Alternatives to IVA – 4 Other Options That Could Be Better

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you thinking about an Individual Voluntary Agreement (IVA) to manage your debt? It may seem like a good idea, but there might be other ways that could help you more. We’re here to help you understand these other options.

Every month, over 170,000 people visit our website seeking advice on debt solutions, so you’re not alone.

In this article, we’ll explain:

- What an IVA is and how it works

- Other ways to manage your debt that could be better

- How to start using these other options

- What happens if you can’t pay your debts

- Steps to take if you’re struggling with debt

Our team is made up of people who have been in your shoes; they’ve faced debt challenges, too. We’re here to help make things a bit easier for you.

Let’s start learning about your options together.

Are IVAs the Best Option?

IVAs are good. If they’re successful then your debts are paid, and you can start to rebuild your credit score, but is it worth it?

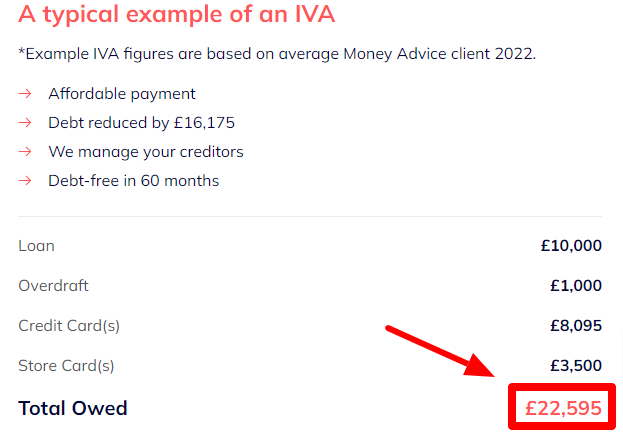

There’s no lower limit on how much debt an IVA can deal with, and there’s no upper limit either. But IVAs aren’t free.

The fees for an IVA are very high, which could mean that solving a debt that’s under £10,000 isn’t always the best option to choose.

Here, you can see just how much you may have to pay back if you choose an IVA, and this is just a typical example, not even one that’s particularly extreme.

Keep in mind that if you choose an IVA, an annual review will be conducted at the end of each year. The IVA annual review ensures that you are effectively managing IVA payments.

And of course, even if you do get an IVA, some restrictions come with it. These can ultimately affect your ability to get and secure certain things outside your IVA, like a mortgage.

So, if you don’t want an IVA, what other options are available to you?

Don’t worry, here’s what to do!

There are several debt solutions in the UK, choosing the right one for you could write off some of your unaffordable debt, but the wrong one may be expensive and drawn out.

Fill out the 5 step form to find out more.

The First Step You Should Take

Before deciding upon any solution, or taking any action to solve your debt, you’ll want to speak with your creditors.

If you do this, you may find that you’re able to come up with an agreement to pay them back, or you can get an extension of time without ever having to go through all the hassle, stress and complications that come with finding a debt solution.

This isn’t to say, however, that from here on in, all other debt solutions are completely useless. That’s just silly, because what you might find is a better solution, and you’ll always want that.

If you don’t speak to them, and you still can’t find an agreement, you can take an extra step before deciding upon a debt solution.

You can get breathing space. This will allow you to get up to 60 days of extra time where creditors cannot contact you for payment, therefore allowing you to carefully consider the right path for you to take.

Debt Management Plans

One of the alternatives to an IVA could be a Debt Management Plan.

Quite simply, this is an informal arrangement that you have with your creditors about paying off your debts. Crucially, though, you cannot pay off priority debts with a DMP.

This means that any debts like rent arrears, magistrates’ court fines, or Income Tax cannot be debts included within the DMP. What makes them priority debts is the consequences you can subsequently face if you don’t pay them can be more severe. Debts like bank or student loans and water charges are seen as non-priority therefore these can be included.

Administration Orders

Like an IVA, and unlike DMP, Administration Orders (AOs) are legally binding, which immediately means that they tick a box that DMPs don’t.

On the other hand, there must be certain boxes ticked in the first place before you can get an AO.

Your debts total must not be above £5,000. You cannot have an unpaid CCJ (County Court Judgement) or a High Court Judgement. You must have multiple debts.

Debt Relief Orders

IVAs can deal with large debts, however what about smaller debts that are bugging and worrying you? This is where a Debt Relief Order (DRO) might help.

DROs can be used if you:

- Owe £30,000 or less

- Aren’t a homeowner

- Don’t have many items or assets of value

- Don’t have much spare income

These usually last a year unless your situation improves, but if it doesn’t, at the end most of your debts will be written off.

However, not every debt is covered by a DRO. Magistrate’s court fines, student loans and social fund loans are just a few that aren’t covered. On the other hand, credit card debt and arrears like council, income or rent are covered, and creditors cannot ask for payment during the DRO period. If they do, you do not have to pay them.

Bankruptcy

Finally, you can declare yourself bankrupt if you can’t pay your debts.

If you do this, most of your creditors won’t be able to contact you about your debts or take you to court to pay them, but it’s not free.

Declaring bankruptcy costs £680. You can pay this fee in instalments, but it must be paid before you can officially declare yourself bankrupt.

If you’re still earning an income during this time, you may be asked to pay small amounts towards your debts, but this cannot happen if your income is either from benefits, or you have no spare money after paying for reasonable living costs.

These are some alternatives to an IVA. What you decide to do, is up to you. But it’s important you take care when choosing, not only when it comes to dealing with your finances, but also when it comes to dealing with your health.

Thanks for reading, I hope it helped!