Asset Link Capital Debt Collection – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Getting a letter from Asset Link Capital Debt Collection can be worrying. But you’re not alone. Each month, more than 170,000 people come to us for help with debt problems.

In this article, we’ll help you to:

- Understand who Asset Link Capital are.

- Find out why they are contacting you.

- Explore if you really need to pay them.

- Discover your rights and what to do if you can’t pay.

- Learn about debt solutions like Debt Management Plans and Bankruptcy.

We know it’s scary when debt collectors contact you, especially when research shows that nearly half of individuals who deal with debt collection agencies have experienced harassment or aggression1. Many of our team members have been in your shoes, which is why we want to help you. Below, we’ll give you the facts so you can decide what to do next.

Our aim is to share useful information to assist you in dealing with Asset Link Capital Debt Collection. We can guide you on how to talk to them, how to settle your debt, and even how to write off some of it if possible.

Let’s dive in.

Should I pay Asset Link Capital?

Only if you can and if you’ve checked with them that the debt is yours. We’re all responsible for settling our debts at some point, but there are sometimes circumstances when you may not need to pay Asset Link Capital.

Make sure that all the letters and documents you receive from them are accurate and have all the correct details on. Sometimes these letters are for the wrong person, or it might be a debt you don’t actually owe.

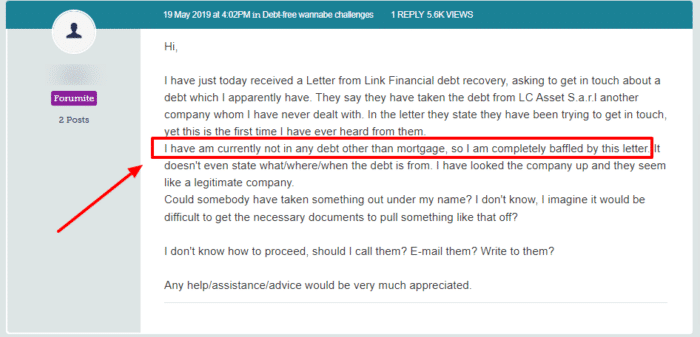

This person should write to Asset Link and make them prove the debt. If you are in this situation, you can use my free letter template as a guide.

Also, if it is a debt from a while ago, you may not actually have to pay it at all.

If it has been 6 years – or 5 years in Scotland – since you last paid towards your unsecured debts and you have not written to your creditor about your debt during this time, it is statute-barred.

This means that the debt is not enforceable. It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

Keep in mind that not all debts become statute-barred!

Any HMRC debts, for example, will stay enforceable for decades. Any debt that had a County Court Judgement (CCJ) attached to it during the 5 or 6-year window will always be enforceable.

If the debt is definitely yours, and you have the funds to pay it, then you should absolutely pay in full. The quicker you reach out to Asset Link Capital Debt Collection, the quicker the phone calls and letters will stop.

I always recommend responding to debt collectors – even just to question the debt’s validity. Remember, you have the right to request proof of the debt. They have to prove it, or they can’t charge you.

Why are they getting in touch?

Getting a letter from a debt collection agency like Asset Link Capital No.1 Limited can be unpleasant. After all, it’s a letter from a company you may not recognise demanding that you pay money you owe. As it is doubtful you have had dealings with Asset Link Capital No.5 Limited in the past; you should rightly ask yourself why they are getting in touch.

Asset Link Capital Debt Collection is a debt collection agency. This means that they collect money on behalf of other companies. If you haven’t kept up payments to a company, and you have ignored their letters and calls, then the company would hand the matter over to a third party, like Asset Link Capital.

Link Financial Outsourcing Ltd, the parent company of Asset Link Capital, specialises in debt purchasing. This is when the original creditor sells a batch of ‘bad’ debts for a fraction of the price. So, instead of owing the original company, you now owe the debt collection agency. In this case, you would have to pay Asset Link capital. So this is likely what Asset Link Capital Debt Collection is contacting you about.

Research shows that the average unsecured debt has increased by 25% year-on-year, rising to £13,9412. This means that it’s very profitable for companies to purchase debt and pursue it, and it becomes even more so every year.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What rights do they have?

There are some rights that debt collection agencies do have, but there are a lot of things that they’re not permitted to do. This is to try to make sure that there are fair debt collection practices at all times.

These companies often abide by rules and regulations dictated in the Credit Services Association (CSA) and the Financial Conduct Authority (FCA). Link Financial Outsourcing Ltd, the parent company for Asset Link Capital Debt Collection, prides itself on adhering to these regulations.

Debt collection agencies are famously persistent when it comes to sending letters and making phone calls. There is a fine line between persistence and harassment though, and if you feel like Asset Link Capital Limited is going a step too far, then you have every right to make a complaint about them.

You can also make a request that they only contact you in writing if their phone calls are becoming annoying. The easiest way to stop them contacting you so regularly is to get in touch with them and see what can be done.

Asset Link Capital Limited could also visit your home if you ignore their correspondence – though they have to give you at least seven days’ warning. If this happens, they are not allowed to enter your home. They also have to leave if you ask them to.

Know Your Rights

Knowing your rights and those of the debt collectors contacting/visiting your home is key to avoiding being taken advantage of. Debt collectors must abide by certain rules and can’t do anything they please when pursuing a debt.

Here’s a quick table summarizing what debt collectors can and can’t do.

| Debt Collectors Can | But They Can’t |

|---|---|

| Contact you by phone or mail. | Call you after 9pm or before 8am. |

| Conduct home visits (on rare occasions) and knock on your door. | Forbily enter your home, or stay if you ask them to leave. |

| Threaten to take you to court by suing you for payment on a debt. | Harrass you, including threats of violence, repeated calls and visits, or abusive language. |

| Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | Visit your workplace. |

| Access your bank account, but only after a court judgment has been made. | Take anything from your home or threaten to do so. |

| Sell your debt. | Speak to other people about your debt without your permission. |

| Contact you frequently. | Keep doing so if you request that they reduce communications. |

What are your next steps if Asset Link Capital Debt Collection have contacted you?

» TAKE ACTION NOW: Fill out the short debt form

You’ve got a letter from Asset Link Capital and you’re now dealing with debt collectors. So what do you do next?

Don’t ignore them

Asset Link Capital Debt Collection won’t just leave you alone if you ignore their letters and calls. They will keep on trying to contact you, so it is best to take the bull by the horns and see what you can do about it. Make sure you have all the information about the issue to hand, as this will make things much easier.

Get in touch with them

If you get in touch with them as soon as you can, then you will be on the front foot. So, if the debt is definitely yours, give them a call or write them a letter and get things underway as soon as possible.

If you are uncertain about whether the debt is yours, you can get them to write you a ‘Prove the Debt’ letter. By law, companies have to provide you with detailed proof about your debt. If they can’t do so, they can’t enforce the debt.

Settle your debt

If you are financially able to pay up, you will need to do exactly that. As I mentioned earlier, there are some different methods of settling up, so try and figure out a plan that suits everyone involved. Many firms will be open to a repayment plan, whereby yofu pay a set amount each month.

For those that are having difficulties with debt, you can check out my guide on debt options. This post outlines some of the ways you can get back on top of your finances.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What happens if I can’t pay them?

It’s always a hard truth to face up to if you can’t settle your debt. But if you are honest and upfront about it with Asset Link Capital, they will be more likely to take your side. They could agree to a payment plan, meaning that you will make a series of regular payments until the debt is cleared.

If you don’t pay them and you keep on ignoring them, then things could escalate. They could get the court involved, along with bailiffs, and in the most extreme cases, they could even petition you for bankruptcy.

If you are struggling with your debts, you may benefit from a debt solution. There are several options for debt relief in the UK so you will need to get some advice before you commit to a solution. I have linked a few organisations at the bottom of this page who offer free financial advice for debt management and free debt counselling services.

Debt Management Plan (DMP)

A DMP is an informal debt solution that lets you pay off your debts via a single monthly payment.

Because it is informal, it is not legally binding so you are not tied into a DMP for a minimum number of payments.

Individual Voluntary Arrangement (IVA)

An IVA is a formal agreement between you and your creditors. You agree to pay a monthly sum that is distributed amongst your debts, and your creditors agree not to contact you during your IVA.

IVAs typically last for 5 or 6 years, and any outstanding debt is wiped off when it ends.

Keep in mind that IVAs are not suitable for everyone. You need to owe several thousand pounds to more than one creditor to be eligible. You also need to demonstrate that you have some disposable income every month.

Trust Deed

IVAs are not available in Scotland. Instead, you will need to opt for a Trust Deed.

Trust Deeds work in the same way as an IVA – you pay an agreed sum each month that is shared amongst your creditors, they can’t contact you, and any leftover debt at the end of your Trust Deed term is written off.

Debt Relief Order (DRO)

A DRO is a good option for those facing financial hardship with no assets and little income.

For 12 months, you make no payments, but your creditors freeze your interest and don’t contact you.

If your finances haven’t improved during this year, you may be able to write off your unsecured debts.

Bankruptcy

If you have debts but no realistic possibility of ever paying them off, you may need to declare bankruptcy.

Bankruptcy has an unfair stigma attached to it as it may be your only way of getting a financial fresh start. That said, it is a serious financial situation that should not be taken lightly and the effects of bankruptcy can last for several years.

Sequestration

Sequestration is the Scottish version of bankruptcy.If you have little income and not valuable assets, you may be able to apply for a minimal asset process bankruptcy (MAP). A MAP is a quicker, cheaper, and more straightforward version of sequestration, so worth considering.

How do I complain about their actions?

If you think that Asset Link Capital has been unreasonable or behaved inappropriately, you can make a complaint. You can also make a complaint if you feel that they have broken any of the Financial Conduct Authority’s (FCA) guidelines or the Credit Services Association’s (CSA) guidelines.

Make your first complaint to Asset Link Capital so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, Asset Link may be fined. You could even be owed compensation.

You can also address a complaint to the CSA. They will also investigate and write to you to inform you of their findings and solution.

Asset Link Capital Debt Contact Details

| Address: | If your loan was originally with Shawbrook Bank Asset Link Capital (No. 7), PO Box 255, Caerphilly CF83 9FF T: 03330 150285 E: [email protected] If your loan was originally with Esme Loans Asset Link Capital (No. 7), PO Box 255, Caerphilly CF83 9FF T: 02920 858789 E: [email protected] If your loan was originally with New Day Asset Link Capital (No. 7), PO Box 255, Caerphilly CF83 9FF T: 02920 858788 E: [email protected] Asset Link Capital (No. 9), PO Box 255, Caerphilly CF83 9FF T: 02920 858786 E: [email protected] |

| Website: | https://assetlinkcapital.com/ |