Is a Debt Written Off after 6 Years? Quick guide

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you wondering, ‘Is a debt written off after 6 years in the UK?’ This question is common for many people struggling to pay off their debts. Every month, we offer guidance to over 170,000 people seeking solutions to their debt problems.

In this easy guide, we’ll explain:

- The truth about debt being written off after 6 years.

- The laws about collecting old debts.

- The process of legally writing off debt.

- How much debt might be too much to handle.

- What else you can do if you are struggling with unaffordable debt.

StepChange stresses the need for professional debt advice, noting that 60% of adults in financial trouble hesitate to seek help.1

We know how worrying debt can be, but don’t fret; we’re here to help. We’ll show you the steps to deal with your debt and answer your questions. We understand the rules about debt, and we will share this knowledge with you. So, whether it’s nearly been six years or not, we have the information you need.

Let’s dive in.

When is debt written off?

Due to a legal loophole technically known as Statute Barred, it is possible for your debt to be written off after six years (kind of!). It is not a rule that applies to everyone with personal debt because it is applied depending on a range of circumstances relating to the debt.

You must meet the statute barred debt criteria criteria to have your debt subject to Statute Barred, specifically:

- Your debt must be at least six years old.

- Your debt must not have been paid in part over the previous six years.

- Your debt must not have been acknowledged in writing over the previous six years.

- Your debt must not have been issued with a CCJ asking you to pay

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What Are the Debt Collection Laws Time Limit?

The rule of six years is crucial for your debt to be ‘wiped’. I’ll explain why I put the word wiped in quotation marks later in this guide.

The debt must be at least six years old, but you must not have made a payment (despite how little you paid) or acknowledged the debt over the last six years. If you did either of these things, the clock resets itself, and you will have to wait for six years until you last made a payment or acknowledged the debt.

Why is it ‘Written Off’ After 6 Years?

You might be wondering why you get the chance to wipe out some personal debts after six years. The reason comes from legislation designed to help the courts struggling with overwhelming numbers of debt cases and insufficient resources.

The law implemented a time limit for debt collection to prevent too many debt cases from ending up in the courtroom. If a debt had not been successfully collected within six years – enough time for creditors to go to court and explore all their options – the case would not be considered before a judge.

Essentially, the debt is banned from being discussed in court. And without a judge to issue a CCJ on the debt, it cannot be legally enforced.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

So, Is the Debt Really Wiped?

Not exactly. Just because the debt cannot be legally enforced with the help of a CCJ, which forces debtors to pay, doesn’t exactly mean the debt is wiped. Instead, the debt simply cannot be collected, and creditors and debt collection agencies cannot do anything to get the money from you. This doesn’t mean they will actually stop asking you to pay, though!

» TAKE ACTION NOW: Fill out the short debt form

Can Debt Collection Agencies Keep Asking for Payment?

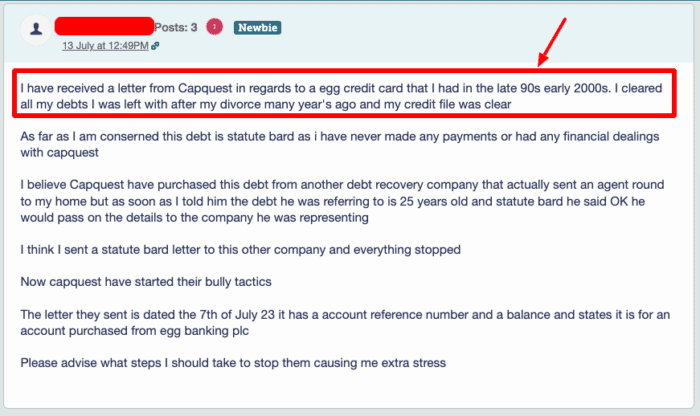

If your debt is classified as Statute Barred, you can inform your creditor or any other group chasing you for payment. There are pre-written letters you can find online (the best are on debt charity websites) and send to your creditors, which tell them the debt is Statute Barred and they have to stop contacting you.

However, in the six years before a debt becomes Statute Barred, actions your creditors can take include:

- Take you to court to get a CCJ issued

- Send bailiffs to recover unpaid CCJs

- Issue your credit score with a default

- Send letters and phone calls

- Visit your home

- Apply for charging orders or an attachment to earnings.

Can I Just Avoid Creditors for 6 Years?

If all this is good news to your ears, you might be considering trying to avoid your creditors for six years or any time remaining before your debt becomes Statute Barred. This is not a good idea because creditors can take you to court if you fail to communicate and agree on a debt solution. If they go to court and get a judge to issue a CCJ, the Statute Barred rule can never apply to the debt.

This means you could end up delaying agreeing on a debt solution or repayment plan and paying more. Trying to hide late fees and interest could make the debt much bigger and plummet you into more debt. It is important to fully understand the consequences of avoiding creditors.

So, Is Statute Barred Even Realistic?

Six years to chase a debt is very long, and creditors know their deadline. Only a lucky few manage to go all the way to six years and not receive requests to pay or get taken to court.

This usually happens because of the creditor’s inability to locate the debtor or because the debt is insignificant and going to court is not worth their time and money.

Most people with personal debt will not get to use the Statute Barred loophole, but it doesn’t mean it is not possible. It is not recommended to call their bluff and believe they won’t take legal action, as they might, and your debts could be much bigger.

A Note On Defaults And The 6 Year Rule

If you miss payments or break the terms of your credit agreement, your creditor could apply a default to your account. A default will remain on your credit file for six years, even if you pay the debt off within that time, making it significantly harder to get most types of credit.

As I said, your credit record will include late payments and account defaults. These remain on your credit record for a total of six years, during which time they contribute to lowering your credit score.

While a debt that has reached its statute of limitations is not listed on your credit report, any late payments, missed payments, defaults, or payment breaks will unquestionably be.

After the day they were registered, each of these remains on your credit report for a total of six years.

What Can You Do Instead?

Instead of hiding from debt letters and sleepless nights worrying, it is usually best to respond to their requests for payment by looking for a debt solution. You might be able to agree on a monthly Debt Management Plan with creditors yourself, or you may even benefit from other debt solutions.

An Individual Voluntary Arrangement is another popular option for people with much bigger debts over £10,000 and a monthly income. These are monthly repayment schedules but have legal weight and wipe off up to 85% of personal debt.

This is only one of the many debt solutions at your disposal. To learn more about other options, please take a look at the table below.

| Debt Solution | Description | Formality | Debt Type | Debt Range | Legally Binding | Impact on Credit Score | Asset Risk | Monthly Payment | Duration | Creditor Agreement Required |

|---|---|---|---|---|---|---|---|---|---|---|

| Debt Management Plan (DMP) | Agreement to pay back non-priority debts in one monthly payment. | Informal | Non-priority debts | Any amount |

No | Yes | No | Varies | Varies (until debt is paid) | No (but creditors must be informed) |

| Individual Voluntary Arrangement (IVA) | Agreement to pay back all or part of your debts over a set period. | Formal | All or part of debts | Usually over £10,000 | Yes | Yes | Possible | Fixed | Fixed period, usually 5-6 years | Yes (75% by debt value must agree) |

| Debt Relief Order (DRO) | Freezes debt for a year and be potentially written off. | Formal | Non-priority debts | <£20,000 debt | Yes | Yes | No | None during freeze | 12 months | No (court approval needed) |

| Bankruptcy | Legal status for those who cannot repay debts, potentially writes off debts. | Formal | Unmanageable debts | Any amount, typically high debt | Yes | Yes | High | None during bankruptcy | Usually 12 months, then discharge | No (court process) |

| Consolidation Loan | Taking out a new loan to pay off all existing debts. | – | Multiple debts | Based on loan amount | Varies | Yes | Depends on loan type | Fixed | Depends on loan terms | No |

| Payment Holiday | Temporary relief or reduced payments offered by creditors. | – |

short-term financial difficulties | Any | No | Yes | Low | Reduced or paused payments | Break of up to 6 or 12 months, depending on circumstances, payment history, and creditor’s policy. | No |

| Informal Negotiation | Direct negotiation with creditors for reduced payments or extended terms. | – | All debts | Any | No | Possible | No | Negotiable | Until agreement terms are met | No |

| Statutory Debt Repayment Plan (SDRP) | Plan to repay debts over a reasonable time, with protections from creditor action. | Formal | All debts | Varies | Yes | Yes | No | Fixed | Varies, based on ability to pay | Yes |

| Equity Release | Homeowners release equity from their home to pay off debts. | – |

Debts of homeowners, typically older individuals aged 55+ | Varies and depends on property value | Yes | Yes | Asset (home) is used as collateral | Varies | 8-10 weeks timeframe from application to fund disbursement. Lifetime; repaid on house sale/death. | No |

It Has Nearly Been Six Years…

If you haven’t heard from your creditor for a long time and six years are nearly up, you might not want to look for a debt solution and instead, try to stay under the radar until you qualify for Statute Barred. But this is a risk and may not work in your favour.

You can call UK debt charities for further help understanding Statute Barred debt!