Ascent Performance Group Debt – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you concerned about a debt letter from Ascent Performance Group? This can be confusing, especially if you don’t know where the debt came from or if you should be paying it.

We get over 170,000 visitors to our site each month, all looking for guidance on debt solutions. So, you’re not alone in this.

In this article, we’ll guide you through:

- Understanding what Ascent Performance Group is.

- Exploring if you really need to pay the debt.

- Learning how to deal with debt collectors.

- Knowing your rights if you can’t afford to pay.

- Discovering other options before paying your debt.

Our team knows the fear and worry that comes with debt letters; we’ve been there too. So, we’re here to help you learn more about how to handle Ascent Performance Group debt.

Have you received a letter?

Ascent debt letters are called Letters Before Action because their client may take legal action against you if you don’t pay. Ascent will usually threaten legal action whether or not there is a realistic chance of legal action being taken.

Are they bailiffs?

The Ascent Performance Group aren’t bailiffs. They are a company that used administration processes to try and recover debts. Bailiffs can come to your home and seize goods, but only after you have lost in court and a judge gives permission for the debt to be enforced with bailiffs.

Ascent should not suggest they have equal powers to bailiffs, and if they do, you should report them using the Financial Ombudsman Service.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Is the group part of Irwin Mitchell?

Yes, Ascent Performance Group Ltd is a wholly-owned subsidiary of Irwin Mitchell Holdings Ltd. Irwin Mitchell is a legal firm and they may work with Ascent clients to advise on taking legal to recover debts. But this doesn’t necessarily mean the client will go down this route.

Do I have to pay?

» TAKE ACTION NOW: Fill out the short debt form

You shouldn’t ignore an Ascent Performance Group debt letter, but at the same time, you don’t have to immediately pay.

You can buy yourself some time by replying to their letter with a specific request. And you don’t have to pay until they fulfil this request adequately. This request is also useful if you think they have made a mistake. So, what is it?

What Happens If I Don’t Pay?

We’ve all wondered – what exactly will happen if you stop paying off your debts? Well, the answer is a whole lot of bother.

- Your creditor will send you reminders and then demands to get you to pay any missed payments

- If you don’t pay, your account will default

- If you still don’t pay your debts, your creditor can choose to sell your debt to a debt collection agency or employ an agency to chase you for the missed payments. This is where Ascent Performance’s debt collectors will come in.

- If you don’t pay the collectors, your creditor or the collection agency might be able to take legal action against you to get their money back. Legal action usually starts with a CCJ.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Will they take me to court?

There’s no way of knowing if you will be taken to court for not paying by Ascent’s deadline. Irwin Mitchell may be advising the client on whether going to court is worth it, but it is the client who will ultimately decide. They might or might not have the appetite for a legal battle with you.

Nevertheless, it’s important not to assume that any legal threats are empty threats.

Customer reviews

Ascent Performance reviews are much better than the average debt collection company reviews. There are lots of reviewers stating how much they enjoyed the empathetic and personalised service.

This is probably because they are helping people catch up on their mortgage and therefore keep hold of their home, rather than chasing payday loans or credit card debts.

Have a read of some below:

“Gary Ellis, I found to be very sympathetic and listened to what I had to say, and was not judgemental at all, made me feel at ease, and made the process a lot less intimidating. Thanks”

- Mr John M (Traustpilot reviewer)

“I am currently dealing with Ascent, who are working with me regarding my mortgage arrears. I had buried my head in the sand for some time prior to Ascent getting involved on behalf of Halifax and was extremely anxious about the whole situation. Since the first contact with Carly, my mind was put at ease.”

- Laura (Traustpilot reviewer)

Alternative options before you pay

Before we tell you about the request you can make, there is one other thing you need to check, which might mean not having to pay a penny to Ascent…

#1: Check to see if they can take you to court

If it has been 6 years – or 5 years in Scotland – since you last paid towards your unsecured debts and you have not written to your creditor about your debt during this time, it is statute-barred.

This means that the debt is not enforceable. It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

Keep in mind that not all debts become statute-barred!

Any HMRC debts, for example, will stay enforceable for decades. Any debt that had a County Court Judgement (CCJ) attached to it during the 5 or 6-year window will be enforceable for the duration of the CCJ.

If your debt is statute-barred, you can use my free letter template to write to Ascent Performance and explain the situation.

If you are unsure about the status of your debt, you can contact a debt charity for some advice. Their advisors will be able to look at the debt in question, determine its status, and advise you on your next steps.

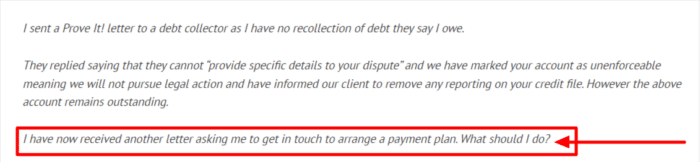

#2: Request evidence that you owe the debt

If you have received debt letters from Ascent Performance, but aren’t sure if they’re legit, what do you do?

From my experience, the best thing to do is ask for proof that the debt is yours. I have a free ‘prove it’ letter template that you can use to help you write to Ascent Performance and request evidence that you are liable for the debt that they are chasing.

You are under no obligation to pay for a debt that can’t be proven to be yours.

It is crucial that you respond to legitimate debt collectors quickly. Responding quickly will help you avoid any extra charges or fees. Not ignoring debt collectors also means that you are less likely to face legal action, such as a CCJ.

Ascent Performance Group Contact Information

| Address: | Ascent Legal, Riverside East, 2 Millsands Sheffield, S3 8DT |

| Phone: | 0345 604 0860 |

| Email: | [email protected] |

| Website: | https://ascent.co.uk/ |