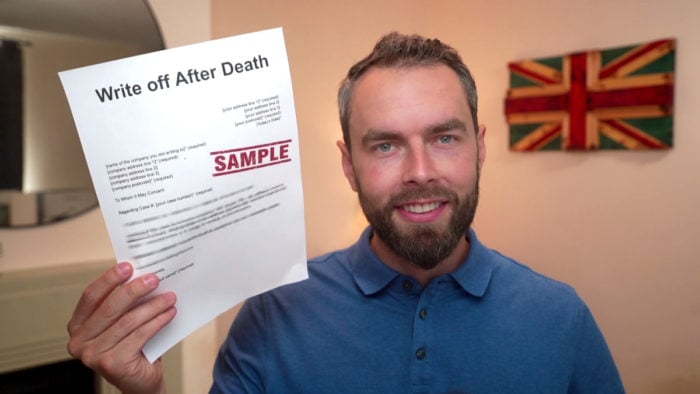

Write off After Death – Sample Letter Template for Creditors

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you trying to sort out a debt problem after the death of a loved one? This article is here to help. It’s a tough time, but many people face this situation. In fact, over 170,000 people visit our website each month looking for guidance on debt issues.

In this article, you’ll find:

- Clear steps to write a letter to creditors about a debt that can’t be paid because the person who owed it has died.

- A sample letter template to use.

- Answers to common questions: Does a debt die when a person dies? Do family members have to pay it? How do you tell creditors about the death?

- How to find lost bank accounts that might help pay the debt.

- Advice on when and how it’s possible to write off some of the debt.

We understand that it’s a difficult time and that dealing with money problems can make it even harder. We hope that this guidance will help you feel more in control and make things a little bit easier.

Letter Template

To Whom It May Concern

Regarding Case #: [your case number]* (required)

I am writing to you about the above account, which [enter the name of the person who has died and include their address so that the creditor can identify them.]* (required) owed.

[enter the name of the person who has died.]* (required) passed away on [enter date of death]* (required). I enclose a copy of their death certificate. They didn’t leave behind any assets and there is no money to pay what they owe.

[you could include a paragraph about the deceased person’s circumstances. for example, if they were living in rented accommodation and were receiving only benefit income. this may help to confirm to the creditor that they did not leave behind any assets.]* (required)

Please consider writing off this debt because there is no prospect of you ever recovering any money towards it. Please write back to me to confirm your decision

I look forward to hearing from you.

Yours sincerely

Downloadable Resource

The download links below take you to a Google document template where you can make a copy or save in any document format you like. Note, you may have to login to your Google account.

Download – Single (for one person)

Download – Joint (for couples)

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

When a person dies does the debt die with them?

If someone dies with debt, the debt has to be paid off with money left within the person’s estate.

For example, if someone dies with a credit card debt of £500 and leaves behind £5,000 in their will, £500 of the estate will need to be used to pay off the debt. The executor of the will is responsible for paying back the debt.

However, some creditors will write the debt off without asking for the money. Sending a letter asking the creditor to write off the debt is a good idea. It is essential if the deceased died without leaving money to pay their debts.

» TAKE ACTION NOW: Fill out the short debt form

Is family responsible for deceased debt?

Family members of the deceased are not directly responsible for paying back the debt, unless it was a joint debt with the deceased person.

For example, if a married couple took out a loan and one of the pair died, the other would still be responsible for the debt. But debt cannot be passed through the family in any other way.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Do I have to notify creditors?

It is the responsibility of the executor of the will to notify creditors of the death. Once you have told them about the death, it is usual practice for the creditor to back off and give you time to arrange the estate before offering them a debt repayment.

Don’t assume they do not want to be repaid. They will still expect to receive the money if it has been left behind.

If the executor of the will fails to notify a creditor of the death, and thus pays out the estate without paying back the debt, the creditor could then chase the executor for the debt.

Remember to look for lost bank accounts

There might not look like there is an estate left behind to pay back the debt, but to be sure and to protect yourself as the executor of the will, you should look for lost savings.

My Lost Account is one website that is known to help people locate lost bank and savings accounts. Give it a try before telling creditors that there is nothing for you to pay back on the deceased’s behalf.