Which Car Insurance Companies Do Not Ask About Criminal Convictions?

The information in this article is for editorial purposes only and not intended as financial advice.

The information in this article is for editorial purposes only and not intended as financial advice.

Are you wondering which car insurance companies don’t ask about criminal convictions? You’ve come to the right place for answers. Every month, over 9,300 people visit this site for advice on similar matters.

In this article, we’ll give you clear and helpful advice on:

- What a driving conviction is and how it may affect your driving status.

- The impact of a driving conviction on your car insurance.

- The difference between losing your licence and getting a driving ban.

- How to get car insurance at a fair price even after a driving conviction.

- The importance of telling your insurance company about your driving conviction.

The Guardian reports that each year in the UK, around 1.2 million people face the challenge of securing car insurance because mainstream insurers typically refuse coverage to those with unspent convictions.1

I know this can be concerning, but we’re here to help you understand your options.

What Is a Driving Conviction?

When you commit a driving offence, you might end up being convicted if the offence is serious enough to warrant prosecution.

Any offence that is the basis of a penalty charge notice is one you can’t be prosecuted for.

However, a fixed penalty notice is different and some offences that result in a fixed penalty notice can become the basis of a conviction.

Here are some examples of driving offences that could lead to you being convicted:

- Speeding

- Drunk driving.

- Drugged driving.

- Ignoring traffic signals and signs.

- Racing or driving dangerously or recklessly.

What Are the Disqualifying Convictions?

Some driving offences are so serious, they can result in you losing your licence and being banned from driving for several years. Offences that could lead to a ban include:

- Careless driving.

- Not stopping at the scene of an accident.

- Failing to report an accident.

- Driving while uninsured.

- Serious speeding offences.

- Jumping a red light.

You don’t necessarily have to be caught by the police committing an offence. Evidence from a traffic camera can be the basis of a prosecution and subsequent driving ban.

Do You Have To Tell Insurance?

If you are trying to find car insurance for disqualified or convicted drivers, you only have to tell the insurance firm about any convictions that are not spent (we explain what this means later).

And you only have to do this if you are specifically asked about convictions or driving bans. You are not legally obliged to divulge this information if not asked about it.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

What Happens If You’re Not Truthful On Insurance Applications?

If an insurer asks you about previous convictions and you hide information from them (relating to convictions that are not spent), then you risk invalidating your insurance.

This could mean that your insurance provider won’t pay if you make a claim, or they may ask for money back from a previous claim.

Are there Insurers that Don’t Ask About Convictions?

Now we come to the crunch.

We know now that you are under no legal obligation to voluntarily divulge information about your driving convictions. So, if the insurer does not directly ask you about convictions, then you don’t have to tell them.

Unfortunately, though, there are no insurers who do not ask you about your driving convictions.

You will find that the question about convictions is on every single application form, and the question should be asked if you apply in person.

You might find an insurer who forgets to ask about driving convictions if you are applying face to face and not filling in an application form. But you would probably have to try many different insurers, hoping one of them does make a mistake.

» TAKE ACTION NOW: Find the best insurance for drivers with points

How Long Do the Convictions Last?

The Rehabilitation of Offenders Act (ROA) is the UK legislation that lays down the rules related to when convictions become spent, and you no longer have to tell your insurance firm about them.

These rules are quite complex, and beyond the scope of this post.

But we can summarise how most driving convictions are handled, thus:

- Under the age of 18 – a conviction is spent 2 ½ years after you were convicted.

- Over the age of 18 – a conviction is spent 5 years after you were convicted.

However, this is a very simplified explanation.

If you want to make sure that convictions are actually spent, you need to contact the Driver Vehicle and Licensing Agency (DVLA). You can call them on 0300 790 6801.

Will It Have an Impact on Your Vehicle Insurance?

If, for example, you are convicted of drunk driving and you have to tell your insurer about this, they will then see you as a high-risk driver.

Insurers have to evaluate risk when they are working out how much your policy should cost.

Therefore, you can expect to pay more, and quite a lot more, if you need vehicle insurance as a convicted driver. Other factors also come into play, such as:

- Your age.

- Type of vehicle.

- Your location.

However, the impact of being a convicted driver is worse than all of these, when it comes to how much your insurance will cost.

Find better convicted driver insurance deals for you

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

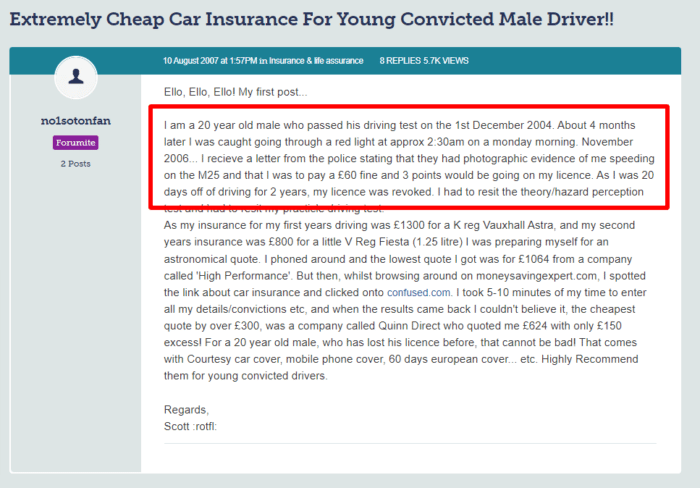

Can You Get Cheap Vehicle Insurance With a Driving Conviction?

The honest answer here, is no, you can’t.

With convictions, your insurance premium will always cost more than if you had not been convicted.

But if your current insurer has given you an expensive quote to renew your insurance now that you have a conviction, it may be possible to find a cheaper option.

There are some specialist insurers that handle people who have convictions.

The best advice here would be to shop around and get a number of quotes from different insurers. You can then pick the cheapest one that provides the cover that you need.

Convicted Driver Insurance Reduction

I understand how frustrating it can be to face high insurance costs due to a mistake. That’s why I’ve prepared a table to help you reduce insurance rates.

| How to Reduce Insurance Rates | Keep in Mind… |

|---|---|

| Choose Your Car Wisely | Consider age, engine, insurance group & price. The lower the group, the lower the premium. A high-powered & fast car, or cheap car with less value come with a higher risk, which means a higher premium. |

| Ensure Car Safety & Security | Park in a driveway or locked garage. Use safety technology. |

| Add a Named Driver | Adding an experienced driver with a good claims history, such as a parent, can lower your insurance premium by reducing the perceived risk. |

| Drive Fewer Miles | Reduced mileage = Reduced risk. |

| Complete a Rehabilitation Course |

Third-Party Only – the bare minimum; as required by law Comprehensive – provides full coverage and may include personal accident and medical expenses coverage Third Party, Fire & Theft – TPO cover and also insures against damage to other vehicles and injuries to others in accidents where you’re at fault, accidental fires or arson, stolen vehicles |

| Determine the Cover Level You Need |

Third-Party Only – the bare minimum; as required by law. Comprehensive – provides full coverage and may include personal accident and medical expenses coverage. Third Party, Fire & Theft – TPO cover and also insures against damage to other vehicles and injuries to others in accidents where you’re at fault, accidental fires or arson, stolen vehicles. |

| Compare Policies and Opt Out of Extras | Get quotes tailored to your specific convictions and needs. Optional extras like excess protection, legal cover, breakdown, windscreen, and gadget cover are nice to have but come with added costs. |

| Increase Your Excess | Raising the amount of excess (upfront payment for any claim; the rest to be paid by the insurer) on your policy can lower your insurance premium. |

What Are Some Steps You Can Take to Rebuild Trust With Insurers?

In order to rebuild trust with your motor insurer, and in turn lower your premium costs, you should focus on maintaining a clean record.

This will prove that you are less of a risk on the road.

There is a possibility for convicted drivers to take rehabilitation courses, which may reduce insurance premiums in the future. These are often intended for those who have drunk driving and drugged driving convictions.