Wescot Credit Services Debt Collectors – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you received a letter from Wescot Credit Services Debt Collectors? Are you feeling confused about the debt and wondering if you should pay it?

You’re not alone, and you’re in the right place. Every month, over 170,000 people visit our website for advice on debt issues just like this one.

In this article, we’ll help you understand:

- Who Wescot Credit Services are.

- How to check if the debt they claim is truly yours.

- The steps to deal with Wescot if you can’t afford to pay.

- Your rights when dealing with Wescot and other debt collectors.

- Options for paying the debt, including ways to possibly write off some of it.

We know how worrying it can be to get a letter from a debt collector. After all, nearly half of individuals who deal with debt collection agencies have experienced harassment or aggression1.

Don’t worry! We’re here to help you navigate this issue and find the best solution for you.

Why Is Wescot Calling?

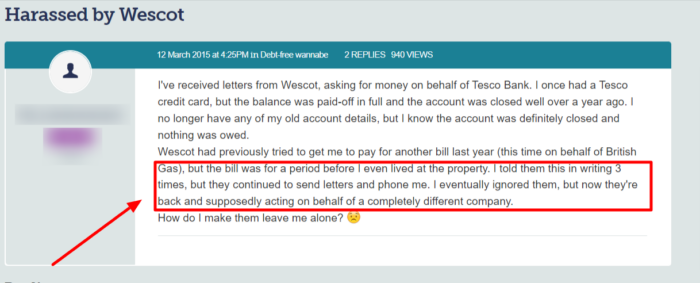

Keep in mind that Wescot will sometimes make mistakes! Take this comment from a financial advice forum:

It appears that Wescot had the wrong information but tried to collect the debt anyway!

While this was probably just an error on their part, it is very important that you keep good records of your finances. Being able to quickly share evidence that they have the wrong person is the easiest way to get them off your back if they have made a mistake!

Typical Debt Collection Process

As mentioned above, Wescot will call or send letters if you’ve missed a payment. This is quite common, as it’s part of the debt collection process.

We’ve put together this table that will help you better understand the debt collector timeline. If you’d like to learn more about this process, be sure to check out our specialized guide.

| Stage | Actions | What you should do: |

|---|---|---|

| Missing one or two small payments | Calls and letters from the debt collector asking for payment. They may enquire about reasons for missing payments. | Contact the debt collector and offer to pay what you can. If you are struggling to pay the debt, get in touch with us to explore your options. |

| Missing large or multiple payments | Their contact will become more frequent, urgent, and threatening. | Contact the debt collection agency and offer to pay what you can. You may also make a complaint if you think the letters are a form of harassment. |

| Debt collector visit | After a few months, if the debt is significant (£200+) you will receive notice of a debt collector visit. They have to notify you before arriving. Debt collectors cannot take anything from your home – they may only ask for payment. | If a debt collector shows up at your home, ask them to show proof of the debt and their ID through a window. Do not open your door or let them in. You can arrange a payment plan with the debt collector, but make sure to get a receipt of this. |

| Court | If you still do not pay your debts to the original lender/debt collector agency, they will take you to court and either attempt to: – File a CCJ against you. – File an attachment of earnings order. – File a lawsuit against you. |

You must show up to your court date. From here, you can either dispute the debt, or the judge will likely suggest a manageable repayment plan for you. |

Fight Wescot Debt Collection with This Simple Trick

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What Happens if You Ignore Wescot?

We always recommend responding to debt collectors – even just to question the debt’s validity. Remember, you have the right to request proof of the debt. They have to prove it or they can’t charge you.

Unfortunately, debt-related harassment can be all too common and you should report this behaviour if you can.

Can You Write Off the Debt?

If the debt is more than six years old, it may have become too old to enforce.

This is called a Statute-Barred Debt. While the debt is not technically written off, your creditors are legally prohibited from doing anything to make you pay.

Even if your debt is younger, you may be able to write off some of it. Keep in mind that this is not guaranteed and will depend on your personal circumstances.

You will need to do some research to make sure you find the best option for you!

Individual Voluntary Arrangement (IVA)

An IVA is a legal agreement between you and your creditors that will allow you to pay back your debt over an agreed period of time.

If you take out an IVA, you will have some obligations.

- You must make all of the payments that you have agreed to

- You can’t take out any new credit until your IVA is finished

- You must inform your IVA provider if you get any money.

Your creditors will also have obligations. Once you have started your IVA, they are not allowed to:

- Hassle you to pay your debts

- Charge you interest on any of your debts.

There are no minimum or maximum amounts of debt that can be included in an IVA. However, fees can be quite high so if your total debt is less than £10 000 a different debt solution may be more suited to you.

Debt Settlement Offer

You can offer to pay your creditors a lump sum. In return, they agree to wipe off any outstanding debt that you may have.

This is a good option if you have some savings available or if you have recently come into some money.

When you make a debt settlement offer, you must explain to your creditors that this is a limited-time deal to pay back some of your debt as you usually would not be able to afford to pay them back at all.

Keep in mind that not all creditors will agree to this. They are more likely to accept if you offer to pay a larger percentage of your debt back!

Debt Relief Order

If you owe less than £30 000, don’t own your own home, don’t own anything of value, and have limited income, your best bet for dealing with your debt could be a Debt Relief Order (DRO).

With a DRO, you do not make payments to most types of debt and you can’t be forced to by your creditors.

Generally, a DRO will last a year but will be cut short if your financial situation improves. At the end of your DRO, any remaining debts will be written off.

Keep in mind that there is a fee to apply for a DRO and you will need to go through an official DRO adviser.

A DRO will not cover all debts – including child maintenance or other court fines – so it is not suitable for everybody.

Bankruptcy

If you are unable to repay your debts and these debts add up to more than the value of your belongings, you might have to declare bankruptcy.

From our experience, a bankruptcy period will last around a year and your creditors will not be able to claim their debts.

However, bankruptcy is a serious financial situation that will have lifelong implications for you. It really only should be used as a final resort.

Feeling overwhelmed?

Don’t hesitate to contact someone for help!

There are several charities and organisations that offer financial counselling, debt advice, and even tips to negotiate with your creditors.

The following organisations can help:

» TAKE ACTION NOW: Fill out the short debt form

Has Wescot Debt Collectors Behaved Like This?

Aggressive Callers

Frequent Calling

Wearing You Down

Breaking Privacy Laws

Pretending to Be More than Debt Collectors

How Can You Contact Wescot Debt Collection?

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Checking for Other Debt Collectors

There are a lot of ways to get into debt. In fact, it’s not uncommon to owe money to several companies at once.

Perhaps you have a mortgage, a car loan, a couple credit cards and an item or two you bought on buy-now-pay-later schemes. It’s easy to lose track.

That’s why it’s important to regularly check your credit report and bank statements to make sure you haven’t missed anything.

If a debt collector has purchased your debt, it appears on your credit report.

Some of the debt collectors you’re most likely to come across are PRA Group, Lowell and Cabot Financial.