What Happens if I Can’t Pay My Overdraft?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Worried about not being able to pay your overdraft? You’re in the right place. Every month, over 170,000 people visit our website seeking advice on debt solutions.

In this guide, we’ll talk about:

- The difference between arranged and unarranged overdrafts.

- What happens if you can’t pay back your overdraft.

- Ways to manage overdraft debt, such as taking out a 0% interest credit card, a personal loan, joining a credit union, or improving your budgeting.

- How to pay off an overdraft, including if you can do so in instalments.

- What too much debt looks like and how to legally write off debt.

We know how stressful debt can be because some of us have been in your shoes. That’s why we’re committed to helping you find the best solutions.

Let’s walk through your options together.

What if I’m unable to pay?

If you cannot pay back your overdraft, the amount you are overdrawn will continue to accrue interest, and the debt will grow bigger. You’ll only be asked to repay the money instantly if you don’t have an arranged overdraft.

If you do have an arranged draft, the bank may still ask for immediate repayment if they feel that your financial circumstances have changed drastically.

As of April 2020, the Financial Conduct Authority (FCA) does not allow banks to charge overdraft fees for using an unarranged overdraft, and they can no longer charge daily fees or late fees.

Previously, banks would charge eye-watering unarranged overdraft fees, which could increase the account holder’s debt rapidly. But this is no longer allowed.

Banks have tried to make up for not being allowed to charge these penalty fees. They have done this by hiking up the interest rates on their overdraft facilities.

Many of the big banks now charge overdraft fees up to 39.9%. So, you might not have to pay fees, but you may pay more in interest.

You can use my free interest calculator to see how interest could affect your overdraft or other debt repayments.

This is a guidance tool only and not an assessment. For accurate interest calculations, contact the company issuing the credit. Do not rely solely on this calculator’s results.

FCA rules also state that banks cannot charge different interest rates for unarranged or arranged overdrafts.

Nonetheless, the bank may reduce or restrict your overdraft limit if you keep going above your agreed limit.

I must also emphasize that an unpaid overdraft can also damage your credit history. If you don’t repay an overdraft and it goes to debt collections, it can negatively affect your credit score. That’s because it shows lenders you may be struggling financially.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can you go to jail for not paying?

You cannot be sent to prison for not paying an overdraft debt. In fact, you will not be sent to prison for not paying the most common debts. But this is not an excuse to not pay your debts.

However, the legal consequences for not paying priority debts are real. For example, you can be sent to prison for not paying criminal fines, business rates, or child maintenance arrears. In extremely rare cases, you can be given a short jail sentence for not paying your council tax.

If the bank cannot get any repayments from you, they could sell the debt to a debt collection agency. This company will chase you for payments and could threaten court action, which could lead to the use of bailiffs if you do not come to an arrangement to pay.

» TAKE ACTION NOW: Fill out the short debt form

Ways to tackle it

There are several different ways to pay off an overdraft. Some of the most popular ways to pay off an overdraft include:

- Using your savings.

- Taking out a low-rate personal loan.

- Moving your overdraft debt to a 0% balance transfer credit card.

- Switching to a cheaper or low-rate overdraft provider through balance transfer.

See how you can quickly pay off your overdraft through careful budgeting and financial planning.

Can I pay in instalments?

Typically, an overdraft doesn’t come with a set repayment plan. So you are free to pay off your overdraft however you wish. As such, you can pay off your overdraft in instalments. However, if you are charged interest on your overdraft, you should carefully consider whether this is the best route forward.

Also, it is vital to contact your bank and explain your financial situation. They may be willing to temporarily pause interest charges or fees or let you take care of your living expenses first before paying off the overdraft.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How can I get out of debt?

The good news is there are lots of ways to get out of your overdraft debt. The best method for you will be based on personal circumstances.

You can also receive free debt advice from a reputable debt charity. These debt advice services will assess your situation and recommend solutions or strategies to help you pay off your overdraft.

Some of the strategies that could help you pay off your overdraft more affordably are:

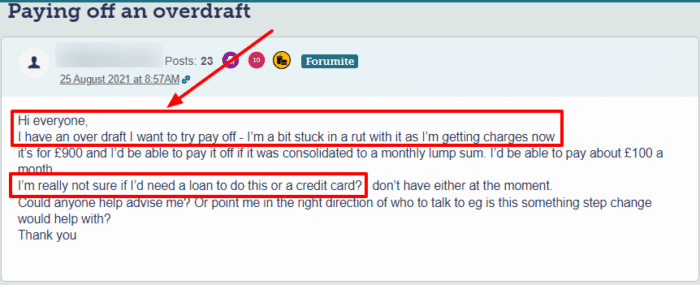

#1: Take out a 0% interest credit card

You might want to consider taking out a 0% interest credit card and using that money to clear your overdraft. This will allow you to repay the capital owed without paying further interest.

However, you should be aware of when the credit card 0% rate ends and what the interest rate charges switches to after this initial period.

This solution can be effective in saving money due to the higher interest rates now charged on overdrafts.

#2: Take out a personal loan

For the same reasons as above, you could also consider taking out a personal loan that has a lower interest rate than what is charged on your overdraft.

By taking out the loan and using the money to clear the overdraft debt, you’ll now have a new debt with lower interest to save money.

That said, think carefully about taking out a personal loan to pay off your overdraft. It might cost you more and cause problems if you can’t afford the payments. Plus, obtaining these loans can be difficult if you already face significant financial hardship. As I see it, you should tell your bank you’re struggling, and they should try to help you.

#3: Join a credit union

Credit unions are not-for-profit financial providers run by their members. They are often found within your local community. Credit unions offer loans at favourable rates, and joining one can be a lifeline to those struggling with an overdraft.

Nowadays, many credit unions don’t require you to have saved with them to apply for a loan. So you can join and borrow right away. Your loan repayments will be set up so that some of the money pays off the loan, and some go into a savings plan.

#4: Improve your budgeting

The options above require a new credit application or credit score check. This could be problematic if you have arrears. If you think you’ll be rejected for more credit, you could instead try to pay off the overdraft by managing your money better.

When you create a monthly budget, you’ll be able to find ways to save money and contribute more to overdraft repayments. Use tools like the Money Advice Service’s Budget Planner to make a budget. Over time, you might be able to clear the overdraft arrears by simply budgeting smarter.