Average Credit Card Debt in the UK

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Interested in knowing about credit card debt in the UK for 2023? You’re in the right place. Each month, over 170,000 people visit our site to learn ways to handle debt.

In this helpful guide, we’ll:

- Share what we mean by ‘credit card debt’.

- Explain the average credit card debt in the UK in 2023.

- Show how this debt may have grown since COVID-19.

- Talk about what happens if you can’t pay your credit card debt.

- Discuss ways to get out of credit card debt in the UK.

We know it can be tough to deal with debt. But remember, you’re not alone. We’ll guide you through your options and help you find a plan that works for you.

UK Statistics

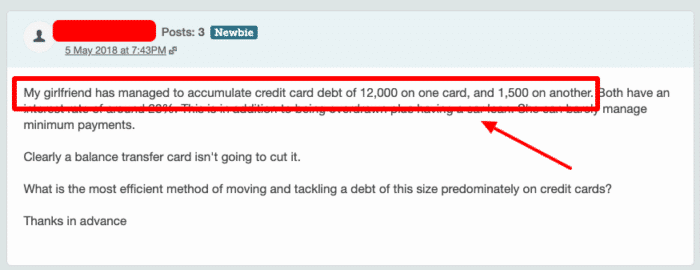

Working out the average credit card debt in the UK is not so simple. One reason for that is because there are no official figures, and another is because credit card debt is changing almost certainly by the day, if not the hour.

At the beginning of 2020, the average credit card debt in the UK was just over £2,500. Although credit card debt has risen exponentially over the last decade, this number has actually decreased compared to comparable figures from 2019.

And the total amount of debt Brits have racked up through their credit card spending equals over £72 billion. The age group carrying the largest load of these debts are people between 25 and 34 years old.

If you are unsure of your debts, you can use my free pay off calculator to get an estimate of how your interest and repayment period will cost.

A loan payoff calculator might be a valuable resource if you have a loan debt in the UK and are struggling to meet repayments or just want to stay on track.

Will It Have Increased Since COVID-19?

It is too early to say for sure.

One side of the argument is that COVID-19 may have caused more people to miss credit card repayments and enter into credit card debt. But on the other hand, credit card providers are being more cautious about who they lend to right now to protect themselves – and to protect you!

What Happens When You Miss Payments?

Credit cards usually come with a minimum monthly repayment figure that you must pay back to your creditor to meet the terms of the credit card agreement. If you miss one or more of these payments, you will likely receive a letter asking you to make the payment or face additional late fees. You will also see the impact of credit card debt on your personal finances.

If you cannot repay, you will have credit card debts. Your creditors can chase you for this money and threaten legal action. They could take you to court and get a judge to make you pay. If you still don’t pay, you could have to deal with bailiffs repossessing your valuables.

But it doesn’t have to get to this stage!

How Can I Get Out of Debt?

If you have not been able to come to a solution with the credit card provider directly and you are already being sent payment requests and legal threats, there are some things you can do. One of the most effective is credit card balance transfers.

Balance Transfer

Throughout the year, you can find great credit card deals where new credit card owners don’t have to make payments in the first months. By switching your existing balance to a new credit card, you could pay off the creditor chasing you for money and obtain a repayment holiday from the new issuer to give you time to get your finances back on track.

This is not as easy as it sounds, and there is always much to consider!

Consolidation

The balance-switching trick is also useful if you have multiple credit card debts. If possible, you can transfer your existing credit card debts to one new credit card with lower interest. Although this won’t pay off your debts, it will lower debt interest and consolidate all debts into one place, which could be easier to deal with from here.

You can also do this with loans; our debt consolidation guide answers the common questions.

Again, this is not a simple solution.

Other Debt Solutions

Credit card debts can be dealt with through debt solutions offered by debt management companies and some debt charities. For example, you might be able to tackle credit card debt with a:

- Debt Management Plan

- Debt Relief Order

- Individual Voluntary Arrangement

- Bankruptcy

These services will cost unless you use a debt charity such as Stepchange or National Debtline, but they could make the whole situation easier over the long term with debt counselling.

Is Owning One a Bad Idea?

After reading this guide and learning about the average credit card debt in the UK, you might think they are a bad idea.

But when credit cards are used responsibly, they are not just a great way to access capital when needed. They are also a fantastic way to build up your credit score (if payments are made on time), which will ultimately help you get more credit or a mortgage.

If you choose to use credit cards, it is important to practise responsible credit card use, make payments in full on time every month, try not to use all of the credit available to you (credit utilisation ratio) and keep an eye on your credit report. It is almost important to fully understand the terms and conditions and fees associated with your credit card before signing up.