EE Missed Payment – Here’s What To Do

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you missed an EE payment? Don’t worry, you’ve come to the right place. Each month, more than 170,000 people visit our website for advice on such issues.

In this helpful guide, we’ll cover:

- The steps to take when you miss an EE payment.

- What to do if EE cuts off your service.

- How to handle late fees and possible debt.

- How to change your payment date if needed.

We understand that missing a payment can be scary. It can lead to worries about late fees, debt, and even having your service cut off.

Our team knows what it’s like, as some of us have been there too. With our experience, we’ll walk you through your options and offer tips to help you avoid future missed payments.

Let’s dive in!

What if I fail to pay on time?

Contact EE support if you can’t pay your bill on time. The sooner you speak to them, the better the outcome should be.

After all, circumstances change.

EE may be able to offer assistance for overdue EE payments. They can also help set up a repayment plan, making your instalments easier to manage.

They may suspend your service

Service suspension due to non-payment on EE is the last thing you want to experience.

First, they will suspend your service, so you won’t be able to use your device. But they might allow you to only make calls to emergency services.

You’ll have to pay what you owe to be reinstated.

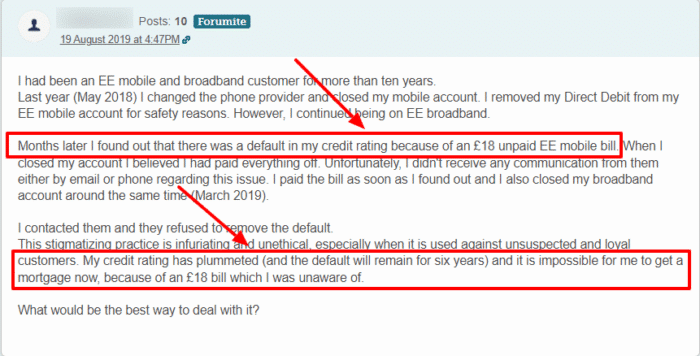

EE sometimes notifies credit reference agencies when you miss a scheduled payment. That will affect your credit score and ability to borrow, get a mortgage, loan or credit card.

This is because overdue payments can suggest you’re struggling to manage your finances.

Sometimes, late payments can lead to a default or a County Court Judgment. These are likely to have a more serious impact on your credit score.

So it really is in your interest to sort missed payments out quickly.

When EE terminates your service for non-payment, they’ll charge you a ‘termination fee’ as set out in their T&Cs.

Remember that if you’ve been late with EE payments, your credit score will take a hit. And this may affect your ability to get credit.

However, the impact on your score will reduce as the record ages.

As long as you keep up with future payments, your score should improve over time, making it easier to get approved for credit in future.

» TAKE ACTION NOW: Fill out the short debt form

Service is suspended. What should you do?

When you have an EE missed payment, the provider will contact you by mail or phone.

If they can’t reach you and you haven’t been in touch with their support, your service is suspended. This applies to most other phone companies, including Vodafone, so be careful and try to stay in touch as often as you can.

You can’t use the EE service until full payment is made.

If the amount on an account is higher than usual, the provider may also suspend your service. You’ll have to pay an ‘interim’ amount to get your service reinstated.

Resolving the EE service suspension should be a priority if you want to continue enjoying their services.

I suggest you contact EE as soon as possible if you think you’re going to miss a payment. They may agree to:

- Reduce your bill.

- Give you more time to pay.

- Increase your data or download limit.

- Move you to a cheaper contract.

If you think you’re vulnerable, or if it’s crucial for you to use a phone or the internet, you should let EE know.

They should make sure you’re treated fairly and help you keep connected.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Will they charge a late fee?

Yes, EE could charge you a late fee when you miss a scheduled payment.

Also, there will be a charge on your account to cover extra administration costs. So penalties for late payment on EE can get quite expensive.

Their fee penalties for missed payments are:

- £5 when your Direct Debit fails – each time the DD fails

- £5 for non-payment of a bill

What happens if a Direct Debit fails?

EE tries to take the money from your account a second time when the first Direct Debit fails. The provider does this about 7 days after the first attempt failed.

But if the second attempt to get the money fails, you’ll find a ‘failed direct debit’ charge on your account.

EE Direct Debit failure consequence is that your account is then cancelled. To avoid this, you must pay what you owe to EE by contacting their customer support team.

When your service is disrupted for non-payment, you can only reinstate it by organising another Direct Debit to EE.

My advice: Contact their support and work something out to get your service up and running as soon as possible.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Do they send details to debt collectors?

Yes, they could send your details to a debt collector.

The debt collector may add further fees and charges when they try to recover what you owe.

However, debt collectors can and cannot do certain things. For example, they cannot:

- Insist you pay more than you can afford

- Force their way into your home – don’t let them come into your house!

- Pretend they hold some kind of authority.

Can I change my payment date?

Yes, you can. But you must do it before the next EE bill is due.

You’ll also need to clear any outstanding amounts too.

Changing payment dates with EE is only possible through their support. Therefore, you must contact EE support to determine whether you can change your payment date.

If you don’t do it in time, you won’t be able to.

Can you reactivate your account?

Yes, you can, but only after paying what you owe the provider.

EE will reinstate your service within 24 hours. It could be in 2 hours if you’re lucky, but this is not guaranteed.

After a suspension, you might need to restart your device once the service is restored.

Can you cancel your service if you’re struggling to pay?

If you want to cancel your EE service, get ready to pay a hefty fee.

This can be over £200 for mobile and over £50 for broadband. EE service cancellation due to payment difficulties are very expensive.

Plus, you must tell EE 30 days before you wish to cancel the service.

EE Debt Collections Contact Details

| Website: | https://ee.co.uk/ |

| Telephone: | about Mobile +44 7953966250 about Broadband & Landline +44 2073620200 Mon to Fri 8 am – 9 pmSat to Sun 8 am – 8 pm about Mobile Broadband +44 7953966250 |

| Opening hours: | about Mobile +44 7953966250 about Broadband & Landline +44 2073620200 Mon to Fri 8 am – 9 pm Sat to Sun 8 am – 8 pm about Mobile Broadband +44 7953966250 |

| Deaf, hearing or speech impaired: | To contact us using the Relay UK service, dial 18001 in front of one of the following numbers: EE: 07953 966 250 Legacy brand: 07953 966 150 |