Can You Go to Prison for Debt? Quick Answer

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Struggling with debt can be a real worry. Many people in the UK, just like you, fear the worst going to prison for unpaid bills. In fact, more than 170,000 people visit our website each month to find answers about debt problems.

Our team of experts, some who have faced debt challenges themselves, are here to help you understand what can happen when you have debt that’s hard to pay. We’ll talk about:

- How bad debt problems can get

- What steps you can take if you’re in debt

- If you can go to prison over a County Court Judgement (CCJ)

- If you can write off some of your debt

- The types of debt that could lead to prison, such as council tax, criminal fines, and disobeying court orders

We know what it’s like to be chased for money you can’t afford to pay. We’re here to help you figure things out and take control of your debt.

Let’s dive in.

How Bad Can It Actually Get?

Debts aren’t always bad. What makes it a problem is when people are indebted to the extent that they can’t pay it back.

To learn if your debt is too severe, we use a particular calculation method that gives you a percentage and helps you know your financial position better.

This percentage is called DTI or debt-to-income ratio and is exactly what it sounds like.

Whether you earn only enough for survival or have a really good-paying job, the DTI percentage can help you figure out how bad your debt is.

So, in other words, it’s free debt advice for you.

It’s important to know that, generally, a DTI higher than 36% is considered bad.

This type of debt calculator is a good way to know if you are indebted to a safe extent, but it doesn’t accurately determine whether your debts will ruin your financial stability.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can You Be Sent to Jail?

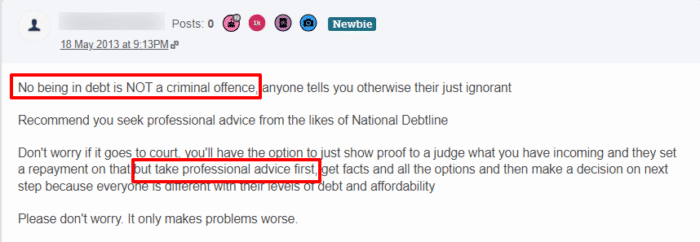

No, a CCJ is not a criminal offence, and nothing but a criminal offence can send people to prison.

A CCJ or a County Court Judgment is issued to you when someone you owe money takes you to court and wins a court case against you.

In other words, a CCJ is a decision made by the judge that asks you to pay someone a certain owed amount.

You cannot simply be sent to prison or stopped at the airport for not paying back an owed amount to a claimant.

Even if the claimant falsely held you accountable for the amount, take the CCJ very seriously.

You need to take the correct action to avoid any further legal notices. Try to get the CCJ removed by validating your ground as early as possible.

In case you are unable to do so, you will have to pay the money according to the plan formulated by the claimant.

Even if you fail to pay them their money, you won’t be sent to jail, and it won’t be a criminal offence – but a CCJ will definitely have a negative impact on your credit report.

What Would be a Criminal Offence?

When it comes to unpaid debts/fines from a library, companies like your employer, your bank, or third parties, you cannot be sent to jail for the failure of being able to pay them back.

It’s not a criminal offence.

However, what is a criminal offence is not paying your council tax or criminal fines.

Council Tax

Council taxes are referred to as priority billing and need to be paid without any drag.

In case of failure to pay council taxes, a person goes into council tax arrears.

Arrears mean that you owe money to your council.

There is no way around this situation than by just paying them the priority debt.

This isn’t any more convenient than paying on time, as it puts more financial pressure on you through court costs, bailiff fees, etc.

So, ultimately, can you go to prison for not paying council tax?

Yes. If you don’t pay the debt as well, you can be taken to jail as it is considered a criminal offence. But rarely do people go to prison for failing to pay council tax as it is considered a last resort.

Criminal Fines

If you have been charged with criminal fines, there isn’t a way for you to avoid them.

You have to either pay the fines or face serious consequences, like going to jail.

Similar to council taxes, if you do not pay your criminal fines, your fines become heavier with the added court costs, bailiff fees, etc.

So, if you want to avoid extra fees and debts, along with the fear of being sent to prison, you should pay your criminal fines within the allotted period of time.

Because there is no other debt advice respective to this situation.

» TAKE ACTION NOW: Fill out the short debt form

Deliberately Disobeying Court Orders

Whether it is not paying back your priority debts or criminal fines, disobeying court orders will take you to jail.

The non-payment of council tax sentencing guidelines – or criminal fines – doesn’t directly take you to jail. But continuously disregarding the Financial Conduct Authority’s directives makes prison an authorised and regulated decision for you.

When you disrespect court orders by not taking them seriously, the consequences are of course too harsh.

So, even in cases such as non-payment of council taxes of criminal fines, a jail term is the very last option in consideration.

The case is initially tried to be sorted through other methods. For example, one way to resolve the situation would be by deducting the amount directly from your income.

However, if this doesn’t work out, then it means that you are not taking the court’s authority seriously and are thus could be sent to jail.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What happens to my bills if I go to jail?

Nothing happens to your bills if you go to prison.

When you are imprisoned, all your monthly subscriptions, your credit cards, etc., keep billing you as before.

If they’re not cancelled by someone else, you come out of prison with huge debts regulated by the financial authorities.

How long can I be chased in the UK?

Your creditor can chase you – for most types of debt – only for six years.

After this period, you no longer owe the debt.

Can I get rid of collectors?

The only way you could get rid of debt collectors is by paying them the amount you owe.

However, if you were wrongfully indebted for a loan you didn’t take, ask them to validate the loan.

Once they fail to do so, your debt is removed from the credit report.

Can creditors take money directly from my income?

The only time your creditors can take money directly from your income is when you owe debt money to your employer, or the same bank or credit card company as your current or saving account.

Other types of debt don’t allow the creditor to take money from your income.

It is always best to get free support from an independent debt charity (e.g. Citizens Advice or MoneyHelper). They can help you clear your dues without the threat of prison hanging over your head.