Council Tax Arrears Debt – What Are Your Options?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about council tax debt and unsure of what to do? You’re at the right place for answers. Each month, over 170,000 people visit this site for advice on debt problems, so you’re not alone.

In this article, we will help you understand:

- What council tax debt is, and what happens if you can’t pay it.

- The steps you can take to deal with this debt.

- How to avoid extra charges if you are taken to court.

- Ways to possibly get some of your debt written off.

- What happens to your council tax debt if you pass away.

We know that dealing with debt can be scary. But don’t worry, we will explain everything clearly. You’ll find out what to do if you receive a summons for council tax, how to avoid bailiff fees, and how to clear your debt. We’ll also cover how council tax debt could affect your credit score and what to do if you’re struggling with unaffordable debt.

Let’s tackle this together.

What are council tax arrears?

Council tax arrears accumulate when you miss a council tax payment and have a debt. Your arrears are classed as a priority debt and will need to be paid.

If not, you could face court action, bailiffs and you could even go to jail for up to 90 days if you willfully neglect or reject making council tax payments. But getting sent to prison is rare.

What happens if you have arrears?

If you have council tax arrears, the council will write to you and say you need to pay within 7 days. If you ignore your council tax arrears, you will receive a final notice asking you to pay a full year’s council tax or face legal proceedings. And the judge might ask you to pay as well…

Ignoring a judge’s instruction can result in a visit from a debt enforcement agent. These agents have to give notice before turning up and an opportunity for you to pay.

Further silence can – although unlikely – result in a prison sentence of up to 90 days.

How to deal with council tax debt

Deal with council tax debt by being proactive and never hiding from the problem. I get it, you don’t want to confront the debt because it’s scary. But not being proactive can cost you money and stress.

Search for free advice from relevant charities for immediate support and guidance.

The easiest way to deal with council tax debt is to pay it off in full before it escalates to legal action. Alternatively, you may be able to negotiate a payments plan to spread out the cost of the debt. If you agree to this and miss a payment, the council will send a letter to your house and threaten court action again.

What to do if you are taken to court

If it does go to the courts and the judge sides with the council, they will issue you with a liability order asking you to make arrangements to pay it back. Again, you’ll have an opportunity to negotiate repaying your council tax arrears with a repayment plan.

Avoid paying bailiff fees!

Communicating with the council is recommended because if you fail to pay, the council will send enforcement agents (also known as bailiffs!) to come to your house and collect council tax payment and/or valuables.

They will charge you an initial £75 just to write to you, and then give 7 clear days to pay or they will start debt enforcement with further fees of £235+.

They may choose different enforcement actions, like trying to get the money directly from benefits like employment and support allowance.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What happens if you ignore the bill?

If you have not been paying your council tax, you should expect the local authority to send you a reminder asking you to pay all the outstanding council tax on your account. They will tell you that you must pay within 7 days.

If seven days to pay is not enough or you have trouble paying what you owe, it is best to reach out and speak with the council – and hopefully agree on an affordable payment plan.

If you do nothing, the local council will send a final notice. This letter will ask you to pay a full year’s council tax (the remainder of the financial year) or face legal action. If they do take legal action, your debt can increase.

Here is what can happen if you ignore a reminder to pay the money owed:

- Liability order

The council may ask the court to issue a liability order, which essentially makes you legally responsible to pay the unpaid council tax money. The £20 fee will be added to the debt.

- Debt enforcement

If you haven’t already, it’s best to get free debt advice from a charity at this stage.

The council can then use the court order to enforce the debt, i.e. take further action to make you pay. They could:

- Use an attachment of earnings to take payments from your wages or from DWP payments you receive. Your employer could be forced to pay some of your weekly or monthly wage to the court, and they will then send this to pay the tax.

- Use a charging order to take the payment owed from any property sale

- Make you bankrupt (in specific circumstances!)

But the most common action taken is to use bailiffs.

What to expect from council tax bailiffs

Enforcement agents, otherwise known as bailiffs, will send you a letter asking you to pay the council tax you owe.

Seek advice from a charity if you are dealing with a bailiff company!

They will send a notice letter asking you to make a full payment or contact them to agree to a CGA, which is a repayment plan secured against your possessions. If you don’t do anything within 7 days (not including holidays and Sundays), the bailiffs will attempt to come to your property and seize possessions which are then sold at auction to pay the council tax debt off.

Paying council tax debt back becomes more expensive at this stage, as you will need to pay bailiff fees, including an initial £75 for sending you the first letter. If the bailiffs have to visit you, fees are an additional £200+.

Ignoring bailiffs can be costly!

What if I am vulnerable?

Before you start addressing the Notice of Enforcement, you should know that if you:

- Are disabled in any way or extremely ill

- Suffer from any kind of mental illness

- Have children or are pregnant

- Are under the age of 18 or over the age of 65

- Are dealing with a stressful situation such as the death of a loved one or unemployment

- Don’t speak English very well

You are considered a vulnerable person. This means that any bailiffs will have to follow some additional rules to ensure their visit is as easy on you as possible.

Furthermore, if any of these conditions apply to you, you can get more time to deal with the Notice of Enforcement. You can also get more time if the Notice of Enforcement was not sent to you properly by the bailiffs.

If you fall into any of the above categories, you need to either tell the bailiffs yourself or get a relative or carer to do it for you. You can then contact them by phone or by post. I have a free letter template that you can use to explain your situation.

When you speak to the bailiffs, you need to:

- Tell them that you’re vulnerable

- Explain why you would find dealing with bailiffs more difficult than other people in the same situation

- Ask them to stop any visits in the future because it will cause harm and distress to you

- Tell them if a letter or a visit could make your situation worse – this could be the case if you have a mental health problem or a heart condition, for example.

Make a note of what you agree with the bailiffs about future contact. This will make it easier to argue with them if they don’t stick to this new agreement, or if you need to make a complaint.

Can you be sent to jail for council tax arrears?

You can be sent to prison for up to three months if you do not pay your council tax arrears. But it is quite rare to go to jail unless you have willfully neglected the debt or rejected all types of payment.

In 2019. The Guardian newspaper reported that an average of 51 people were imprisoned for these types of debts between 2013 and 2019.

If the local authority still doesn’t get your council tax payment, they can apply for a hearing at the Magistrates’ Court. You will be summoned and you must attend or an arrest warrant can be issued.

If the judge believes you have willfully rejected the debt, they may send you to prison. If you do go to jail for unpaid council tax, you are still required to pay this tax, as well as your arrears.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

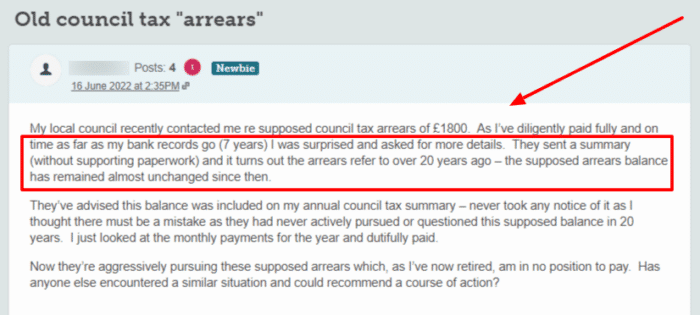

How long can you be chased for a council tax?

In England and Wales, your council tax debt can be chased until it becomes Statute Barred as per The Limitations Act 1980. The council will have six years until the debt originated, or until you last paid towards it, to collect the money. After this time, the debt becomes legally unenforceable.

However, in Scotland the situation is different and local councils there have 20 years. Scotland has the equivalent laws, but council tax debts are not covered by those equivalent laws.

It is unlikely that a council will not track you down in either of these timeframes.

Seek advice if you think your debts are legally unenforceable and shouldn’t be asked to make a payment.

Will it affect my credit score?

Yes, council tax arrears can affect your credit score because it can lead to legal action.

This is because companies use your credit file to see if you are a ‘high-risk’ customer – someone who might have difficulty paying their bills on time. If you have a CCJ for any debt, including council tax, you have had such trouble paying back your debt that someone had to go to court about it.

If you have an earnings arrestment as well, you:

- Haven’t paid off your debts according to your original credit agreement

- Got taken to court over your lack of repayment

- Got a CCJ against you

- Didn’t pay according to the terms of the CCJ

- Forced your creditor to go back to court for an earnings arrestment.

Understandably, companies are going to be reluctant to give you credit!

After 6 years, it is no longer visible on your credit report, and you should find it easier to get credit again.

Can you get it written off?

You might be able to write off some of your council tax debts wiht a debt solution. Even if these debts can’t be covered, getting a debt solution might help you get back in control of your finances enough to pay back the council.

There are several different debt solutions available in the UK, so I recommend speaking to a debt charity as soon as possible. Their advisors will be able to look at your finances in detail and help you work out which debt solution will work best for you.

I have linked a few charities that offer these advisory services for free below.

Individual Voluntary Arrangement (IVA)

An IVA is a formal agreement between you and your creditors. You agree to pay a monthly sum that is distributed amongst your debts, and your creditors agree not to contact you during your IVA.

IVAs typically last for 5 or 6 years, and any outstanding debt is wiped off when it ends.

Keep in mind that IVAs are not suitable for everyone. You need to owe several thousand pounds to more than one creditor to be eligible. You also need to demonstrate that you have some disposable income every month.

Trust Deed

IVAs are not available in Scotland. Instead, you will need to opt for a Trust Deed.

Trust Deeds work in the same way as an IVA – you pay an agreed sum each month that is shared amongst your creditors, they can’t contact you, and any leftover debt at the end of your Trust Deed term is written off.

Debt Relief Order (DRO)

A DRO is a good option for those facing financial hardship with no assets and little income.

For 12 months, you make no payments, but your creditors freeze your interest and don’t contact you.

If your finances haven’t improved during this year, you may be able to write off your unsecured debts.

Bankruptcy

If you have debts but no realistic possibility of ever paying them off, you may need to declare bankruptcy.

Bankruptcy has an unfair stigma attached to it as it may be your only way of getting a financial fresh start. That said, it is a serious financial situation that should not be taken lightly.

Sequestration

Sequestration is the Scottish version of bankruptcy.

If you have little income and no valuable assets, you may be able to apply for a minimal asset process bankruptcy (MAP). A MAP is a quicker, cheaper, and more straightforward version of sequestration, so worth considering.

Another way to not have to pay!

If it has been 6 years – or 5 years in Scotland – since you last paid towards your unsecured debts and you have not written to your creditor about your debt during this time, it is statute-barred.

This means that the debt is not enforceable. It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

Keep in mind that not all debts become statute-barred!

Any HMRC debts, for example, will stay enforceable for decades. Any debt that had a County Court Judgement (CCJ) attached to it during the 5 or 6-year window will be enforceable for the duration of the CCJ.

If your debt is statute-barred, you can use my free letter template to write to your council and explain the situation.

If you are unsure about the status of your debt, you can contact a debt charity for some advice. Their advisors will be able to look at the debt in question, determine its status, and advise you on your next steps.

What about Scotland?

In Scotland, things are a little different. Their equivalent to Statute Barred exists, but it doesn’t include local council tax debt. Instead, you would have to wait 20 years for the debt to become unenforceable.

You can contact your local authority to tell them the debt is too old to be enforced using this letter template!

How to clear council tax debt

If you want to clear your council debt with affordable repayments, and you are unsure what you can afford or how to go about it, there are people who can help with free debt advice.

Debt charities are trained to help with council tax debts across England, Wales and Scotland. They will help you communicate with local authorities and come up with a payments plan you can comfortably afford by helping you budget accurately.

Pay council tax with their free support by finding the charity that’s right for you!

What happens to the debt when someone dies?

Council tax debts can be paid through the deceased’s estate, or they might have to be paid by anyone else living in the property, even if they were not named on the account.

When someone dies, their debts are usually paid from what they leave behind. And if they don’t have enough money to pay their debts, the estate is termed as insolvent and debts are paid in priority order. It is possible that a debt will die with the person – but that’s not exactly how it works for council tax.

Council tax debt after death

If you lived with someone who paid council tax and you were not named on the bill, in the event of their death, you will be liable to pay the local council back.

Note: If you are now the sole occupier of the property, you will be eligible for a reduction. People with a low income or on state benefits like universal credit allowance, income support or pension credit may qualify for a reduction too. Contact your respective council for information on reductions.

Can you get a reduction?

You can get a council tax reduction if you live alone, live with non-payers, such as full-time students, apprentices, diplomats and other qualifying adults. You can also reduce your council tax payments if you have a low income and receive some benefits, such as income support pension credit, employment and support allowance, universal credit or jobseekers’ allowance.

Charities will also provide advice on these types of discounts.

Can I backdate a reduction?

You can typically backdate a reduction easily for six months. However, you can apply to backdate council tax overpayments until you started paying, but you may need to provide extensive evidence and an explanation as to why you never applied for a reduction.

What happens if you wrongfully claim a reduction?

If you claim a deduction you are not eligible for, you can be charged penalty fees up to £1,000. If you make a mistake applying for a reduction and then notify the local authority, you can avoid paying any fees.

Incorrect reductions can be backdated too, which can put you into arrears.

Can I make a complaint about my local authority?

If you think your council has acted inappropriately or is making a mistake, you should lodge a complaint directly to the council.

If you want more helpful guides and answers to questions relating to council tax debt, look no further than MoneyNerd.

I discuss and dissect every aspect of being chased and made liable for these types of debts in my dedicated council tax debt hub.

Take a look now and find answers without the jargon!