Can I Get a Credit Card While on a Debt Management Plan (DMP)?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Understanding if you can get a credit card while on a Debt Management Plan (DMP) is an important question. You’re not alone in asking this.

Every month, over 170,000 people come to us for advice on debt solutions. We know how it feels to worry about whether a new credit card can affect your DMP and we’re here to guide you.

In this article, we’ll cover:

- What a Debt Management Plan is and how it works.

- How to know if you qualify for a DMP.

- How your current credit cards can be affected by a DMP.

- If your spending habits are watched by your creditors.

- If getting a credit card while on a DMP is a good idea.

We have a team with a deep understanding of debt matters, as some of us have even been through similar situations and know how you feel

Let’s dive into the topic and help you make an informed decision about getting a credit card while on a DMP.

Will I be Approved for New Credit Cards While I’m on a Debt Management Plan?

A potential creditor might view this positively, but each lender has their own lending policies. For example, some lenders might let you make deposits to your savings account while on a DMP, whereas others might demand payment to any outstanding debt you have first.

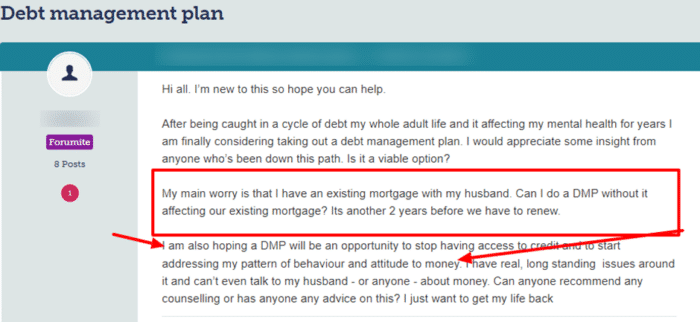

See this message posted on a popular online forum about a debt management plan.

Source: Moneysavingexpert

Points to keep in mind while looking to Open a New Credit on a Debt Management Plan

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Will my already existing credit cards get shut down on a DMP?

» TAKE ACTION NOW: Fill out the short debt form

What does it mean to have a credit card on a DMP and can I be sensible about it?

The impact of DMP on lifestyle means managing finances more carefully.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Wrapping it Up

Using a credit card while a DMP is in place may lead to further financial hardship.

A DMP provider may let you keep a credit card for emergency use only, but it’s at their discretion whether to leave the card out of the agreement.

I suggest you seek advice from a debt adviser if you’re considering applying for a new credit card while a DMP is in place.