Does Overdraft Affect Credit Score? – Simple Guide

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Worried that your overdraft could harm your credit score? You’ve come to the right place.

Every month, over 170,000 people visit our website looking for guidance on money matters, just like this one. You’re not alone.

In this article, we’ll guide you through:

- Understanding what an overdraft is and how it works.

- The difference between an authorised and unauthorised overdraft.

- How an overdraft can affect your credit score.

- Whether using an overdraft every month is bad.

- The impact of an overdraft on getting a mortgage or credit.

Our team knows how it feels to worry about money; some of us have had overdrafts too. We’re here to help you make smart choices about your money.

Authorised

An authorised or agreed overdraft is when you have a prior agreement with the bank to go below a zero balance on your current account. You will be given an overdraft limit when you have an agreed overdraft facility.

For example, you may be able to go overdrawn by £500, £1,000 or £2,000. You will have to pay back all of the money at a certain date or when requested.

You may be charged interest for using the agreed overdraft, which should be explained before agreeing to the overdraft. Any fees or interest is usually lower than you would get from a loan company.

Does an arranged overdraft affect credit rating UK? It depends on how you use it and whether you are seen to depend on the overdraft a little too much.

Unauthorised

Does unarranged overdraft affect credit score? An unauthorised overdraft happens when your bank has not given you an overdraft facility. Instead, you spend and go into a negative bank balance.

Banks will typically allow this on some of their accounts to prevent you not being able to make the payment.

One common reason for this happening is not realising bills are being paid by direct debit, making the bank account go overdrawn. You will only have the ability to go overdrawn by so much before your bank will reject the next transaction.

It is likely that you’ll be charged fees and interest for this. So, in short, it’s not a good idea to go into an unarranged overdraft. Why? It will cost you in fees.

And to answer the question: does going into an unarranged overdraft affect credit rating? Yes it could.

Read this guide if you want to get out of overdraft debts!

Does reducing your limit affect your credit?

If you’re asking, does reducing your overdraft limit affect credit rating? The answer is that reducing an overdraft could help improve your credit score. However, as it happens with many institutions, such as Clearpay, if you pay late or miss a payment entirely, your credit score might start to suffer.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Does it appear on your report?

Your current account overdraft will appear on your credit report.

It will show up as a debt on an unauthorised overdraft. And it appears even when you have an agreed overdraft. If you have an agreed overdraft but are not currently using it, it will still appear, but it will have a nil balance.

So does being in overdraft affect credit score? It will appear on your report even if you don’t use an overdraft facility.

You may also be asking, ‘Does debit card overdraft affect credit scores?’ The answer is that it could affect your credit rating if you don’t use it wisely.

In short, if you’re wondering, does paying off overdraft improves credit score, it may well do.

Does applying for one hurt your score?

Does applying for overdraft affect credit score UK? A bank may check your credit history before adding an overdraft to your bank account – or before increasing your overdraft limit.

That said, does increasing overdraft affect credit score? It may well do if you don’t use the facility wisely.

However, applying for one is unlikely to have any real impact on your credit score. So, if you’re wondering if ‘do overdrafts affect credit scores’, applying for one won’t hurt you but how you use an overdraft might.

For example, multiple overdraft applications in a short time frame can particularly be seen as a red flag by lenders.

» TAKE ACTION NOW: Fill out the short debt form

Does exceeding my limit have an impact?

If you’re asking, ‘Does an overdraft affect your credit score?’ the answer is that going into an overdraft may impact your credit score in different ways.

If you go into an unarranged overdraft or exceed your agreed limit by spending money you don’t have, it will show up as a debt and decrease your score.

But if you use an agreed overdraft sensibly, i.e. by having a low credit utilisation and paying it off regularly, it will not harm your credit score.

So, in short, do overdrafts affect your credit score? They could have a positive impact on your credit rating. This shows that you can manage your money and repay any borrowing on time.

That said, lenders often view reliance on an overdraft, even an agreed one, as poor money management. So you may want to limit your urge to use this facility.

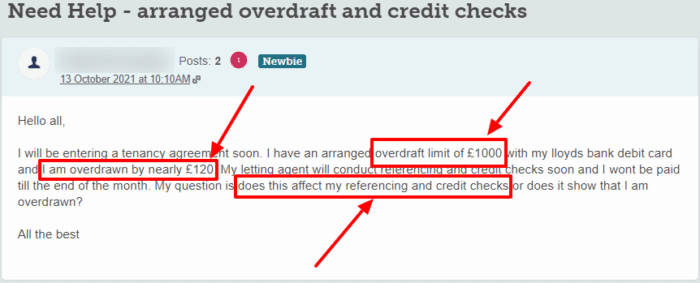

Credit utilisation ratio is the percentage of your total available credit that is currently being used. As this forum users states, they’ve utilised £120 of available £1000 meaning their credit utilisation ratio is 12%. Keeping your utilisation low is the key to improving your credit score.

Is your credit affected as a student?

Many student accounts in the UK offer the option of an agreed overdraft. This is typically available throughout your time as a student and even in the first years after graduation.

Your student overdraft works just like any other agreed overdraft. If you don’t exceed your limit and pay it off frequently, your credit rating will improve – and vice versa.

In short, as a student you may be wondering, ‘Does arranged overdraft affect credit score?’. The answer is it could improve things if you use the facility intelligently.

So the answer to the question, ‘Does uni overdraft affect credit scores?’ Here’s my take: It may well help, or it could impact your credit score depending on how you use it.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Will using it stop me from getting credit?

The ability to get further credit from a lender, whether it be a loan, overdraft or a credit card, depends on your credit report. Thus, using an overdraft sensibly can have a positive impact on your credit report and improve your chances of getting credit.

On the other hand, using an unarranged overdraft can deteriorate your credit report and stop you from accessing credit.

Can it affect you getting a mortgage?

A mortgage lender will assess your finances with a toothcomb. You will usually be asked to provide them with three months’ bank statements for your savings and current account.

If you continually rely on an unauthorised or agreed overdraft, the mortgage provider will notice. This could cause problems, but it all depends on how you manage your overdrafts and wider finances.

Many people asking questions concerning overdrafts and mortgages include things like, “Does Halifax overdraft affect credit score?” and “Does Barclays overdraft affect credit score?” The answer is that yes, it could, especially if you show too much reliance on overdrafts.

Is it bad to use it every month?

Does being in your overdraft affect credit score if you use an arranged overdraft every month but continually pay it off? It can help you build up your credit score.

However, you should not be using all of your credit utilisation (or close to the limit) as this shows you are relying too heavily on your overdraft.

You may want to consider this budgeting resource to dial back how much of your overdraft you’re using and to lower you credit utilisation ratio.

Managing accounts with overdrafts and lenders can be difficult, but implementing a plan can make things a little bit easier.

So, does overdraft affect credit score UK? The way you use the facility could help improve things.