Appealing Final Charging Order – How To Challenge and Win?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

When a Final Charging Order lands on your doorstep, it can be a scary moment. But don’t fret because you’ve found the right place to get the help you need. Every month, over 170,000 people come to our website for advice on debt issues, just like this one.

In this enlightening article, we’ll walk through:

- What a Final Charging Order really is.

- When and why a creditor might apply for one.

- The possibility of writing off some of your debt.

- The difference between an Interim and a Final Charging Order.

- How to appeal, challenge or change a Final Charging Order.

Our team has had first-hand experience with debt problems, so we know just how worrying it can be. But with the right knowledge and guidance, you can navigate through this tricky time.

This article is here to help you understand and deal with a Final Charging Order in a calm and informed way. Let’s dive in.

What is a Final Charging Order?

If you have been issued a County Court Judgment (CCJ) for a debt, you have been ordered by the court to either make regular payments against the debt or to pay the debt in full by a certain deadline.

Once such a court order has been made, a creditor can apply to have a charging order issued. This will secure the debt against any property you own.

If you jointly own the property, then the creditor can only apply for a charging order against your share of the property.

This is about as serious as things get when you are being pursued for a debt, as you are in danger of losing your home.

A final charging order is issued when the creditor is preparing to make good on their threat to make you sell your home and pay up.

This means that they could ultimately be evicted from the property. Whether that happened would depend on all the circumstances.

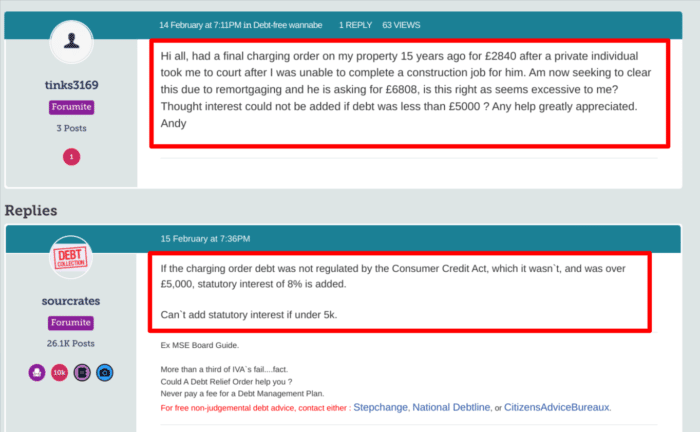

If the debt is under £5,000, then the creditor cannot add any more interest to the debt once the charging order has been issued. For debts over £5,000, statutory interest can be added.

» TAKE ACTION NOW: Fill out the short debt form

How To Appeal, Challenge or Change It

There will be a court hearing before the final charging order is issued. At this hearing, you can present evidence and facts that could stop the final charging order from being issued. Or force the court to change the conditions of the final charging order.

You can present arguments such as:

- You have kept up regular repayments against the debt and are not in arrears.

- You have very little equity in the property, likely not enough to cover the debt.

- You have no other debt problems, and no other creditors have applied for a charging order.

- A charging order would be unfair to other people who live on the property.

- A charging order would negatively impact your ability to pay other creditors.

Additionally, even if a final charging order is issued, you can still take some steps to try and improve the situation. Such as the following:

- Ask for the final charging order to be set aside.

- Ask for special conditions to be added to the final charging order.

- Ask for the final charging order to be changed.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How Does It Differ to An Interim?

You need to understand the difference between an interim and a final charging order so that you know just when matters are reaching a head.

- Interim charging order is applied without the need for a court hearing. Think of it as the creditor taking the first action in having your property underwrite your debt; this is how you are notified of this intent.

- Final charging order: If you have objected to or challenged the interim charging order within 28 days, the creditor can then apply for a final charging order. And once this has been issued, you must settle your debt. Otherwise, you could lose your home.

Note that charging orders aren’t recorded separately on your credit file, but the CCJ is recorded. A CCJ will remain on your credit report for six years.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

When Can a Creditor Apply for One?

If a creditor such as Lowell Financial is chasing you to pay a debt, they can only apply for a charging order once they have already had a County Court Judgment issued against you.

Once this has been done, the creditor can apply to the court again for a charging notice to be put in place.

This holds true whether or not you have been making regular payments as per the schedule set out in the CCJ.

Put simply, a charging notice acts as a further threat to ensure you continue to make payments.