Average Retirement Savings UK

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

How much money should you have saved when you retire? The average retirement savings in the UK is £61,897. This article will help you understand more about this figure and what it means for your future.

You might be worried about the amount of money you need to retire. That’s okay, a lot of people feel the same. In fact, over 170,000 people visit our website each month to get advice on topics like this.

In this article, we will cover:

- How much money you really need in your retirement savings

- What is a state pension and how does it work

- What are final salary pensions

- What are pensions that are purchased with money

- How to legally write off debt

The team here at MoneyNerd knows what it’s like to worry about money; some of us have been in your shoes. We hope that this article will help you feel more confident about your retirement savings.

How much do you really need?

It is important to think about your pension income in stepping stones – first with the state pension, then with your private or workplace pension savings, and then with any other additional income you might get, whether from investments or property.

Thinking about your pension income in this way will help you plan for its future.

In 2018/2019, the average state pension was £176 a week.

State pension

When you reach the age of state retirement, which is currently 66 years old for both men and women, the government will contribute a sizable amount to your post-retirement income.

However, not everyone receives the full amount of the new state pension, which is £185.15 per week in 2022-23.

People who became eligible for the pension on or after April 6, 2016, will receive the full amount of the pension.

A man who became eligible for the state pension after April 2016 received an average of £170.36 per week, which equated to £8,859 per year, in May 2021.

A woman received an average of £164.32 per week, which equated to £8,545.00 per year.

17% of Brits aged 55 and over have no private retirement savings.

How a debt solution could help

Get StartedSome debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

Monthly income £2,504 Monthly expenses £2,345 Total debt £32,049 Monthly debt repayments

Before £587 After £158 £429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

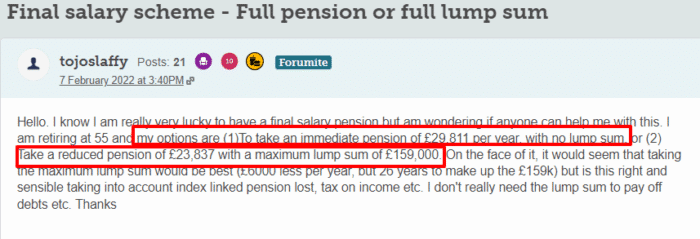

Final salary pensions

The type of private pension you have will determine how much additional income you need to generate from your retirement savings in order to meet your financial obligations.

You will receive a predetermined amount of money on a monthly basis if you have a defined benefit or a final salary pension. The amount that you receive is determined by the amount of money that you earned while you were employed.

If you own one or more of these, you should receive annual updates that outline the amount of money you can anticipate receiving.

When you factor in your state pension, which you can determine by requesting a forecast of your state pension, you will have a better idea of how much financial flexibility you will have once you reach retirement age.

69% of pensioners have a private pension income.

Remember, defined benefits pension at retirement may be provided as an income or as a tax-free cash lump sum and an income. You might also be able to delay taking your pension, which means you get a higher income when you do take it. Check your scheme for details.

» TAKE ACTION NOW: Fill out the short debt form

Pensions that are purchased with money.

A money purchase pension, also known as a defined contribution pension, is one in which your pension payments are invested in a pool of money.

When the time comes for you to retire, you will need to decide how you will continue to make money.

You have the option of withdrawing the entirety of your pension pots at once. However, doing so will place the onus of ensuring that the money lasts squarely on your shoulders, and it will almost certainly result in a sizable tax bill.

When it comes to taking money out of their pensions, the majority of people who have these pensions will choose either income drawdown or an annuity, or sometimes a combination of the two.

If you want to have a pension of £28,000 a year from an annuity, you need to have pension savings of £204,750.

If you want a pension of £45, 000 a year from an annuity, you need savings of £664, 450.

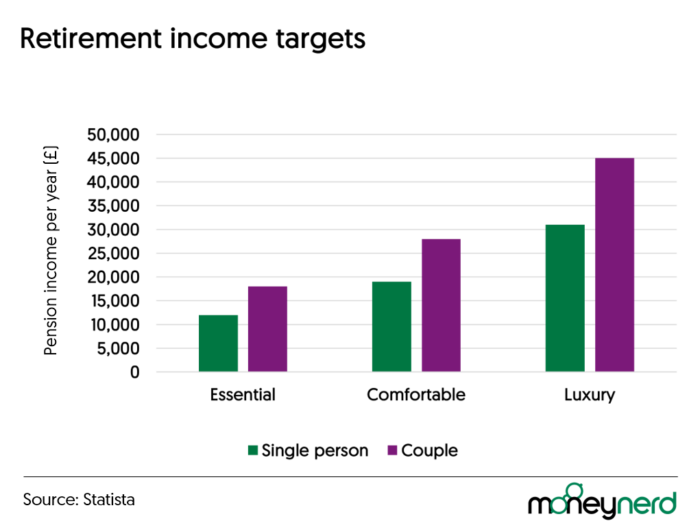

The graph below shows the annual pension you need to live on for essentials, to be comfortable, or to live in luxury.

Source: Statista showing the target pension income to live for essentials, comfortably and to live in luxury for both single people and couples.

It can be difficult to think about how much money you need to put aside for a comfortable retirement, especially in your younger years when you have other costs such as childcare to think about.

However, it is never too early to start thinking about your retirement and planning ahead – especially as the earlier you start saving, the smaller the monthly contribution you need to make.

As you get older, you should see an increase in the amount of money you bring in each month, and if you participate in a company pension plan, your employer will likely make a contribution to help you reach your goal amount.

A minimum of 8% must be paid into your pension each month in accordance with the rules of pension auto-enrolment. Of this amount, 5% must come from you, and 3% must come from your employer.

If you earn the average salary in the UK of £28,000, you will have savings of £186 every single month.

Women’s annual pension incomes are, on average, £7,000 less than men’s.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Get started

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Tax relief

The government likes to give you a bonus as a way of rewarding you for saving for your future by contributing to a pension during your working life.

This is done in order to encourage people to save for their retirement. This is accomplished through the provision of tax relief.

If you are eligible for tax relief on your pension, a portion of the money that you would have paid in tax on your earnings is instead deposited into your pension account.

If you were not eligible for this relief, the money would have gone to the government.

Your pension contributions are eligible for tax relief equal to the highest rate of income tax that you currently owe. So:

Taxpayers who pay the basic rate will receive a 20% reduction in the pension tax.

Pension tax relief of up to 40 percent is available to taxpayers who pay the higher rates.

Pension tax relief in the amount of 45% can be claimed by additional-rate taxpayers.