Grants to Pay Off Loans Reviews & In-depth Info

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about a debt? Do you need to know about UK grants that can help? You’ve come to the right place. Every month, over 170,000 people use our website to find answers about debt, so you’re not alone.

In this article, we’ll help you understand:

- What to do if you have a debt problem.

- How payment holidays work.

- What student loans and loan forgiveness are.

- How to get a quote that fits your needs.

- The different types of help the government can offer.

We know how hard it is to deal with debt, as some of our team members have been in the same place as you. We know how it feels to worry about money, but there’s help out there.

Let’s learn more about how grants can help you pay off your debt and find all the answers you need.

Payment Holidays

If you’re struggling with your debt repayments, you can write to your creditors and inform them of this.

Negotiating with creditors can yield great results as you might be able to get a payment holiday (also known as a payment break) for a few months. This is one of the debt relief options available to UK citizens.

A payment break would give you some breathing space to get your finances in order. Your creditor may agree to give you a payment holiday after looking at your personal circumstances.

In order to convince your creditors, you may need to provide evidence and/or documentation of your financial situation.

This can be in the form of a copy of your wage slips and bank account statements. Based on personal experience, enclosing a copy of your financial statement within your letter to your creditor(s) can play a huge role in convincing them to consider your payment break request.

If your creditor(s) are refusing to give you a payment break and there’s no other way you can manage your finances, it’s a good idea to get in touch with a debt charity and seek debt advice from them. National Debtline, StepChange Debt Charity, and Citizens Advice are great debt advice services to contact.

They have professionals who will assess your financial situation, after which they might be able to provide you with a personal debt management plan to deal with your debts.

Alternatively, they could also negotiate with your creditors on your behalf to get you a payment break.

What’s the Impact of Payment Break in the Long-Term?

Taking an agreed payment holiday should offer the lifeline you need to manage your finances. However, it does come with some long-term consequences. From my experience, the following are bound to happen due to a payment break:

- Your monthly instalment amount, according to the term of the loan, will likely remain the same or go up.

- You will accrue interest and fees during the payment holiday since the term of your loan has been extended.

- While you will have gained immediate financial relief, the payment break will add to the cost of your loan in the long term.

- The payment break will not hurt your credit score itself, but it could have a knockoff effect. For example, your repayments may increase after your payment break ends (to account for the missed payments, plus interest). This increased burden could lead to a missed payment, knocking some points off your credit score.

Student Loans and Forgiveness

You are not obligated to make repayments towards your student loans if your income is below a certain threshold.

The threshold differs depending on what style of student loan debt you have. If your course started before 1998, then you have an old-style student loan, also referred to as a mortgage-style loan. These types of loans are repayable over either a period of five years or a period of seven years if your course was longer than three years.

Student loans taken out after 1998 are new-style loans, also referred to as income-contingent loans. The loan repayment plans for these types of loans are taken out straight from your wages every month once you start earning above the threshold.

If you have an old-style loan, you can defer your student loan repayment if your annual income is below a certain threshold. You can contact your student loan provider to determine this threshold. This will be either Erudio Student Loans, Honours Student Loans or Thesis Servicing.

If you qualify to get your student loan debt repayment deferred, then you can contact your provider and ask them to do so.

It’s important for you to note that interest will keep being added even if you defer your payments. You won’t need to make any payments for 12 months once your repayments get deferred.

For new-style loans, repayments will only start getting deducted from your wages once your income goes above the appropriate threshold.

As for student loan forgiveness for new-style loans, any loan taken out after 1st September 2012 will be written off 30 years after the first repayment was due.

As for new-style loans taken out before 1st September 2012, the following apply:

- In England and Wales and Northern Ireland, loans taken out before 1st September 2006 are written off when you reach the age of 65. Loans taken out between 1st September 2006 and 1st September 2012 get written off 25 years after the first payment was due

- In Scotland, loans that were taken out before 1st September 2007 are written off when you reach the age of 65, and loans taken between 1st September 2007 and 1st September 2012 are written off 35 years after the first payment was due.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Government Financial Help and Money

Hardship Payments

You could qualify for a hardship payment if you’re on either Jobseeker’s Allowance (JSA), Employment and Support Allowance (ESA) or Universal Credit (UC) and your benefits (e.g. Housing Benefit) have been stopped, which is causing you to struggle with payments.

You can also qualify for it if you’re caring for an individual who is physically or mentally vulnerable.

As I see it, it’s worth claiming Universal Credit if you struggle to pay bills or repay your loans. You may also receive a notice to move to UC if you’re currently on the following tax credits:

- Housing Benefit

- Child Tax Credit

- Working Tax Credit

- Income Support

- Income-based Jobseeker’s Allowance

- Income-related Employment and Support Allowance

By migrating to Universal Credit, you will continue to receive the benefit you are entitled to through a modern benefits system that the government is trying to roll out.

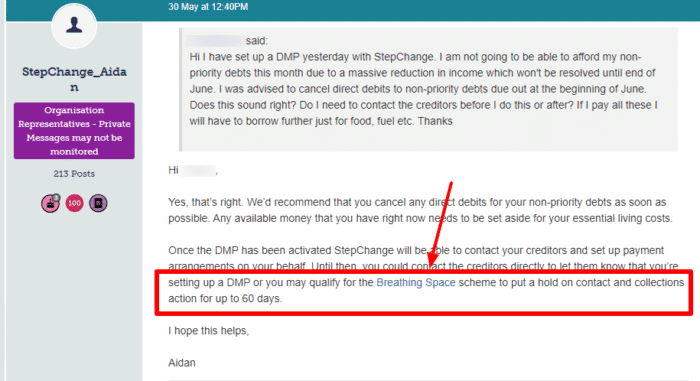

Breathing Space Scheme

In addition, check out the government’s Breathing Space scheme (also known as the Debt Respite Scheme UK), which gives you legal protection from creditors for 60 days. This temporary protection program can help stop people you owe money from:

- charging any more interest and fees on the debt and;

- enforcing any action or contacting you

Only those who live in England or Wales qualify for this scheme. You must also have a qualifying debt and don’t have a debt relief order (DRO), individual voluntary arrangement (IVA), interim order, or are not an undischarged bankrupt at the time you apply. Lastly, you must not have already taken Standard Breathing Space in the last 12 months.

If you’re swamped with mountains of demands from debt collectors, as this forum user says, you can put a limit to their calls via the Breathing Space scheme. You are not alone, and there is help available.

» TAKE ACTION NOW: Fill out the short debt form

Assistance from Your Local Council

You can check your local council to see if they have a local welfare assistance scheme. Schemes such as these are offered to low-income people who are facing difficulties with their payments.

Check your local council for what the qualifying criteria are. If you qualify, you could be eligible for a number of different benefits such as small cash loans, grants or free used household goods.

Social Fund

If you’re on any of the following benefits for a minimum of 26 weeks and an emergency or unexpected expense has come up, then you may qualify for a budgeting loan:

- Pension Credits

- Income Support

- Income-based Jobseeker’s Allowance

- Income-related Employment and Support Allowance

The amount of money you can apply for depends on your financial situation and what you need the loan for. Debt repayments to these interest-free loans would then be deducted from your future benefit payments.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Short-term Benefits Advance

If you’re struggling with debt repayments or other payments, it can be worthwhile to try and apply for a short-term benefit advance. You can apply for this from a number of different benefits.

In order to apply for a benefit advance, you can contact the Department of Work and Pensions (DWP) office that is responsible for your benefit claim.

How Can I Find Out About Different Grants?

It’s definitely worth researching what grants and benefits you’re eligible for as part of your debt management plan. Not only could they improve your living condition, but they could help you pay off your debts as well.

You can look for grants and benefits available to you online, but if you need extra help, then you can contact Turn2Us for further debt advice. Turn2Us is a charity that helps people suffering from debt and other financial issues find grants and other services to support themselves. Personally, I use Turn2Us in addition to the “Grants Search” feature on the MoneySavingExpert website to find suitable charities and grants.