Affordable Car Insurance with DG10 Conviction for you

The information in this article is for editorial purposes only and not intended as financial advice.

The information in this article is for editorial purposes only and not intended as financial advice.

Are you worried about finding affordable car insurance after a DG10 conviction?

We know it’s a tough situation, but you’re not alone. In fact, over 9,300 people visit our site each month for advice on this very topic.

In this article, we’ll discuss:

- What a DG10 conviction means and its potential consequences.

- The impact of a DG10 conviction on your car insurance.

- The difference between a revoked licence and a driving ban.

- Ways to find affordable car insurance despite a DG10 conviction.

- The importance of informing your insurance company about your conviction.

The Guardian reports that each year in the UK, around 1.2 million people face the challenge of securing car insurance because mainstream insurers typically refuse coverage to those with unspent convictions.1

I know this can be worrying, but we’re here to provide clear information and useful advice to help you get affordable car insurance.

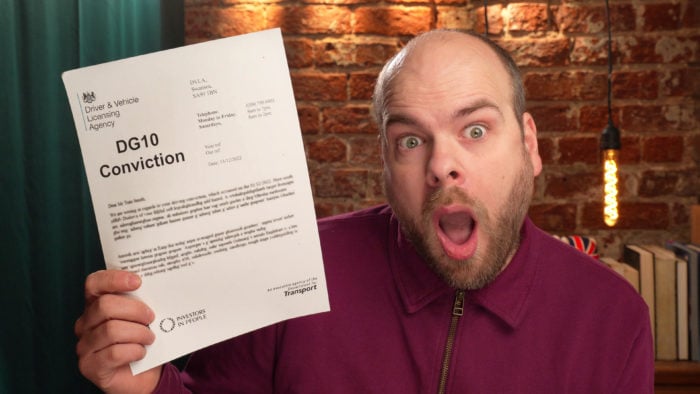

The Definition

A DG10 conviction is a serious one.

It means that you killed somebody while you were in charge of a vehicle, and were under the influence of drugs.

These can be either recreational drugs, or medication.

If you were prescribed medication and warned not to drive but still did, you are just as guilty of drug driving as a person using recreational drugs.

Below, you can see details of what a DG10 conviction is.

| Conviction Code | Driving Offence | Penalty Points | Spent After |

| DG10 | Driving or trying to drive while under the influence of drugs, causing a death by careless driving. | 3 – 11 | 11 Years |

Can You Get Insurance for a Vehicle if You Have It?

This is the million-dollar question here.

Whether any traditional vehicle insurance firms would be willing to take you on if you have an unspent DG10 conviction.

Finding affordable insurance as a drunk or drug driver is going to be tough. You will be seen as a very high-risk by insurance firms.

There are other factors that can have an impact on how much of a risk you are to ensure, and we cover some of these in the next section.

However, with a DG10, you are likely going to be forced into the arms of a subprime insurance firm.

These are specialist vehicle insurers that are willing to take on high-risk drivers, but at a cost.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

Will the Cost Go Up?

The answer to this question is almost certainly yes.

The cost of insurance after a drug or drunk driving ban is going to be more. But it isn’t just the conviction itself that adds to the risk factor of insuring you.

There are other things that can have a significant negative effect on the cost of vehicle insurance. Such as the ones we have listed below.

- The number of years you have had a full driving licence.

- How old you are.

- How much no-claims bonus that you have.

- The type of vehicle you want to insure.

- The area where you live.

- How many miles that you drive each year.

- Whether you use the vehicle for work or not.

- The type of insurance cover you are asking for.

These factors will combine into your own unique situation.

Convicted Driver Insurance Reduction

Now let’s look at a few things you could do to try and lower the risk factor. This could result in more affordable vehicle insurance.

You could try any or all of the following:

| How to Reduce Insurance Rates | Keep in Mind… |

|---|---|

| Choose Your Car Wisely | Consider age, engine, insurance group & price. The lower the group, the lower the premium. A high-powered & fast car, or cheap car with less value come with a higher risk, which means a higher premium. |

| Ensure Car Safety & Security | Park in a driveway or locked garage. Use safety technology. |

| Add a Named Driver | Adding an experienced driver with a good claims history, such as a parent, can lower your insurance premium by reducing the perceived risk. |

| Drive Fewer Miles | Reduced mileage = Reduced risk. |

| Complete a Rehabilitation Course |

Third-Party Only – the bare minimum; as required by law Comprehensive – provides full coverage and may include personal accident and medical expenses coverage Third Party, Fire & Theft – TPO cover and also insures against damage to other vehicles and injuries to others in accidents where you’re at fault, accidental fires or arson, stolen vehicles |

| Determine the Cover Level You Need |

Third-Party Only – the bare minimum; as required by law. Comprehensive – provides full coverage and may include personal accident and medical expenses coverage. Third Party, Fire & Theft – TPO cover and also insures against damage to other vehicles and injuries to others in accidents where you’re at fault, accidental fires or arson, stolen vehicles. |

| Compare Policies and Opt Out of Extras | Get quotes tailored to your specific convictions and needs. Optional extras like excess protection, legal cover, breakdown, windscreen, and gadget cover are nice to have but come with added costs. |

| Increase Your Excess | Raising the amount of excess (upfront payment for any claim; the rest to be paid by the insurer) on your policy can lower your insurance premium. |

All of these things could help to bring the cost of your vehicle insurance down. And don’t forget to shop around.

Contact a number of insurance providers and find the most competitive quote you can.

Similar Codes

There are some similar conviction codes to a DG10. This post can equally relate to any of these.

The table below outlines the other DG conviction codes in more detail.

| Conviction Code | Driving Offence | Penalty Points | Spent After |

| DG60 | While under the influence of drugs, causing a death by careless driving. | 3 – 11 | 11 Years |

| DG40 | In control of a vehicle while under the influence of drugs, causing a death by careless driving. | 10 | 4 Years |

» TAKE ACTION NOW: Find the best insurance for drivers with points

Do You Have To Let Your Insurer Know?

If your insurer asks you about any unspent convictions, you have to tell them about your DG10.

But only if they ask.

However, in reality, every insurer will ask. You don’t have to tell them about spent convictions, even if they do ask.

Don’t be tempted to cover up your DG10 conviction by lying through omission.

And if your insurer does make a mistake and doesn’t take your DG10 into account, you should contact them and resolve the problem. Because if you are driving on a policy that is based on false information, you are not insured.