Bailiffs and Mental Health – All You Need To Know

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

When dealing with bailiffs, it’s normal to feel worried, especially if you have mental health issues. It’s important to know that rules are in place to protect you. This guide will help you understand these rules better.

Over 170,000 people come to our site each month, looking for information about their debt problems, and Citizens Advice estimate households have around £18.9 billion in unpaid bills like council tax and utilities1. You’re not alone, and we’re here to provide the support you need. We will cover:

- What bailiffs can and cannot do when dealing with someone who has mental health problems.

- How to notify enforcement agents about your mental health issues.

- Understanding bailiff fees and how they can affect your debt.

- Steps you can take if you believe a bailiff has not treated you fairly.

- How to manage overwhelming debt and the possibility of getting some of it written off due to mental health.

Our team knows how hard it can be to deal with debt and bailiffs. We understand what you’re going through and can provide useful advice based on real-life experiences. So please read on, and start taking control of your situation today.

The Link Between Mental and Financial Health

The psychological effects of debt can be devastating enough without being harassed by bailiffs. StepChange found that over half of their respondents say dealing with bailiffs made paying off their debt more difficult. Many say that they had to take out more credit to pay the bailiffs2.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How a vulnerable person must be treated

Enforcement agents must abide by the Mental Health Act when contacting vulnerable debtors.

Not only this, but bailiffs must also take into account that their actions must not contravene The Equality Act.

Bailiff conduct with vulnerable individuals must follow the law. Plus, they must take into account the rights of vulnerable people with debt.

» TAKE ACTION NOW: Fill out the short debt form

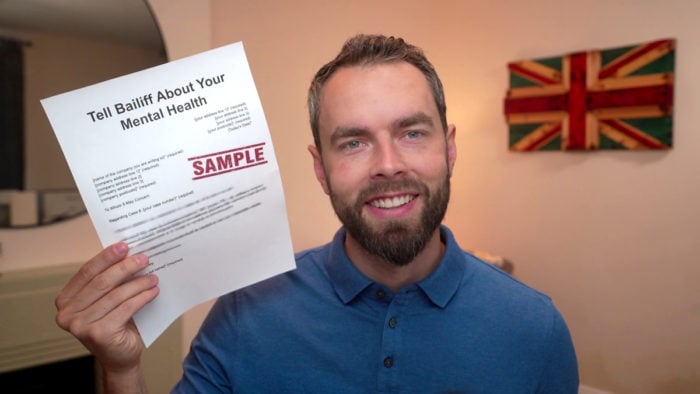

Beat their vulnerability letter

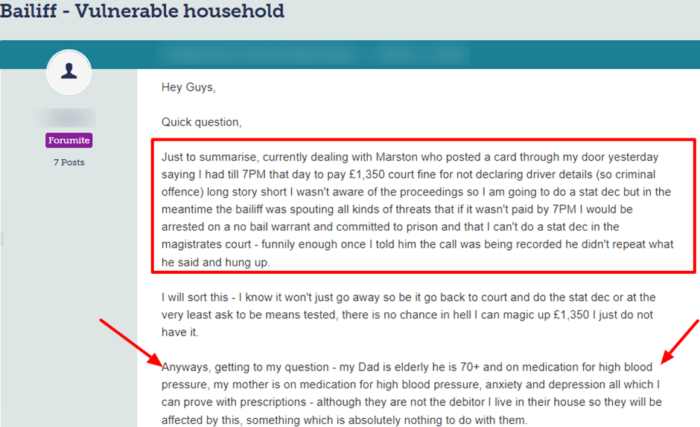

See this post that someone placed on a popular online forum.

Source: Moneysavingexpert

Can you complain about them?

| Bailiffs Can | But They Can’t |

|---|---|

| Call and visit your home multiple times, any day of the week. | Visit your workplace (if you are not self-employed) |

| Take items from your home. These items have to be considered ‘luxury’. | Take essential items from your home. This includes beds, clothing, and work equipment. |

| Use ANPR technology and DVLA information to locate your car and take it. | Enter your home without permission unless they have a warrant to force entry for a CCJ. |

| Peacefully enter your property. | Harass or threaten you. |

| Issue notices to those who owe a debt. | Take items that belong to someone else. However, they may be able to seize jointly owned property. |

| Offer to conduct a Virtual Controlled Goods Agreement (rather than in-person). This will typically be offered to vulnerable people. | Sell goods they have seized at auction until seven clear days have passed. |

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can you get debt written off?

In short, mental health and debt forgiveness are not written in stone.