is written off.

The DWP has many powers enabling them to collect what you owe. I have shared below some of the things that could happen if you owe the DWP money below.

- Your benefits would be reduced, and some of the money set aside to pay the debt if you are not working.

- If you are working, the following can happen:

- Have your employer make deductions from your pay.

- Pass the debt to a debt collector.

- Pass the debt to the DWP enforcement team (bailiffs).

If your debt is passed to a collection agency, you will then be faced with potential legal action if the debt collector seeks a County Court Judgement (CCJ) against you. If a CCJ is granted, you will need to repay the debt in full.

If you don’t, the court may sanction bailiffs to visit your home to collect the debt.

If you can’t pay the bailiffs when they visit, they will want to take goods from your home that can be sold off to pay the debt.

As you can clearly see, it is highly likely that if you owe money to the DWP, you will be forced to pay it eventually. This holds true of both benefit overpayments that were a mistake and benefits you claimed fraudulently.

The DWP debt collection never fails.

Debt Solutions Comparison

If you’re struggling with debt, don’t worry. There are different debt solutions that can help you manage your finances effectively.

These are:

| Debt Solution | Description | Formality | Debt Type | Debt Range | Legally Binding | Impact on Credit Score | Asset Risk | Monthly Payment | Duration | Creditor Agreement Required |

|---|---|---|---|---|---|---|---|---|---|---|

| Debt Management Plan (DMP) | Agreement to pay back non-priority debts in one monthly payment. | Informal | Non-priority debts | Any amount |

No | Yes | No | Varies | Varies (until debt is paid) | No (but creditors must be informed) |

| Individual Voluntary Arrangement (IVA) | Agreement to pay back all or part of your debts over a set period. | Formal | All or part of debts | Usually over £10,000 | Yes | Yes | Possible | Fixed | Fixed period, usually 5-6 years | Yes (75% by debt value must agree) |

| Debt Relief Order (DRO) | Freezes debt for a year and be potentially written off. | Formal | Non-priority debts | <£20,000 debt | Yes | Yes | No | None during freeze | 12 months | No (court approval needed) |

| Bankruptcy | Legal status for those who cannot repay debts, potentially writes off debts. | Formal | Unmanageable debts | Any amount, typically high debt | Yes | Yes | High | None during bankruptcy | Usually 12 months, then discharge | No (court process) |

| Consolidation Loan | Taking out a new loan to pay off all existing debts. | – | Multiple debts | Based on loan amount | Varies | Yes | Depends on loan type | Fixed | Depends on loan terms | No |

| Payment Holiday | Temporary relief or reduced payments offered by creditors. | – |

short-term financial difficulties | Any | No | Yes | Low | Reduced or paused payments | Break of up to 6 or 12 months, depending on circumstances, payment history, and creditor’s policy. | No |

| Informal Negotiation | Direct negotiation with creditors for reduced payments or extended terms. | – | All debts | Any | No | Possible | No | Negotiable | Until agreement terms are met | No |

| Statutory Debt Repayment Plan (SDRP) | Plan to repay debts over a reasonable time, with protections from creditor action. | Formal | All debts | Varies | Yes | Yes | No | Fixed | Varies, based on ability to pay | Yes |

| Equity Release | Homeowners release equity from their home to pay off debts. | – |

Debts of homeowners, typically older individuals aged 55+ | Varies and depends on property value | Yes | Yes | Asset (home) is used as collateral | Varies | 8-10 weeks timeframe from application to fund disbursement. Lifetime; repaid on house sale/death. | No |