ACT Credit Management Debt – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

When a surprise letter comes from a debt collector, it can be a bit scary. You may wonder, why do I owe ACT Credit Management money? Should I pay it? Is this a real company?

Don’t worry, you’re not alone. Each month, over 170,000 people come to our website for help with debts.

We know it’s tough, as research shows 64% of UK adults find interactions with current debt collectors stressful1. We’re here to answer common questions about ACT Credit Management and tell you what to do if you get a letter from them.

In this article, we’ll cover:

- What ACT Credit Management is and if it’s a real company.

- Who ACT Credit Management collects debts for.

- How ACT Credit Management may try to get money from you.

- What to do if you get a letter from ACT Credit Management.

- Options for handling your debt, such as a Debt Management Plan or Bankruptcy.

Remember, you’re not in this alone. We’re here to help you through it.

Have you received a letter?

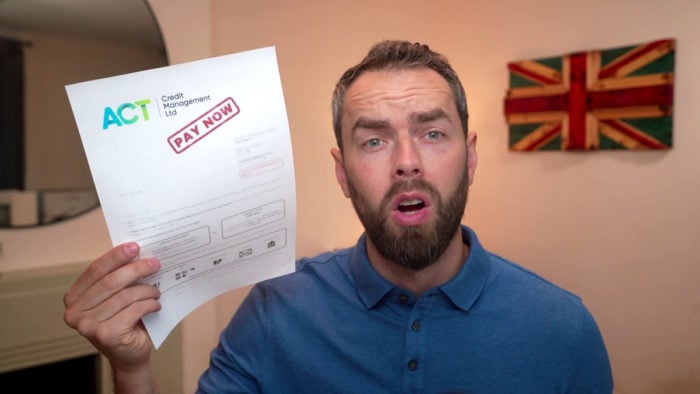

An ACT Credit Management debt letter is a Letter Before Action (LBA). In legal speak, this means it is a letter before the client may take you to court. You are given an opportunity to pay by a fixed deadline or should expect to be taken to court.

Sometimes these letters are genuine, and their client does intend to take you to court if you don’t pay. This is more likely if you owe a considerable sum of money.

But in other times, these threats could be unrealistic and ingenuine. They may simply threaten court action to make you anxious, encouraging you to pay. But there is no method of knowing when legal threats are real and when they’re not.

The average unsecured debt has increased by 25% year-on-year, rising to £13,9412, which means debt collection companies aren’t going anywhere any time soon. It’s key that you pay attention to the debt collection process and any contact ACT Credit Management tries to make with you. Otherwise,

Request proof the easier way!

You should request proof of the debt in writing and keep a copy of the letter in case they still take you to court. Not providing proof and then taking you to court could backfire on them. Don’t sign your letter.

To make things easier, you can use our own letter template to ask for proof of the debt. This will save you time and ensure your request is made firmly.

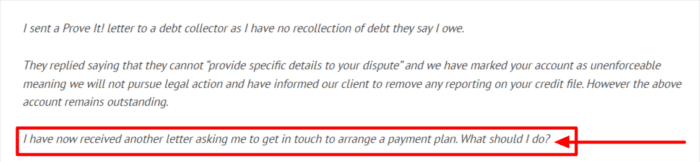

Remember that you don’t have to pay for a debt that can’t be proven to be yours. Take a look at this example.

This forum user doesn’t have to do anything – their debt collectors can’t do anything to make them pay. The second letter was probably sent on the off chance that they wouldn’t double-check their accounts and pay anyway. Cheeky!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Should you pay them?

You don’t have to pay ACT Credit Management after receiving a Letter Before Action, but that doesn’t mean you should ignore them either! Of course, you can always pay them if you know about the debt and want to clear it.

They should offer you an affordable payment plan based on your circumstances if you can’t pay it off at once. However, one of the reviews published above suggests they may not consider your financial situation.

But if you shouldn’t ignore the letter and don’t have to pay it straight away, what should you do? You can request proof that you owe the money. This is beneficial because:

- They might not provide proof and then you don’t have to pay

- It may take them weeks to provide proof, giving you more time

- It may help them realise they have the wrong person

The legal loophole to get you off the hook!

There is one way that you won’t have to pay ACT Credit Management Debt Collection, and that’s when your debt is statute-barred.

If it has been 6 years – or 5 years in Scotland – since you last paid towards your unsecured debts and you have not written to your creditor about your debt during this time, it is statute-barred.

This means that the debt is not enforceable. It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

Keep in mind that not all debts become statute-barred!

Any HMRC debts, for example, will stay enforceable for decades. Any debt that had a County Court Judgement (CCJ) attached to it during the 5 or 6-year window will be enforceable for the duration of the CCJ.

If your debt is statute-barred, you can use my free letter template to write to ACT and explain the situation.

If you are unsure about the status of your debt, you can contact a debt charity for some advice. Their advisors will be able to look at the debt in question, determine its status, and advise you on your next steps.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How do they chase you?

ACT Credit Management will chase you for payment on a debt by calling, texting and emailing. But the most important communication you’ll receive from this is the ACT Credit Management debt letter.

We’ll come back to these letters shortly. But first…

» TAKE ACTION NOW: Fill out the short debt form

Online reviews

ACT Credit Management reviews suggest the company is aggressive and doesn’t always have the interests of debtors in mind. Here are some of the ACT Credit Management complaints mentioned on their Google business reviews:

“Try to make an arrangement with clearing out my debt and they forced me to pay more than I could afford! The guy was absolutely horrible!”

- Dan P (Google review)

“I don’t understand why you guys are charging me so much! Maybe you are collecting my tuition from the college. Your harassing letters affect me badly! It was agreed at the beginning, but now it is forcibly asked for money! Obviously bullying people?”

- Sa Le (Google review)

What Happens If I Don’t Pay?

We’ve all wondered – what exactly will happen if you stop paying off your debt? Well, the answer is a whole lot of bother.

- Your creditor will send you reminders and then demands that you pay any missed payments

- If you don’t pay, your account will default

- If you still don’t pay your debts, your creditor can choose to sell your debt to a debt collection agency or employ an agency to chase you for the missed payments. This is when you’ll most likely meet ACT Credit Debt Management.

- If you don’t pay the collectors, your creditor or the collection agency might be able to take legal action against you to get their money back. Legal action usually starts with a CCJ.

Janine, our financial expert, explained that while debt collectors can visit your home for payments, they cannot come to your workplace, act threateningly, force payment, or discuss your finances with others. If they violate these rules, you can complain.

How do I Make a Complaint?

If you think that ACT Credit Management has been unreasonable or behaved inappropriately, you can make a complaint. You can also make a complaint if you feel that they have broken any of the Financial Conduct Authority’s (FCA) guidelines.

Make your first complaint to ACT Credit Management so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, ACT Credit Management may be fined. You could even be owed compensation.

Know Your Rights

To have an edge over the situation, it’s important that you know your rights and those of debt collectors. Here’s a quick table summarizing everything you need to know.

| Debt Collectors Can | But They Can’t |

|---|---|

| Contact you by phone or mail. | Call you after 9pm or before 8am. |

| Conduct home visits (on rare occasions) and knock on your door. | Forbily enter your home, or stay if you ask them to leave. |

| Threaten to take you to court by suing you for payment on a debt. | Harrass you, including threats of violence, repeated calls and visits, or abusive language. |

| Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | Visit your workplace. |

| Access your bank account, but only after a court judgment has been made. | Take anything from your home or threaten to do so. |

| Sell your debt. | Speak to other people about your debt without your permission. |

| Contact you frequently. | Keep doing so if you request that they reduce communications. |

ACT Credit Management Contact Details

| Address: | ACT Credit Management Ltd Bank House, 7 St John’s Road, Harrow, HA1 2EE Te: +44 (0) 203 1500 150 ACT Credit Management Ltd Caithness House, 127 St Vincent Street, Glasgow, G2 5JF Tel: +44 (0)141 739 9800 |

| Email: | [email protected] |

| Website: | https://www.actcredit.com/ |