Can I Cash in My Pension and Use to Pay Off Debt?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about your debts and wondering if you can use your pension to pay them off? You’re in the right place to find answers.

Every month, over 170,000 people visit our website looking for guidance on debt issues. We know how tough it can be to deal with debts and the impact they can have on your financial health and pension.

In this article, we’ll cover:

- How you might be able to cash in your pension to pay off debt.

- The strict rules about who can do this.

- The types of pensions you can cash in to pay off debt.

- Other ways to pay off your debt without using your pension.

- The risks of using your pension to pay off debt.

We understand your worries because some of us have faced debt problems too. That’s why we’re here to help you learn more about managing your debt and protecting your pension.

Is it Possible?

Yes, pension release is possible.

However, just because you’re getting a pension, doesn’t mean you’re eligible to avail this option. You only qualify if:

- You are aged 55 or more.

- You have a ‘Personal Pension’ or ‘Company Pension’ that you are no longer associated with/taking, or actively pay into.

- You can – at any time in the future – be employed and be able to continue work.

According to the Financial Conduct Authority (FCA), there are scammers who push people make an early pension withdrawal.

You should be very wary when approached by anyone who suggests they can help you do this.

As mentioned, you have to wait until you’re 55 or older to release money from a pension. However, there are exceptions. For example, when a person is in poor health.

Does It Apply to All Kinds?

I’ll talk about the types of pensions you could use to repay any debts. In general, ‘defined’ pensions are more commonly used to pay off debts.

However, there are two other kinds of pensions that are also used to repay loans, although less frequently.

The following types of pensions can be used to contribute towards repayments are:

- Defined Contribution Pensions – these may be, but are not limited to: Company, Personal, Stakeholder and Group Personal Pensions.

- Defined Benefit Pensions – these are categorized under the mandate of Private Sector and Public Sector Funded Salary Pensions that are Final.

- LGPS – Local Government Pension Schemes.

- The pensions that do not apply are ‘State Old Age Pensions’.

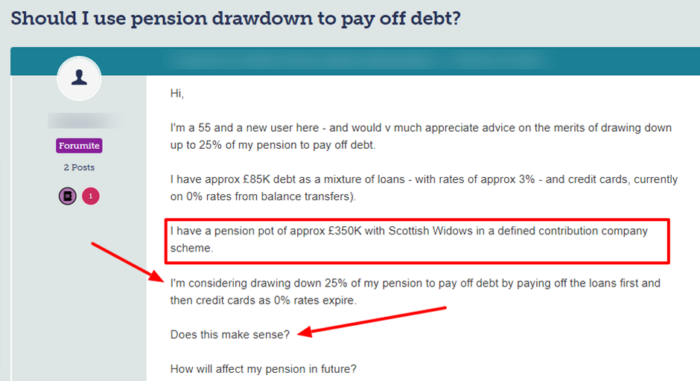

Once question many people ask are clearly shown in this online post:

Source: Moneysavingexpert

How Can You Repay Off Debt? Know Your Options

There are a couple of options available at your disposal, let me elaborate:

The first option to consider is that you can take a 100% cash lump sum – out of which the first 25% is tax-free. However, the rest of it is taxed at the marginal tax rate that is applicable at the time you take it.

Hence the tax implications should not be overlooked. Note, that the marginal tax rate can alternate in the future.

Secondly, a pension fund transfer to a UK approved pension contract. The contract should be in a position to put you in control of your money and should allow you to access your money.

However you want it, whenever you want it. It is basically the same as if you’re using a savings account in a bank.

When you die you are able to transfer your pensions in a scheme that allows you to pass 100% of the fund to your heirs.

If you die before 75, pension death benefits are paid with no tax involved. In the case you die after 75, the death benefits are taxed at the marginal rate, that of the heir.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Is It a Good Idea?

In general, whether or not it is a good idea to repay your loans out of a pension pot is conditional.

In certain situations, such as those related to credit debt and missed payments, taking out a lump sum and using it to contribute to repayment could be a good idea.

I’ll cover the specific situations and arrangements where it may be a good idea to repay debts with pensions.

But however good the situation may be, lump sum withdrawals from your pension may adversely affect your financial situation in a number of ways.

» TAKE ACTION NOW: Fill out the short debt form

What Could Go Wrong? 5 Things to Consider

Let’s cover the five most important things that you have to look out for if you’re looking to cash in your pension to repay your debt.

- Early encashment charges

If you’re willing to take out a lump sum before you retire, you may incur charges called “early encashment” charges.

Once you get to individual withdrawals, you may incur a fee every time you withdraw as well, which is bad.

If you were eligible for benefits such as Universal Credit, they may be reduced or even completely redacted in your case.

Taking a lump sum from your pension may definitely come at a price if it means that you lose any benefits you were eligible for.

You’re required by law to inform the DWP if you are getting any benefits and you decide to take a lump sum from your pension.

Losing your benefits can be very harsh, especially if you were planning to pass along the money from the benefits to your children.

- Tax liabilities

As per the rules, around 25% of the lump sum you retrieve is not subject to tax.

However, you are required to pay tax on the rest. If you take out a very big sum, you may be liable to pay a much higher tax than you originally anticipated.

Taking money from your pension in large sums can make you liable to pay very high amounts of tax on the amount.

- The recycling rule

The recycling rules state that if you retrieve £30,000 or more, you could be liable for a tax charge of around 70%

- Final salary pension scheme

The last problem you have to consider is that if you’re on a financial salary scheme, converting it to a pension and cashing it in can possibly give you a very poor conversion rate.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Impact on Future Retirement

There are three things to consider when using a pension to pay off your debts which I’ve listed below:

- Your retirement income would be impacted

- Your State benefits would be impacted

- Your future tax situation would be impacted