British Gas Debt Collection Agency – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you received a letter from the British Gas Debt Collection Agency and are you unsure what to do next?

It’s natural to feel concerned. After all, nearly half of individuals who deal with debt collection agencies have experienced harassment or aggression1.

Don’t worry; you’re not alone. Every month, over 170,000 people visit our website seeking advice on issues just like this one.

In this easy-to-understand guide, we’ll explain:

- Who the British Gas Debt Collection Agency are and if they’re a real company.

- How to figure out if the debt they’re asking for is really yours.

- What choices you have if you can’t afford to pay the debt.

- Tips on communicating with debt collection agencies.

- The effect of not paying on your credit score.

Our team knows what it’s like to be in your shoes, some of us have faced debt collectors, too. So, we understand your concerns and are here to support you.

What to Do

We’ll go into what you should do next and give you a guide to how to deal with them.

Is it yours?

You may be wondering if you do actually owe the amount that British Gas Debt Collection Agency say you owe. There are a few ways of working out if you do actually owe the amount they say you owe.

The steps to verify a debt begin with asking the debt collector to prove the debt is yours.

Gathering Information

Go through all the correspondence you have received from British Gas and compare the amounts on these letters to the amount on the letter from British Gas Debt Collection Agency.

If these amounts are different, you may not have to pay them.

Prove the debt

If you feel quite strongly that the debt isn’t yours, you can send British Gas Debt Collection Agency a ‘Prove the Debt’ letter. This requires them to prove the debt and give you a rundown of the debt.

You can find templates for a ‘Prove the Debt’ letter at this link.

Should you pay them?

If you have confirmed that the debt is yours and you have the funds to pay them, you should pay British Gas Debt Collection Agency.

Doing so will stop them from sending you any further letters or making any further calls to your home. Dealing with debt collection agencies, in this instance, is best-done head-on.

You can negotiate with a British Gas debt collector, and it’s best to do so. But first, understand your budget so you don’t commit to paying more than you can afford.

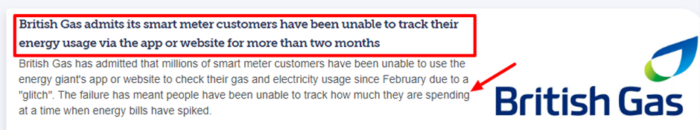

That said, mistakes happen, including glitching in the services they provide, as the case study shows below.

Source: Moneysavingexpert

Repayment Options and Negotiating a Payment Plan

Negotiating debt with British Gas debt collectors is your best option when you’ve fallen behind with payments.

Debt collectors must consider payment plans with British Gas to settle the outstanding. But first, understand your budget so you don’t commit to paying more than you can afford.

You could:

- Try to negotiate paying a lesser amount than the original amount

- See if the debt collector accepts smaller monthly payments to settle the debt

- If possible, make a lump-sum payment to clear the debt

The debt collector must agree to any payment arrangement and should provide you with a written acknowledgement of the payment plan.

Your Rights

Debt collection agencies have no extra legal powers. In fact, they have no more power than the original creditor.

Here’s a quick table that explains what debt collectors can and cannot do. If you’d like to learn more about your rights, make sure to read our complete guide.

| Debt Collectors Can | But They Can’t |

|---|---|

| Contact you by phone or mail. | Call you after 9pm or before 8am. |

| Conduct home visits (on rare occasions) and knock on your door. | Forbily enter your home, or stay if you ask them to leave. |

| Threaten to take you to court by suing you for payment on a debt. | Harrass you, including threats of violence, repeated calls and visits, or abusive language. |

| Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | Visit your workplace. |

| Access your bank account, but only after a court judgment has been made. | Take anything from your home or threaten to do so. |

| Sell your debt. | Speak to other people about your debt without your permission. |

| Contact you frequently. | Keep doing so if you request that they reduce communications. |

Will they go away if you ignore them?

We always recommend responding to debt collectors – even just to question the debt’s validity. Remember, you have the right to request proof of the debt. They have to prove it or they can’t charge you.

If you don’t pay them or contact them and simply ignore them, they won’t go away. Debt collectors are often incredibly persistent and will continue to try and make contact with you by any means possible.

British Gas Debt Collection Agency may even send a representative to your home to discuss your debt – however, they will give you a prior warning in writing.

The best way to avoid this happening is to get in touch with them as soon as you can.

Effect of Non-Payment on Credit Score

When you fall into debt, creditors and debt collection agencies record a default on your credit file. Each record (CCJ) impacts your credit score and does so for six years until the default expires.

That’s the impact of unpaid British Gas bills on credit scores.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Tips on How to Communicate with Them

When a debt collector contacts you, there are things you should do. For example, you should be willing to talk to them calmly.

However, it would be best to admit nothing until you’re satisfied they are legit and you owe the money.

In our experience, it’s always better to respond to debt collectors promptly and never to ignore them. The sooner you deal with the problem, the sooner you can resolve it with a better outcome.

» TAKE ACTION NOW: Fill out the short debt form

British Gas contact details

| British Gas telephone number: | 0333 202 9804 |

| 24 hour contact number: | 0800 111 999 |

| Live Chat: | https://www.britishgas.co.uk/help-and-support/contact-us |

| Energy customers: | 03301000056 |

| Complaints: | https://www.britishgas.co.uk/complaints.html |

If you can’t pay

In these uncertain times, many of us are having a hard time making ends meet. If you find you are struggling with your British Gas bill and can’t afford to pay British Gas Debt Collection Agency help for British Gas debt is available.

Support services for handling British Gas debt could get you back on track.

There are several different services and charities that provide advice and help you get your finances back on track.

You should contact British Gas Debt Collection Agency first and let them know about your situation. If it was Arvato British Gas debt recovery agents, contact them as soon as possible.

You could seek advice from an independent debt advisor if you’re struggling with your finances. Debt management companies and debt charities could liaise with the British Gas debt collector on your behalf.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

We answer some of the more commonly asked questions about British Gas Debt Collection Agency, and debt collectors in general.