The best Budgeting Apps – Emma vs YNAB, etc

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re looking for help managing your money and reducing debt, then you’re in the right place. This article aims to guide you through the best budgeting apps available, including a detailed comparison between Emma and YNAB, among others.

We understand your worries about managing debt and repayments. That’s why every month, over 170,000 people visit our site looking for guidance on debt solutions — you’re not alone.

Here’s what this article will cover:

- A comprehensive review of the 7 top budgeting apps

- The pros and cons of each app, including Emma and YNAB

- How to choose the right budgeting app for you

- Understanding when and how you can legally write off debt

- Exploring how much debt is too much and what to do about it

Our team consists of individuals who have personally managed and overcome debt themselves. So, we know firsthand what it’s like to be in your shoes.

We’re here to help you understand your options, make informed decisions, and take control of your finances. Let’s get started.

Plum

Plum takes budgeting to the next level. Using artificial intelligence and an overview of your incomings and outgoings, it calculates an affordable amount you could save. This app also keeps you updated about whether you’re overpaying your bills and suggests how to save money. So, it’s a great tool for expense tracking.

With its pro/paid-for options, you can also unlock investment opportunities, cashback earnings and savings spaces to separate your money. It’s especially good for automated savings, so if you don’t want to worry about how much you should put away, just leave Plum to do its thing.

Plum allows users to set aside cash in an ‘Interest Pocket’ account that pays up to 3.82% AER (variable). However, you must be a Premium subscriber to access these rates. The free Basic plan pays 2.99%, though the rates vary.

Pros

- Helps you save with a minimal effort

- Earn interest on your savings if you invest

- Automated saving setting

Cons

- Other apps offer Plum’s paid features for free (goal setting, cashback)

- Monthly fee to pay if you want to invest your money

Check out Plum today and see why they’re our top recommendation for a budgeting app.

Emma

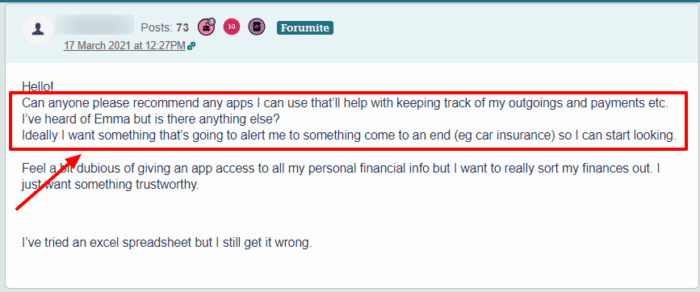

With so many budgeting tools out there, it can be a bit overwhelming to pick the most suitable one.

By analysing your credit cards, savings and current accounts, Emma puts your spending into different categories, making it crystal clear to see where your money goes. These categories include Netflix subscriptions, grocery, utility bills and more. A handy addition to the subscription management feature is that Emma tells you how often you use it or if you’re paying for something and not using it.

Emma will also show you all bank fees that you might get charged, which can come in handy to keep tabs on. And with the premium version, Emma Pro, you can access personalised categories and cashback initiatives. Emma is particularly helpful for beginners and is one of the best budgeting apps for managing your subscriptions.

Pros

- Easy to use, with a clear interface

- Rewards system

- Cashback with lots of stores (Body Shop, B&Q, Boots)

Cons

- Suffers from overt gamification, though some people might find that an advantage

- Lots of push notifications about Emma Pro

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Mint

One of the oldest and most well-known budgeting apps out there, Mint has it all. You can track and manage your money from a huge list of banks and other finance lenders. There’s also a great category setting available for your expenditure and debt management.

What Mint is really good for is its budgeting tools, which you can find front and centre as you open up the app. It also sends you notifications and alerts if and when you exceed your allotted budget. So it offers you a well-rounded picture of just where your money goes each month.

Pros

- Easy-to-use and intuitive budgeting tools

- Credit monitoring service

- Free to use

Cons

- It may be free, but there are lots of adverts which can be annoying

- You can sometimes get inundated with notifications

- Not available in the UK yet

YNAB

YNAB, or You Need A Budget, is for the committed budgeteer. With an almost cult-like following, YNAB changes things up and lets you build your budget based on your income, meaning every penny has a purpose. This app accounts for everything coming into your account, letting you see what you get in and what you spend it on.

YNAB is a great financial planning tool for couples or roommates looking to work on a budget together. It has mobile and desktop capabilities, as well as the option to sync all your accounts. You can also manually enter your expenses and set goals for your savings.

Pros

- Easy-to-use interface

- Secure access to your financial information

- Offers free workshops

Cons

- Basic interface that looks much like a Microsoft Excel spreadsheet

- Lack of investment tracking

- The pro version is quite expensive

» TAKE ACTION NOW: Fill out the short debt form

Goodbudget

Another great money management software for couples wanting to budget, Goodbudget lets you share and sync your plans and budgets quickly and easily.

You can create personalised budgets separated into different categories, and you can automatically have your income added to each category as and when it comes in, letting you know exactly how much you have left at the end of the month.

With all these wonderful features, Goodbudget is one of the best budgeting apps for nurturing healthy financial habits.

While Goodbudget is ideal for couples and budget buddies, solo budgeteers can also use it to optimise their budgeting. It is also available on iPhone and Android.

Pros

- Clear interface

- Great for couples

- A good forum support system

Cons

- Limited free version available

- Doesn’t sync to financial accounts for UK users

- Investments can’t be tracked

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How to Choose a Budgeting App

A budgeting app can provide valuable insights into your spending habits. This helps you identify where your money goes and where you can improve. But you still need to pick the right budgeting app to get the most out of your personal financial goals.

Speaking of goals, you need to set your goals first before selecting a budgeting app. This is crucial as it can help refine your search for the right budgeting tool. Apart from goals, I explain other features to consider when picking your budgeting app.

- Fees: Many budgeting apps are free—or offer free versions—while some charge a monthly fee. I suggest you start with a free app. Once you feel a budgeting app can significantly improve your financial outlook, go for a paid app.

- Ease of use: Apps like YNAB help you understand where every pound is going, while apps like Plum automates your budgeting so you rarely have to think about it.

- Features: The most vital features you need include: connecting all your financial accounts, receiving notifications of upcoming bill payments and designing a budget. Credit score tracking, spending tracking, and setting up financial goals should also offer good value.

- Security. The security of your personal information is extremely important due to banking data and logins. Choose a budgeting app that has some level of security, encryption, and even GDPR compliance. of each app. For example, 256-bit encryption and multi-factor authentication can help deter intruders from accessing your information.

- Customer service: Be sure to find out what customer service options are available for the app. It also may help to read reviews of others’ experiences with the app you’re considering.

If you want to create a successful budget, you must have the right mindset. A budgeting app can help you cultivate good money habits and gain control over your finances. Indeed, the intuitive feature and automation that a budgeting app provides will keep you motivated to stay on top of your finances.