What Happens to Catalogue Debt when Someone Dies?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

When someone dies, what happens to any catalogue debt they leave behind? You’ve come to the right place for answers. Every month, more than 170,000 people visit our website seeking advice on debt solutions.

We’ll share our expert knowledge on:

- Who is responsible for a deceased person’s catalogue debt

- How this debt is handled if there are no assets left behind

- What happens if the debt was shared or someone else was a guarantor

- The legal time frame for creditors to claim on an estate

- How to deal with debts after a person has passed away

Citizens Advice says that catalogue shoppers who miss payment deadlines get charged very high fees, sometimes more than twice what they borrowed.1

Not being able to pay a catalogue debt can be a great worry. It’s a tough spot to be in, not knowing what to do or who to talk to. But don’t worry; we’ll help you understand your options and make the best decisions.

Does It Pass On to a Family Member or Spouse?

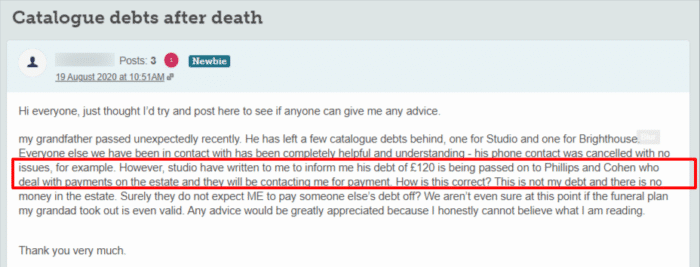

Catalogue debt after death isn’t passed on to anyone else. The credit agreement is between the catalogue company and the deceased.

The forum user in this example is right – debt collectors can’t chase them for the remaining debt because the debts aren’t theirs. Instead, the debt collectors should be looking to get the money from the grandfather’s estate.

However, there are a couple of exceptions to this:

- The catalogue debt is jointly owned with someone else. In this situation, the debt becomes the sole responsibility of the other named person on the account.

- The debt has someone acting as guarantor on the account. This is not likely for catalogue debt, but it is worth being aware of. There may be other debts belonging to the deceased that do have a named guarantor. In this situation, the guarantor becomes liable for the debt. However, this won’t be applicable for catalogue debt.

Will I Have to Pay if The Deceased Has No Assets?

As I said above, the catalogue debt, providing it isn’t a joint account, becomes the liability of the estate of the deceased. However, there may be no assets or money in the estate to cover the cost of the debt. In this case, the debt still isn’t passed over to someone else.

If there’s no money to pay the catalogue debt, the company will usually write off the debt. The catalogue debt doesn’t become the responsibility of any remaining family members. The only exceptions are if the debt has a joint account holder or there’s a guarantor on the debt.

» TAKE ACTION NOW: Fill out the short debt form

How Long do Creditors Have to Claim on a Deceased Estate?

Creditors have a six-month period to claim money owed after the account holder passes away. If you are the executor or administrator of the estate, you will need to get in touch with the catalogue company and all other accounts held by the deceased. The debts need to be recovered through the estate before the estate is distributed to the beneficiaries.

Can Executors Refuse to Pay Debts?

The executor of the estate must take steps to ensure debts are cleared through the estate. You can’t distribute the estate until you pay the debts, including catalogue debt. An executor can become liable for the debts owed after someone dies, up to the value of the estate.

If the executor distributes the estate before clearing the outstanding debts, the creditors can claim them. This is the case even if the executor is unaware of the debt.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can I Get It Written Off?

Some companies might be willing to write off the debt once they know that the debtor has died.

You can use my free letter template to write the creditors and explain the situation. Keep in mind that creditors have no legal obligation to write off debts after someone has died. They may be able to make a claim against the estate.

Luckily, there are many catalogue debt solutions available out there. If you want to learn more about them, please take a look at the following table.

| Catalogue Shopping Debt Help | How to Tackle Your Catalogue Payments |

|---|---|

| Installment Plans | Negotiate smaller, budget-friendly payments with your catalogue company |

| One-Off Payment | Pay a lump sum to reduce your debt and possibly get a discount for settling in one go |

| Company-Specific Hardship Programs | Inquire about any hardship assistance, which may include payment holidays, reduced payment plans, or even temporary freezes on interest |

| Budgeting and Financial Advice | Reach out to financial counseling services or debt charities for budgeting advice and help with negotiating debts |

| Debt Solutions | Explore your options for managing catalogue debts, such as IVAs or DMPs |

| Government Schemes | Government aid such as Universal Credit Budgeting Advances or Local Welfare Assistance can help with your overall financial situation, and potentially free up funds to pay off your catalogue debts |

| Interest-Free Payment Options | Transfer debt to an interest-free credit card or loan to stop the debt from growing and make repayments more manageable |

Notify Creditors of the Situation

The executor, administrator or family member should notify the creditors about the situation. You can do this by writing a letter or email to the catalogue company and any other accounts held. Let them know that you will contact them with further information as soon as it becomes available. Most catalogue companies will be patient and sympathetic if you keep them updated.

It’s also sensible to place a classified ad in a paper that’s local to the deceased, providing information regarding the death.

Give creditors around 2 months to contact you regarding the debt. However, as mentioned above, it is important to be aware that you can become liable for a debt to the value of the estate even if you weren’t aware the debt existed. By posting an advert in the local paper you can prove you took steps to notify all creditors.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Get Help Distributing the Estate, Even When There is No Money

Dealing with estates, even insolvent estates, can be complicated and stressful. I recommend getting help from a solicitor or a probate specialist. They will help you to avoid issues and mix-ups from occurring. At the very least, seek help from debt advisors who can inform you about the steps to take when dealing with catalogue debt after death. The debt advisors I recommend are:

Debts After Death – Key Points

- The catalogue debts won’t pass on to relatives, it becomes the liability of the estate.

- If there’s no money in the estate (an insolvent estate) the debt is normally written off.

- You must take the necessary steps to ensure the catalogue debt is paid out of the estate if possible.

- You must pay creditors before you distribute the estate to beneficiaries.

Dealing with catalogue debt after death can be worrying and stressful at an already challenging time. Seeking help will help you to ensure everything is correctly managed.

References

- Citizens Advice – Catalogue customers hit hard for missing interest free deadlines