Download The “Prove It” Letter Templates

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

When a debt collector sends a letter, it can feel scary. You might not know where this debt comes from or if you really need to pay it.

But don’t worry, we’re here to help. Every month, over 170,000 people visit our website seeking advice on debt matters.

In this easy guide, we’ll show you:

- Ways to question or even ignore the debt collector.

- Steps to stop the collector from bothering you too much.

- Tips to set up plans to pay back what you owe.

- Advice on how to get rid of your debt legally.

Nearly half of people who deal with debt collection agencies have experienced harassment or aggression1, and even our team knows what it’s like to be chased by debt collectors.

With our experience, we’ll help you understand your options. Let’s get started!

Someone Else Owes the Money

It is quite common for someone who owes money to “forget” to tell their lender when they move home.

As a result, you might have received a letter from a debt collection agency that relates to a debt that is owed by someone who lived in your home before you moved into it.

You are not legally obliged to do anything if you receive such a letter and the debt will not affect your credit rating because credit files apply to individuals rather than addresses.

However, if you don’t do anything, the debt collection agency will continue to hassle you so it is in your interest to let them know that the person no longer lives at your address.

The easiest way to do this is to send them the following letter:

Dear Sir/Madam

Re: [Reference]

I refer your letter dated [date] regarding this debt.

I moved into this address on [date] and I can confirm that [account holder] has not lived at this address since then. I am sorry but I cannot let you have a forwarding address for [account holder].

If you continue to contact me about this debt you will be committing what amounts to psychological and/or physical harassment.

Please would you update your records and confirm that you will not be contacting me again about this debt.

Yours faithfully.

Be aware that the debt collection agency may ask you for evidence that the account holder no longer lives at your address. You are not legally required to provide that.

Neither are you legally required to provide a forwarding address, even if you have one. In fact, sharing this information with the debt collection agency could potentially pose risks for you. Therefore, it’s advisable not to disclose that information.

» TAKE ACTION NOW: Fill out the short debt form

You Don’t Think You Owe the Money

There are a number of reasons that you might think you don’t owe the money that is being claimed. You might think that you have already settled the debt. You might have forgotten that you owe the money.

But commonly, the reason you don’t know if the debt is yours is because you don’t recognise the name of the debt collector.

For example, Intrum Justitia debt collectors certainly are not a household name yet they buy debt from well-known companies like eBay, O2 and Paypal. Therefore, there is no reason for you to suspect the debt is yours and after all, it may be a mistake.

A debt collection agency has to mark a debt as settled unless they can provide evidence that you owe the money that they claim you owe.

If you don’t think that you owe the money that they are claiming you owe, you can send them the following letter:

Dear Sir/Madam

Re: [Reference]

I refer your letter dated [date] regarding this debt.

I believe that I do not owe the money that you are claiming. You will be aware that the Financial Conduct Authority (FCA) Consumer Credit sourcebook says:

A firm should neither ignore nor disregard a customer’s claim that his debt has been settled and/or is disputed and must stop making demands for payment without providing the customer clear justification and/or evidence as to why the claim is not valid. (7.5.3)

A firm must suspend or cease the steps it or its agent takes in the recovery of a customer’s debt where the customer disputes or has settled the debt on valid grounds or what may be considered valid grounds. (7.14.1)

If a customer disputes the debt on valid grounds or on what may be considered valid grounds, the firm must re-examine the dispute and provide details of the customer’s debt to the customer in a reasonably timely manner. (7.14.3)

If there is a dispute regarding the identity of the borrower or the amount of the debt, it is for the firm (not the customer) to establish, that the customer is indeed the correct person/identity in relation to the debt owed or that the amount is correct under the agreement. (7.14.4)

A collection firm must provide the customer with information regarding the outcome of its investigations about a debt that the customer disputed or has settled on valid grounds. (7.14.5)

If the customer disputes the debt and the firm who seeks to recover the debt is neither the lender nor the owner, the firm is required to:

(1) Pass the information given by the customer to the actual lender or the owner; or

(2) If the firm was given authority by the lender or the owner to investigate the dispute, the firm is required to notify the lender or owner regarding the outcome of the investigation. (7.14.6)

Please either provide evidence that I am liable for this debt or confirm that you will not contact me further regarding the debt.

If you continue chasing me without providing evidence that I am liable for this debt this is deceptive and unfair. It also amounts to what is essentially physical and/or psychological harassment.

If you do not either provide evidence that I am liable for the debt or confirm that you will not be contacting me further, I will complain to Trading Standards and the FCA.

I await your reply.

Yours faithfully

Don’t sign this letter. Most debt collection agencies are reputable, but some aren’t.

If you sign the letter they could scan your signature and attach it to a credit agreement to “prove” that you owe the money even though you do not.

Also, they need to provide actual evidence. If they simply say that they’ve checked and they are convinced that you owe the money, that is not good enough.

The evidence that they provide needs to be the sort of evidence that they would need if they took you to court.

It’s important to know your rights when dealing with debt collectors to prevent any unwanted situations. That’s why I’ve put together this table.

If you want to learn more about your rights, don’t forget to check out our detailed guide.

| Debt Collectors Can | But They Can’t |

|---|---|

| Contact you by phone or mail. | Call you after 9pm or before 8am. |

| Conduct home visits (on rare occasions) and knock on your door. | Forbily enter your home, or stay if you ask them to leave. |

| Threaten to take you to court by suing you for payment on a debt. | Harrass you, including threats of violence, repeated calls and visits, or abusive language. |

| Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | Visit your workplace. |

| Access your bank account, but only after a court judgment has been made. | Take anything from your home or threaten to do so. |

| Sell your debt. | Speak to other people about your debt without your permission. |

| Contact you frequently. | Keep doing so if you request that they reduce communications. |

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Staying On Top Of Your Debts

One of the hardest parts about being in debt is that the industry isn’t at all transparent.

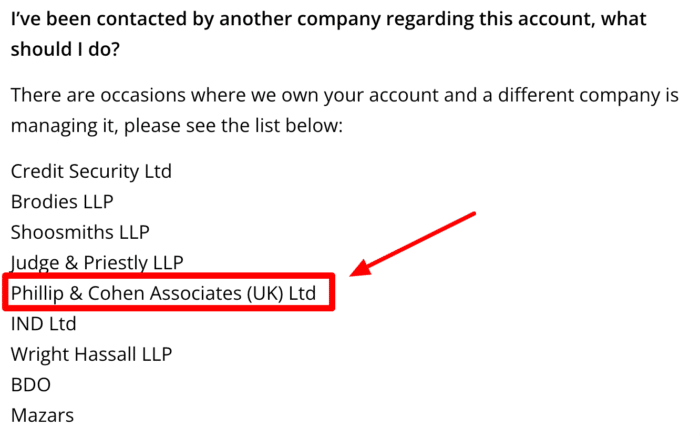

One common tactic used by Debt Collectors is contacting you under multiple names and addresses.

Sometimes, it’s for practical reasons, but even then it can be confusing and intimidating. So it’s important to try to keep a level head and research what’s going on.

Some of the biggest debt collectors in the UK operate under multiple names.

- Robinson Way will sometimes contact you under the name Hoist Finance.

- Cabot Financial Group recently bought Wescot Credit Services

- Credit Style communicate as both Credit Style and CST Law.

- Lowell Financial also owns Overdales and collects debts under both names.

In fact, in the case of PRA Group, they’ve been known to use multiple company names. As you can see in the image below.

If you’ve been contacted by a debt collector recently, it’s worth going through your post and emails to check that you haven’t missed anything, just in case they’ve started writing to you under a different name.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Do you need to keep records?

Yes, I recommend keeping a record of all of your communications with debt collectors.

This will make it much easier for you if the debt collectors challenge or argue with you in the future!

Your records don’t need to be complicated – just keep a copy of any letters that you send them, and keep hold of their responses. You can make a note of any phone calls that you have or request written communication only and avoid speaking to them directly altogether.

Up-to-date and accurate records will help you prove any wrongful debt collection or mistaken debt identity. Good record keeping will also help you more generally with your personal financial management.