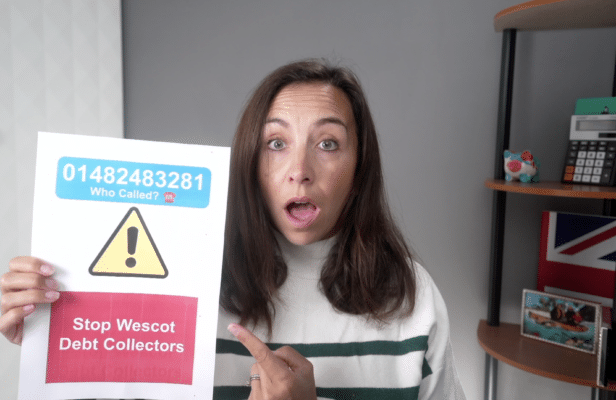

01482483281 – Who Called? Stop Wescot Debt Collectors

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Did you receive a call from 01482483281? This is Wescot Debt Collectors.

We know that getting a call from a debt collector can be scary, but you’re not alone. Each month, over 170,000 people visit our website for help with debt queries, just like you.

In this article, we will give you clear and easy-to-understand information about:

- Who Wescot Debt Collectors are.

- Why you have been contacted by 01482483281.

- How to handle a call from Wescot Debt Collectors.

- Ways to stop Wescot Debt Collectors from contacting you.

Research shows that 64% of people in the UK find dealing with debt collectors stressful1. So we understand how you feel, and we’re here to help you.

Let’s figure out the best way to handle this situation!

Who called you?

It was Wescot Debt Collectors who called you from 01482483281.

They is a legitimate debt collection business working to recover account arrears in the UK – a very profitable endeavor, as research shows that in 2022, arrears on household bills increased by 68% from £1,739 to £2,9202.

Wescot Debt Collection is one of the most established collections agencies, which is why we’ve already covered them here at MoneyNerd.

You can read our Wescot Debt Collection guide for help dealing with them and your debts.

Why have they made contact?

A call from 01482483281 probably means Wescot is chasing you for an unpaid debt, or they’re chasing someone who they believe owns your phone number.

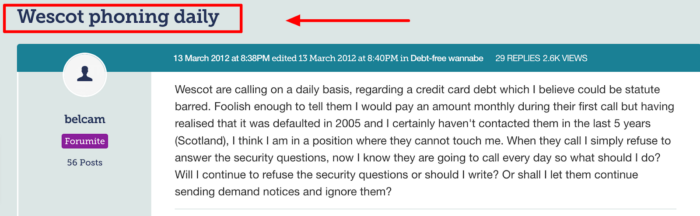

There is evidence from online forums that Wescot can be persistent, which is against rules set down by the FCA. See here:

Source: https://forums.moneysavingexpert.com/discussion/3849213/wescot-phoning-daily

We’ll discuss how you can report Wescot for breaking communication rules in just a minute.

Normally, persistent phone calling is used if a debt collection letter was sent and ignored.

Wescot Debt Collection must send a letter first if they do want to follow up with threats of legal action. They can’t just rely on phone calls.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can you ignore their calls?

You don’t have to answer the phone to Westcot Debt Collectors, especially if you’ve already responded to their debt letters.

However, if you haven’t received any other form of communication from them, you might want to answer to clarify what’s going on.

This could also reduce your stress levels.

If you do answer the call, don’t provide the caller with your personal information. You’re not obligated to do so.

They should be able to tell you who they are and why they’re calling without getting you to confirm details.

Ignoring all communications is risky because you could end up subject to a court order called a CCJ, which could then escalate to the use of bailiffs.

We always recommend responding to debt collectors – even just to question the debt’s validity. You have the right to request proof of the debt.

They have to prove it or they can’t charge you.

How do you stop them from contacting you?

It’s possible to limit Wescot Debt Collection from contacting you, and you can even stop them from calling altogether.

The FCA says that debtors can provide debt collection companies with their communication preferences.

It’s best to do this in writing and keep a copy of the letter in case you need to complain later.

For example, you could tell Wescot to only write to you and to stop calling. Wescot must then adhere to your preferences, along with any of the existing rules when communicating with debtors.

» TAKE ACTION NOW: Fill out the short debt form

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How do you complain?

If you provided Wescot Debt Collection with your communication preferences and they ignored them, you should lodge a complaint directly to Wescot.

If Wescot fails to respond, fails to respond adequately or fails to keep to your communication preferences again, you can escalate the matter to the Financial Ombudsman Service (FOS).

This service will review the series of events, preferably with proof supplied by you.

Providing call logs can be a good way to prove persistent calling. The FOS can then punish Wescot if they have acted wrongfully.

Know Your Rights

Even while recovering a legitimate debt, debt collectors must abide by certain rules and have limited rights when doing their job.

Knowing your rights and those of the debt collectors visiting/contacting you is key to ensuring that they don’t take advantage of you during the process.

Please check out our related article on the topic and take a quick look at the table below to learn more.

| Debt Collectors Can | But They Can’t |

|---|---|

| Contact you by phone or mail. | Call you after 9pm or before 8am. |

| Conduct home visits (on rare occasions) and knock on your door. | Forbily enter your home, or stay if you ask them to leave. |

| Threaten to take you to court by suing you for payment on a debt. | Harrass you, including threats of violence, repeated calls and visits, or abusive language. |

| Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | Visit your workplace. |

| Access your bank account, but only after a court judgment has been made. | Take anything from your home or threaten to do so. |

| Sell your debt. | Speak to other people about your debt without your permission. |

| Contact you frequently. | Keep doing so if you request that they reduce communications. |

Wescot Credit Services Debt Collection Contact Details

| Telephone number | 01482 484673 |

| Email address | [email protected] |

| Postal address | Wescot Credit Services Limited PO Box 137 Hull HU2 8HF |