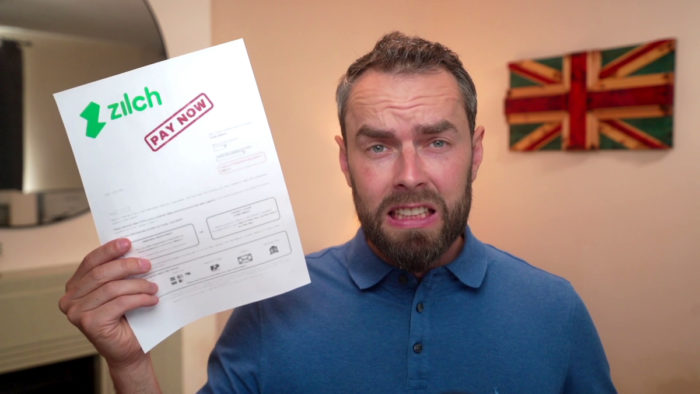

Zilch Missed Payment – Should you Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you missed a Zilch payment and are unsure of what to do? You’ve come to the right place for answers. Each month, over 170,000 people visit our website looking for guidance on debt matters.

In this simple guide, we’ll explain:

- What to do if you miss a Zilch payment

- How the Buy Now Pay Later scheme with Zilch works

- How to handle Zilch debt in a manageable way

- What happens if you can’t make a Zilch payment on time

- How to avoid late payments with Zilch in the future

In 2022, arrears on household bills increased by 68% from £1,739 to £2,9201. So it’s quite common to miss payments.

I know this can cause worry, especially when you’re not sure how to handle it. Rest assured, we’re here to help. We aim to answer all your questions and ease your worries about missed Zilch payments.

Let’s get started.

How Does It Work?

A Zilch late payment on your credit score can make it much harder to get credit in the future.

This can be big things like mortgages and car finance, to simple things like a mobile phone contract. The impact lasts for six years, so it really is something you want to avoid.

What Happens if I’m Unable to Pay on Time?

» TAKE ACTION NOW: Fill out the short debt form

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Failure to Pay due to Financial Difficulties

- Change your Zilch payment options.

- Put your Zilch account on hold.

- Change your repayment dates.

Debt Solutions Comparison

There are different debt solutions available that can help you deal with Zilch payments. These are:

| Debt Solution | Description | Formality | Debt Type | Debt Range | Legally Binding | Impact on Credit Score | Asset Risk | Monthly Payment | Duration | Creditor Agreement Required |

|---|---|---|---|---|---|---|---|---|---|---|

| Debt Management Plan (DMP) | Agreement to pay back non-priority debts in one monthly payment. | Informal | Non-priority debts | Any amount |

No | Yes | No | Varies | Varies (until debt is paid) | No (but creditors must be informed) |

| Individual Voluntary Arrangement (IVA) | Agreement to pay back all or part of your debts over a set period. | Formal | All or part of debts | Usually over £10,000 | Yes | Yes | Possible | Fixed | Fixed period, usually 5-6 years | Yes (75% by debt value must agree) |

| Debt Relief Order (DRO) | Freezes debt for a year and be potentially written off. | Formal | Non-priority debts | <£20,000 debt | Yes | Yes | No | None during freeze | 12 months | No (court approval needed) |

| Bankruptcy | Legal status for those who cannot repay debts, potentially writes off debts. | Formal | Unmanageable debts | Any amount, typically high debt | Yes | Yes | High | None during bankruptcy | Usually 12 months, then discharge | No (court process) |

| Consolidation Loan | Taking out a new loan to pay off all existing debts. | – | Multiple debts | Based on loan amount | Varies | Yes | Depends on loan type | Fixed | Depends on loan terms | No |

| Payment Holiday | Temporary relief or reduced payments offered by creditors. | – |

short-term financial difficulties | Any | No | Yes | Low | Reduced or paused payments | Break of up to 6 or 12 months, depending on circumstances, payment history, and creditor’s policy. | No |

| Informal Negotiation | Direct negotiation with creditors for reduced payments or extended terms. | – | All debts | Any | No | Possible | No | Negotiable | Until agreement terms are met | No |

| Statutory Debt Repayment Plan (SDRP) | Plan to repay debts over a reasonable time, with protections from creditor action. | Formal | All debts | Varies | Yes | Yes | No | Fixed | Varies, based on ability to pay | Yes |

| Equity Release | Homeowners release equity from their home to pay off debts. | – |

Debts of homeowners, typically older individuals aged 55+ | Varies and depends on property value | Yes | Yes | Asset (home) is used as collateral | Varies | 8-10 weeks timeframe from application to fund disbursement. Lifetime; repaid on house sale/death. | No |

Can I Delay Paying?

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Avoiding late payments

You can avoid missed payments and paying late penalties by writing down your payment dates.

Consider setting payment reminders with Zilch on your phone when payments are due.

You should also look at putting together a budget so you know how much money you have and setting aside an emergency fund for Zilch payments.

Will It be Reported to a Credit Agency?

Alternatively, you can look at other UK debt solutions.

There are many debt management options available, depending on your circumstances. Talk to one of the debt advice services in the UK, such as StepChange, for more information on dealing with unaffordable debt and assistance with Zilch missed payments.