Borrow from Retirement Funds to Pay Debt? UK Guide

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about your debts and thinking about using your pension to pay them off? You’re in the right place. Over 170,000 people visit our website each month seeking advice on debt problems.

In this article, we’ll help you understand:

- The rules around using retirement funds.

- The impact on your benefits and taxes.

- How to look at your pension details.

- Ways to manage unaffordable debt.

- Answers to frequently asked questions.

We know how tough it is to deal with debt; some of us have been in the same boat. You’re not alone! Our aim is to give you clear, helpful advice.

Let’s get started.

Taking money out of your pension

Considering the new rules and regulations surrounding your pension, you may think that you can borrow from your retirement funds to pay off your debts.

However, taking money from your retirement fund could leave you in a worse position than you expected.

Before you take any money out, you should consider three important things that might affect you now and in the future. These three things are:

- The impact on your benefits

- The impact on your tax position

- The impact on your pension

The impact on your benefits

If you borrow from your retirement funds to pay off your debt, you may reduce the amount of money you can get from social security benefits both now and in the future.

This is because some benefits are based on the income you receive, and can be affected by the savings you have.

Not only that but your benefits can also be affected by taking money out of your pension and using it to pay your debts.

Benefit decisions can be really complicated. You can find more information by following this link to a handy document published by Age UK, or to this link from the Department for Work and Pensions (DWP).

» TAKE ACTION NOW: Fill out the short debt form

The effect on tax

Borrowing from your retirement funds to settle your debts can also affect the amount of tax you pay and the amount of tax relief you get.

If you take more than 25% from your pension, you may have to pay tax on everything more than the 25% amount.

This could end up being quite a large tax bill, and you could end up with significantly less than you expect.

When it comes to tax relief, taking more than 25% from your retirement fund could mean you are affected by the Money Purchase Annual Allowance.

This means that the government limits the amount you pay back into a retirement fund, and the amount you get as tax relief.

How your pension will be affected

Taking money from your retirement fund for your debts also means that you won’t have that money in your pension when you retire.

You’ll end up getting less monthly income from your pension, and the options on how to use your pension will be more limited.

In addition, withdrawing early can dramatically reduce the compound growth potential of a pension. You could end up with less money for you or your beneficiaries.

It’s a tricky but necessary process to weigh up the usefulness of borrowing money from your retirement fund now or to keep it for later.

Reducing the size of your pension can also be really complicated, and you’ll usually require regulated financial advice to understand them fully.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

The current rules

In 2015, a series of new changes came into play regarding pensions. These ‘pension freedoms’ meant that you could now take up to 25% of the value of your pension as a tax-free sum.

You can also take more if you want to – but doing so will result in you paying income tax on this.

In 2017, some of these rules were revised by the Financial Conduct Authority (FCA). These rulings included early exit charges being capped at 1% of the value of the pension.

Many people may see these new pieces of legislation as a way to repay their mortgage or even clear other debts. But is this a good idea?

Next steps

That’s the basics of what might happen if you borrow from your retirement funds to pay off your debt.

Here are some other information you should consider.

Look at your pension statement

The company that provides your pension should send you a pension statement every year. This will tell you everything you need to know about your retirement fund.

You might need to contact your provider to get an up-to-the-minute balance.

Multiple funds

You may have paid money into more than one retirement fund. You will need to get in touch with each pension provider in order to find out how much each fund is worth.

Pension policy details

If you’ve misplaced or lost the details of your pension policy, you can use the GOV.UK website to find the contact details – follow this link.

You could also contact old employers to see if you still have a pension with them or find out who your provider was.

Income information

Make a list of all your income and their sources. This should include your wages, any benefits you might receive, the amount you might hold in savings accounts and all the assets you have too.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Below, we will go through some of the more frequently asked questions about borrowing from retirement funds in order to pay your debt.

Are there different kinds of pension?

Yes. There are two distinct types of pension – defined contribution pensions and defined benefit pensions. Defined contribution pensions are affected by the pension freedom changes mentioned above, whereas defined benefit schemes are not.

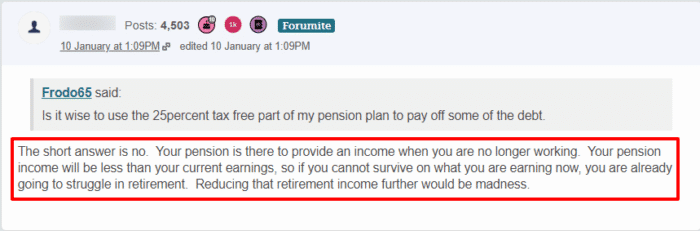

Is it a good idea to use it to pay off my debts?

In short – it is not advisable. There are many implications for the present and the future if you do decide to use your retirement funds to pay your debts.

However, this doesn’t mean that you can’t. A lot will depend on your circumstances, so be sure to gather as much information as you can.

Are there any other places I can get more information?

Yes. There are several different services available for free that will offer you advice about what to do if you are worried about your debts and your retirement fund.

Head over to the Pensions Advisory Service. They have lots of information and a helpful live webchat service. You can also head over to Pensionwise for face-to-face appointments if need be.