Is It Possible To Get My Council Tax Debt Written Off?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Dealing with council tax debt can feel overwhelming.

Luckily, you’ve come to the right place. Each month, over 170,000 people turn to us for help with debt solutions.

In this article, we’ll explain in a simple way:

- What steps to take if you’re finding it hard to pay your council tax.

- How to understand the different council tax bands.

- How you can ask the council to write off your council tax debt.

- How not paying your council tax can affect your credit score.

- The legal issues that can come up if you don’t pay your council tax.

Among those seeking support from Citizens Advice, the average council tax debt has remained stable at £1,100 over the last year.1 So, if you’re feeling worried, rest assured that you’re not alone in facing these challenges.

With our expertise, we’re here to guide you towards resolving your council tax debt.

How Do I Get Council Tax Written Off?

There are a few Council Tax debt solutions to consider to write off council tax debt.

Please discuss any of the following solutions with a debt advisor before deciding. Each one has pros and cons you must be aware of.

Debt Relief Order

You can apply for a debt relief order (DRO).

A debt relief order and Council Tax requires the help of a DRO advisor who will help you to establish if this debt solution is the right one for you.

Additionally, they will help you with your application to the official receiver. The DRO lasts around one year, after this time any debts not cleared are written off.

However, the DRO will remain on your credit file for 6 years.

Bankruptcy

You can write off council tax debt with bankruptcy.

Bankruptcy and Council Tax debt have dire consequences, and you should not take this option lightly.

Speak to your debt advisor about how bankruptcy can be used to write off council tax debt. I have some useful information about the pros and cons of bankruptcy that I advise you to read.

IVA

You can use an IVA to write off council tax debt.

However, the creditors must agree to the IVA. There’s no guarantee that your local council will agree, which would mean your council tax debt would remain.

» TAKE ACTION NOW: Fill out the short debt form

Council Tax Debt Solutions

I’ve put together this table to help you better understand how the different debt strategies can help you deal with council tax arrears.

Remember, learning about these options can make a significant difference in overcoming financial struggles.

| Debt Strategy | How It Can Help With Council Tax Arrears |

|---|---|

| Flexible Payment Arrangements | Local councils often offer the option to spread council tax payments over 12 months instead of the standard 10. |

| One-Off Payment | If feasible, pay council tax in full and potentially negotiate a slightly reduced amount. |

| Hardship Schemes | Council Tax Reduction (CTR) Discretionary Relief Hardship Funds Support for Vulnerable Individuals COVID-19 Specific Support Charitable Grants |

| Discounts and Exemptions | Check for eligibility for discounts (e.g., single-person discount of 25%) or exemptions (e.g., properties unoccupied due to the resident’s death, properties where everyone’s a full-time student, or a resident has severe mental impairment) |

| Deferred Payments | Some councils allow deferring payments wherein you’ll pay less now and make up for it later. |

| Challenge your Council Tax Band | If you believe your property’s council tax band is incorrect, you can challenge it to potentially lower future payments and refund previous overpayments. |

| Debt Solutions | Certain formal debt solutions like Debt Relief Orders (DRO), Bankruptcy, and Individual Voluntary Arrangements (IVA) can potentially write off council tax arrears, |

| Professional Debt Advice | UK residents can seek free advice from debt organizations and charities for council tax guidance tailored to their specific financial situation. |

When Can the Council Write Off the Debt?

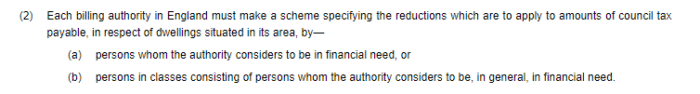

Councils have the power to write off council tax debt thanks to the Local Government Finance Act 1992.

Section 13A (1)(c) of the Local Government Finance Act details discretionary relief. This section can be applied to individuals suffering from severe hardship.

It also applies when individuals are suffering from severe mental health or physical conditions.

Council Tax debt and mental health are a serious issue.

If you’re struggling to pay bills and have council tax arrears, I suggest you seek help from a debt advisor.

Using Section 13 relief the council can reduce the amount you owe on your council tax arrears. It can include writing off the council tax debt in its entirety.

But, as mentioned, you must be in severe hardship, which means you don’t have enough money left over to pay council tax after your other bills are paid.

Your local council will have their own policy relating to Section 13A.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How to Apply to Write Off Your Council Tax Debt

If you think you qualify, you can apply to your local council to write off your council tax debt through Section 13.

To do this you must:

- Write a letter to the council to apply for discretionary relief

- Quote Section 13A of the Local Government Finance Act 1992 in your letter

[https://www.legislation.gov.uk/ukpga/1992/14/section/13A]

- Show evidence that you are unable to pay. I have a free budgeting tool you can use to work out your finances. Fill this in to help you establish what you can and can’t afford. Use this budgeting tool before you contact the council to ensure you are fully aware of your current financial situation.

- I also suggest contacting a debt advisor if you have any questions or are unsure of how to work out your budget.

The council must consider all applications for discretionary relief.

You can complain if your council dismisses your application. If you feel your application has been dismissed without being evaluated fairly, you can escalate your complaint to a Valuation Tribunal.

Does It Get Written Off After 6 Years?

A council tax debt can expire after 6 years and become statute-barred.

However, the council is not likely to allow it to get to this point. At the six-year point, council tax debt becomes effectively written off, but the debt still exists.

Statute-barred Council Tax debts must meet specific criteria if a local authority lets things get this far.

Check out the article I have written that explains statute-barred debts in greater detail.

What is the Council Tax Reduction Scheme?

You could be entitled to a Council Tax Reduction if you are on a low income, and you could receive a reduction even if you own a property or rented accommodation.

The one stipulation is that the address is your main address.

Low-income Council Tax relief could help you settle what’s owed by keeping future bills lower.

Tips to prevent Council Tax arrears

I suggest making an offer to the council which could prevent further action from being taken against you.

You should work out your budget to see how much you can afford to pay the council every month to clear your council tax arrears. Then send your payment offer with a copy of your budget to the council as soon as possible.

Keep copies of all your correspondence for your records.

Moreover, start making payments to the council straight away.

I suggest you manage Council Tax debt with the help of an advisor whose help could be invaluable.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Impact of Council Tax arrears on Credit Score

Council tax arrears won’t affect your credit score because local authorities don’t report any information to credit reference agencies.

In short, your credit history won’t be negatively impacted when you’ve fallen behind paying your Council Tax.

Can the Council Send Bailiffs?

Bailiffs can come to your home for council tax debt if you fail to maintain council tax payments.

Your council can apply for a Council Tax Liability Order which will state how much you owe to the council and include any additional court costs the council have had to pay.

If you fail to pay what you owe the council can take enforcement action to recover the debt.

Council Tax enforcement action includes:

- Using bailiffs to take your belongings

- Taking deductions directly through your wages or benefits

- Bankruptcy

- Imprisonment (could be for 3 months)

- Charging orders