What are the Pros and Cons of Debt Consolidation

Debt consolidation is a common way to manage money troubles in the UK. It means putting all your debts into one, which could make it easier to keep track of payments. However, it might not be the best choice for everyone. This article will help you understand the good and bad points of debt consolidation.

We know that it can be hard to pay off debts and it can be worrying to think about how unpaid debt might affect you. We also understand that choosing the best debt consolidation loan can be confusing. That’s why over 170,000 people use our website each month for guidance on debt solutions.

Here’s what we’ll cover in this article:

- How debt consolidation works.

- The types of debts that can be included.

- The benefits and drawbacks of debt consolidation.

- When debt consolidation might be a good idea.

- How debt consolidation can affect your credit score.

We have a lot of experience in offering guidance to people regarding their money worries, and some of us have even been in your position, so we truly understand how you’re feeling.

Let’s dive in and talk about your options.

Advantages and Disadvantages

Debt consolidation might be the best debt management strategy for you – or it might not be.

Understanding the pros and cons of debt consolidation and considering them against your personal circumstances will help you make the right decision.

If you’re considering debt consolidation today, weigh up the potential benefits and disadvantages first. Here’s what to consider.

What are its benefits?

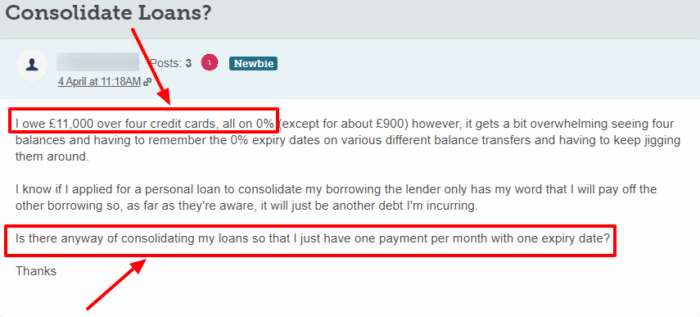

#1: Easier to budget and manage

If you consolidate debt, you are making it much easier to budget for your new repayment than paying off multiple debts and credit card balances each month at different times.

Instead of worrying about numerous payment dates every month, there’s now only one! This makes managing your finances simple, less stressful, and arguably less likely that you will overspend and default on monthly payments in the future.

#2: Protecting your credit score

By making it easier to meet monthly repayments on time, you are reducing the chances of missing any payments at all. Therefore, you’re protecting your credit score from further damage.

This is especially useful if you plan on applying for a mortgage soon after paying back your single new debt.

#3: Potential lower monthly payment

Debt consolidation becomes even more worthwhile if you can take out a new personal loan or balance transfer credit card with a lower monthly payment than the cumulative amount you were paying back on the other debts.

The interest rate you get will influence this, but you should always be aware of other possible additional fees.

Many debtors manage to secure a new debt with better repayment terms, meaning they pay less than they were paying before.

Lender |

APRC |

Monthly payment |

Total amount repayable |

|---|---|---|---|

| United Trust Bank Ltd | 5.99% |

£218.73 |

£26,247.92 |

| Equifinance | 6.59% |

£219.77 |

£26,372.92 |

| Pepper Money | 6.86% |

£220.24 |

£26,429.17 |

| Together | 7.65% |

£221.61 |

£26,593.75 |

| Selina | 7.79% |

£221.86 |

£26,622.92 |

| Spring | 10.05% |

£225.78 |

£27,093.75 |

| Loan Logics | 11.2% |

£227.78 |

£27,333.33 |

| Evolution | 11.28% |

£227.92 |

£27,350.00 |

Representative example: If you borrow £34,000 over 15 years at a rate of 8.26% variable, you will pay 180 instalments of £370.70 per month and a total amount payable of £66,726.00. This includes the net loan, interest of £28,531.00, a broker fee of £3,400 and a lender fee of £795. The overall cost for comparison is 10.8% APRC variable. Typical 10.8% APRC variable.

Search powered by our partners at LoansWarehouse.

What are the disadvantages?

#1: It’s not available to everyone

Even if consolidating your debts would be the best choice for you, it may not be available to you.

People with a poor credit history might not be able to get one of these loans in the first place. A lender may be unwilling to lend further credit to you if you have a poor credit rating.

The fact that you need a debt consolidation loan is a sign that your credit score doesn’t look pretty.

#2: You might pay back more

Debt consolidation will not guarantee that you will get a loan with lower interest.

You may have to pay back more than you are doing now. Or you may pay back less each month but have to pay back more over the life of the loan.

If the margins are small, debt consolidation can still be worth it for streamlining your repayments. This will help you avoid payment defaults.

As you can tell by the advantages and disadvantages of debt consolidation, the financial aspect can be highly dependent on personal circumstances and the loan interest rate you qualify for.

#3: Additional fees and charges

A debt consolidation personal loan or balance transfer credit card may include additional fees and payments that you wouldn’t have to pay if you didn’t consolidate your debts.

This is more relevant to a balance transfer credit card, which typically includes a balance transfer fee.

» TAKE ACTION NOW: Compare deals from the UK’s leading lenders

Is it right for you?

Weighing the advantages and disadvantages of debt consolidation and considering your personal situation is the only way to know if it’s the best debt management option for you.

Unfortunately, there is no fixed answer for everyone, but the points discussed in this article should offer a fantastic place to start.

The good news is that we have lots of tips on debt consolidation here on MoneyNerd. If that’s not enough, there are other free and insightful resources online, especially by many UK debt charities.

But again, it is always best to get support from an independent debt charity or debt management company. They can guide you to a debt-free life again.

The best free debt advice organisations to contact include:

When is consolidating a good idea?

Debt consolidation is usually a good idea if you have taken the time to fully understand the process.

Also, take this option if your new monthly payments are going to be lower than they were before consolidating.

If you’ve found a debt consolidation loan with a lucrative interest rate, then it might be a good idea for you.

If the loan is comparable to the interest rates you’re paying on existing loans and credit card debt, it may still be a good idea.

Even though you might not be able to reduce monthly payments, having just one repayment can make managing your money easier.

However, there may be times when other debt management solutions (e.g. DMP, IVAs, etc.) are better. Credit counselling and debt charities should be your first point of call when needing advice.

It would be a good idea to shift debt from existing credit cards to 0% with a balance transfer. This means getting a specialist new card that repays debts on other credit cards for you, so you owe it instead but at 0%. This is the best way to cut the costs of your debt and ensure easier management of repayments.

Do THIS before applying!

Now that you understand the advantages and disadvantages of debt consolidation, you may have decided that this method can help you.

But, before you find a loan provider and apply, you should check your credit file for errors. Spotting an error and having it removed could be the difference between being accepted and rejected.

You can access your credit history online using a credit reference agency website (e.g. Experian or Equifax).

If you see a mistake, report it to the company that made it and ask them to remove it.

If they don’t cooperate, you can then ask the credit reference agency to remove it for you. And if the CRA you used offered you a free trial, don’t forget to unsubscribe, or you will be billed.

Debt consolidations loans for all purposes

- Stuck paying high interest on credit card debts & loans?

- Looking for a better interest rate?

- Stuck with the confusion of multiple repayment plans?

Polly

“This was by far possibly one of the nicest experiences I’ve had getting a secured loan.”

Reviews shown are for Loans Warehouse. Search powered by Loans Warehouse.

When is it bad?

Debt consolidation would be a bad idea if you can only access a loan with higher interest. This will cause you to pay more each month or pay significantly more over the life of the loan.

It’s also not a good idea if there are more suitable debt management solutions available.

One of the cons of debt consolidation is that it can give the feeling to the debtor that they have immediately paid off a chunk of their debt.

It gives the illusion that they are in a far better financial position than before, even immediately after consolidating debt. In reality, at such an early stage, they are in a similar position, and they are still vulnerable to a financial emergency.

Moreover, debt consolidation does not solve underlying issues for which some people got into debt in the first place. Of course, this does not apply to everyone.

Overspending after consolidating debt is not uncommon and is one of the biggest reasons why debtors who take this strategy can get themselves into bigger debt down the line.

Even after debt consolidation you will need to monitor your finances closely and use a monthly budget.

Does it affect your credit score?

Debt consolidation will not affect your credit score.

The only way debt consolidation will significantly impact your credit file is if you apply for multiple debt consolidation loans in a short period of time.

Doing so causes each lender to leave a search mark on your file (hard search). Having too many of these searches in a short period can harm your file. This is because it appears like you are erratically applying for credit without giving it careful thought.

On the contrary, using debt consolidation can improve your credit score in hindsight. Instead of struggling to meet repayments and potentially defaulting on others, consolidating debt can protect your credit file – as discussed in our pros of debt consolidation section earlier.

Alternative Solutions

Some of the other ways that people reduce their debts and make them more manageable is using:

- The snowball method: This involves paying off the minimum payment on each debt and then using any remaining money to clear one debt at a time.

- Debt Relief Order: A way to potentially wipe all debts if you have less than £75 disposable income per month and no assets.

- Individual Voluntary Arrangement: Another way to consolidate debts and wipe all of them after five years.

- Debt settlement: Making a settlement offer to creditors below the total value to save you money. You may want to consider this before trying to combine some of your debts if it is affordable to you.

- Bankruptcy: This is seen as a nuclear option, but bankruptcy can be smart and the best move for you. Get credit counselling advice before choosing bankruptcy.