Allied International Credit Debt (AIC) Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Getting a surprise letter from debt collectors can be scary. After all, nearly half of individuals who deal with debt collection agencies have experienced harassment or aggression1.

You’re not alone! This article is here to help. We’ll cover common worries such as:

- What is Allied International Credit?

- Should I pay Allied International Credit Debt?

- How could I maybe write off some of this debt?

- What can I do if I can’t afford to pay?

Over 170,000 people come to our website every month for advice on debt. We’re experts in this area, and we’re here to guide you through it.

Remember, it’s important not to ignore the situation. We’ll explain your options and how to deal with it in a clear way. After all, we know dealing with debt can be tough, but together, we can handle it.

Have You Received a Letter?

Debt collection agencies buy billions of debt annually at rock bottom prices, at an average of 10p to £1!2 So, AIC Debt will send a letter to anyone they think owes money to their client.

This letter is formally known as a Letter Before Action (LBA)3. Exactly as it sounds, they are asking you to pay before taking further action, that being legal proceedings.

We understand that reading this letter, probably out of the blue, can be daunting. It is designed to make you act fast and just pay to get rid of them. But there are options to hand, and there is something you should do first that could stop you from having to pay back any of your debt.

If you do not reply, they might bombard you with phone calls, and their agents might start to become rude and aggressive. You should write to Allied and request that they only contact you in a particular way. As long as your request is reasonable, there is no reason for them to say no!

Your Rights

As mentioned above, debt collectors may try to intimidate you to make you pay. However, they should never harass you.

To prevent unfair treatment, it’s crucial to understand your rights when dealing with debt collectors. That’s why we’ve created this quick table that explains what they can and can’t do. If you want to learn more about your rights, make sure to check out our detailed guide.

| Debt Collectors Can | But They Can’t |

|---|---|

| Contact you by phone or mail. | Call you after 9pm or before 8am. |

| Conduct home visits (on rare occasions) and knock on your door. | Forbily enter your home, or stay if you ask them to leave. |

| Threaten to take you to court by suing you for payment on a debt. | Harrass you, including threats of violence, repeated calls and visits, or abusive language. |

| Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | Visit your workplace. |

| Access your bank account, but only after a court judgment has been made. | Take anything from your home or threaten to do so. |

| Sell your debt. | Speak to other people about your debt without your permission. |

| Contact you frequently. | Keep doing so if you request that they reduce communications. |

Janine, our financial expert, explained that while debt collectors can visit your home for payments, they cannot come to your workplace, act threateningly, force payment, or discuss your finances with others. If they violate these rules, you can complain.

Ask Them to Prove It

AIC Debt and any other debt collection agencies must supply the supposed debtor with proof that they owe the money. It is their responsibility to send this to you and you do not have to make a payment until they do this.

A judge will also expect them to provide this before stepping foot in the courtroom.

Most debt collectors will not provide this because it means they have to do a lot of research and digging. They hope by sending you a letter and making threats that you will cave and pay up. So, make them work for it! Even if you know you owe money to their client, ask them to show their hand first.

This is a good strategy as it buys you time, could stop you needing to pay the debt and if you genuinely think there has been a mistake, it will make them realise it.

We have made sending this request for proof effortless with our free prove the debt templates.

Keep copies of your requests and if they do start legal action, you can show a judge that you asked for proof and they withheld it.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

They Proved I Owe the Money, Help!

If you sent your letter requesting proof and they replied with proof you owe the debt, such as a signed agreement that you did not sick to, do not worry.

The bad news is that you will now have to pay the debt, and Allied International Credit Debt have a good case if it went to court. So, ignoring them now is not smart and could cause you to owe even more due to interest and debt collection fees.

The easy way out of the situation is to ask for a payment plan that they provide to their “customers”. This will help you to pay the debt in your own time, and more importantly, stop you getting into further debts elsewhere.

Always conduct a thorough budget before agreeing to a plan with them. If you do not know your disposable income then you might commit to paying back too much and get into other debts.

Use this friendly budgeting article for help!

UK Personal Debt 2021 Update:

As of April 2021, the average total debt per UK household was £61,509

(Source: The Money Charity)

But there are other ways to get out of debt – and they could be cheaper!

Don’t allow Allied International Debt Collectors to trick you into thinking that their offer is the only way to spread out the cost of your debt. It is one option but it is not necessarily the best for you.

Read about these and more on our debt solutions page.

There are several debt solutions available in the UK. We recommend speaking to a debt charity to help you find out which will work best for you.

Debt Management Plan (DMP)

A DMP is an informal debt solution that lets you pay off your debts via a single monthly payment.

Because it is informal, it is not legally binding so you are not tied into a DMP for a minimum number of payments.

Individual Voluntary Arrangement (IVA)

An IVA is a formal agreement between you and your creditors. You agree to pay a monthly sum that is distributed amongst your debts, and your creditors agree not to contact you during your IVA.

IVAs typically last for 5 or 6 years, and any outstanding debt is wiped off when it ends.

Keep in mind that IVAs are not suitable for everyone. You need to owe several thousand pounds to more than one creditor to be eligible. You also need to demonstrate that you have some disposable income every month.

Trust Deed

IVAs are not available in Scotland. Instead, you will need to opt for a Trust Deed.

Trust Deeds work in the same way as an IVA – you pay an agreed sum each month that is shared amongst your creditors, they can’t contact you, and any leftover debt at the end of your Trust Deed term is written off.

Debt Relief Order (DRO)

A DRO is a good option for those facing financial hardship with no assets and little income.

For 12 months, you make no payments, but your creditors freeze your interest and don’t contact you.

If your finances haven’t improved during this year, you may be able to write off your unsecured debts.

Bankruptcy

If you have debts but no realistic possibility of ever paying them off, you may need to declare bankruptcy.

Bankruptcy has an unfair stigma attached to it as it may be your only way of getting a financial fresh start. That said, it is a serious financial situation that should not be taken lightly.

Sequestration

Sequestration is the Scottish version of bankruptcy.

If you have little income and no valuable assets, you may be able to apply for a minimal asset process bankruptcy (MAP). A MAP is a quicker, cheaper, and more straightforward version of sequestration, so worth considering.

How to Make a Payment

Allied International Credit Debt Collectors make it very simple for you to make a payment. They would be more than willing to take a payment over the phone with a debit or credit card, and you can make an online payment to AIC.

We would advise that you do it online so they don’t pressure you into paying more than you can afford. To do this, go to their site at https://aiccorp.co.uk/ and then click the ‘make a payment’ button.

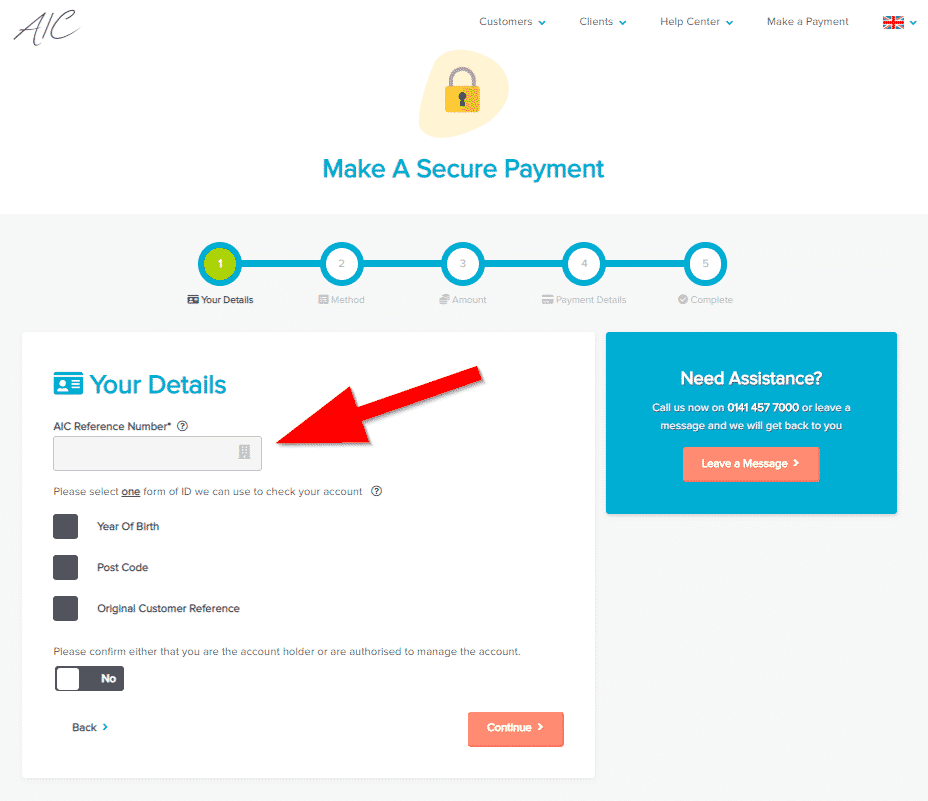

On the next page, you will need your ‘AIC reference number’, which you can get from one of the many letters they would have sent to you. And then you can choose to verify your identity with either your birth year, postcode or customer account reference number.

What Laws Must They Stick to?

The debt collection industry is full of bad practices and debt collectors bending the rules to get the money. But there are laws you can quote and use to stop them from exploiting their position.

They must:

- Respect your communication wishes if you only want to be contacted in writing

- Explain all terms and phrases they use when asked, to ensure they do not confuse and mislead you

- Point you to debt advice and support channels

- Offer an affordable payment plan based on your circumstances

- Give you reasonable time to decide how to get out of debt

- Show an understanding of the situation

- Never lie or intend to deceive you

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Is There a Way to Get It Written Off?

A debt management group will not wipe your debt voluntarily, after all, they probably do not own the debt and are just chasing you for someone else.

But there are ways to get some or most of the debt wiped, usually with a formal debt solution for AIC debts:

- The aforementioned Individual Voluntary Arrangement (IVA) can wipe up to 85% of all debts owed

- Settlement offers can wipe a small amount of the debt for paying most of it off at once

- The earlier mentioned Debt Relief Order can wipe all debt for people who do not have a high income

- Bankruptcy is another way to wipe all your debt but it should not be a decision taken lightly

You should be aware that having debt wiped may save you having to pay, but it can decrease your credit score. This will make it less likely you will be given credit in the future and could stop you getting a mortgage, or even something as insignificant as a mobile phone contract.

When Can I Complain?

If you think that Allied International has been unreasonable or behaved inappropriately, you can make a complaint. You can also make a complaint if you feel that they have broken any of the Financial Conduct Authority’s (FCA) guidelines.

Fortunately, filing a complaint against AIC is quite straightforward.

Make your first complaint to Allied International so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, Allied International may be fined. You could even be owed compensation.

» TAKE ACTION NOW: Fill out the short debt form

Here are some of the things to complain about:

If they are aggressive and intimidating

If agents call you and ask you to pay become aggressive, you can simply record what went on and lodge a complaint. Some agents will do this because they are trying to earn a bonus or commission from getting you to agree to pay the money. A variety of techniques may be used to wear you down.

If they call you too much

They may start calling more often if you ignore them. Some even have computers that call you for them so they can annoy and get to you without effort. You can send them a letter stating you only want to be contacted in writing. If they do not listen to your preferences, they are committing harassment.

If they threaten to take your possessions

Debt collection groups cannot take your items in any situation. This is the job of a bailiff who has nothing to do with Allied Debt Collection. Even if they suggest this is possible, they are breaking the law by lying and threatening you.

If they tell others about it

Having debt is a sensitive topic and there are privacy laws in place to ensure no debt collection company tells a family member or other person about your debt.

They should confirm who they are speaking to you before discussing the situation on a call. If they tell someone else that you owe money, these break these laws and open themselves up to complaints and claims.

Allied International Credit Contact Details

| Website: | https://aiccorp.co.uk/ |

| Registered Address: | Adamson House, Towers Business Park, Didsbury, Manchester, M20 2YY |

| Postal Address: | Anderston House, 389 Argyle St, Glasgow, G2 8LR |

| Phone number: | 0141 457 7000 |

| Email: | [email protected] |

| Numbers they call from: | 01412283089 07814390283 07815564516 |