Central Debt Recovery Unit Group Debt – Do You Need to Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Has a letter from Central Debt Recovery landed on your doormat? You’re not alone. Every month, over 170,000 people visit our website for advice on handling debt.

We understand that you may be confused about this debt, questioning whether it’s legitimate, or worried if you can’t afford to pay. We’ve got your back.

In this guide, we’re going to share:

- Who Central Debt Recovery are and why they might contact you.

- How to find out if the debt is really yours.

- Ways to deal with debt collectors without feeling stressed.

- How Central Debt Recovery might affect your credit score.

- What to do if you can’t afford to pay back the debt.

Research shows that 64% of UK adults find interactions with current debt collectors stressful1. So, we understand the pressure you might be feeling. But remember, there are always options to explore.

Let’s get started on understanding your next steps.

What are the reasons for contact?

If Central Debt Recovery Unit Debt Collectors are contacting you, it is because you owe money to an organisation they are dealing with.

It may be a debt you are unaware of or have completely forgotten about. Either way, it is imperative that you speak to the debt collection company when they contact you.

The way these organisations work is that they purchase the debt from other companies, and this is why they are so keen to get in touch with you to arrange a repayment. They buy billions of debt annually at rock bottom prices – at an average of 10p to £1! 2

They may go to extreme lengths to get hold of you, including frequent calls, emails and letters. Although it is frustrating, you should take steps to pay your debt back as otherwise, you will be dealing with this contact for a long time to come.

Typical Collection Process

We’ve put together this simple table that explains the key stages in the debt collector timeline. It’s crucial to understand them to keep debt collectors from filing a CCJ against you or any other unwanted situations. For more information, be sure to check out our specialized guide.

| Stage | Actions | What you should do: |

|---|---|---|

| Missing one or two small payments | Calls and letters from the debt collector asking for payment. They may enquire about reasons for missing payments. | Contact the debt collector and offer to pay what you can. If you are struggling to pay the debt, get in touch with us to explore your options. |

| Missing large or multiple payments | Their contact will become more frequent, urgent, and threatening. | Contact the debt collection agency and offer to pay what you can. You may also make a complaint if you think the letters are a form of harassment. |

| Debt collector visit | After a few months, if the debt is significant (£200+) you will receive notice of a debt collector visit. They have to notify you before arriving. Debt collectors cannot take anything from your home – they may only ask for payment. | If a debt collector shows up at your home, ask them to show proof of the debt and their ID through a window. Do not open your door or let them in. You can arrange a payment plan with the debt collector, but make sure to get a receipt of this. |

| Court | If you still do not pay your debts to the original lender/debt collector agency, they will take you to court and either attempt to: – File a CCJ against you. – File an attachment of earnings order. – File a lawsuit against you. |

You must show up to your court date. From here, you can either dispute the debt, or the judge will likely suggest a manageable repayment plan for you. |

Is it yours?

You should clarify whether this is your debt before you start making payments to Central Debt Recovery Unit Debt Collectors.

If you don’t recognise the debt, you should get evidence in the form of an original credit agreement. It may be more than you think with fees and interest being added. If the debt collection company are unable to provide evidence, you should not pay the debt, unless you know it is definitely yours.

Follow our ‘prove it’ guide with letter templates and get them to prove that you owe the money.

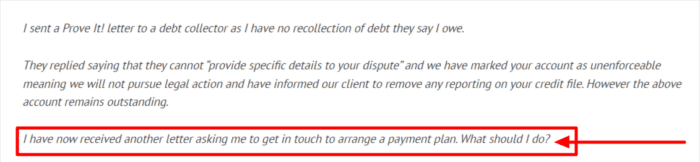

Remember, you are under no obligation to pay for a debt that can’t be proven to be yours. Take a look at this example.

This person absolutely doesn’t have to pay the debt collectors anything. They’ve probably just sent the payment plan letter on the off chance that someone will pay up without checking!

If you are in a similar situation, stay vigilant and check your correspondents. This is actually why we think that communicating via letter as much as possible is important – you can easily check to see what has been said.

Is my debt statute-barred?

If Central Debt Recovery can provide you with evidence that the debt is yours, pause for a second before you pay! From our experience, too many people immediately rush to pay a debt without checking to see if it’s even enforceable.

If it has been 6 years – or 5 years in Scotland – since you last paid towards your unsecured debts and you have not written to your creditor about your debt during this time, it is statute-barred.

This means that the debt is not enforceable. It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

Keep in mind that not all debts become statute-barred!

Any HMRC debts, for example, will stay enforceable for decades. Any debt that had a County Court Judgement (CCJ) attached to it during the 5 or 6-year window will be enforceable for the duration of the CCJ.

If your debt is statute-barred, you can use our free letter template to write to Central Debt Recovery Group and explain the situation.

If you are unsure about the status of your debt, you can contact a debt charity for some advice. Their advisors will be able to look at the debt in question, determine its status, and advise you on your next steps.

» TAKE ACTION NOW: Fill out the short debt form

How to deal with them

Sometimes debt collectors will go to extreme lengths to get you to pay back debt, even if you can’t afford it. It’s important that you understand your rights when it comes to dealing with debt companies.

They should not be causing you stress and anxiety. These are some ways to deal with debt collecting agencies like Central Debt Recovery Unit Debt Collectors.

Keep calm

It is important to have some perspective when dealing with your debt issues. Although it’s a difficult situation to deal with, debt problems can be resolved and it is best to stay as calm and composed as possible.

Try to make payments

If possible, try to set up a payment plan with Central Debt Recovery Unit Debt Collectors and even better if you can clear the debt completely. You should not ignore the debt, as it won’t go away, and you’ll just feel even more stress and pressure when the debt collection agency continues to chase you.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What if you can’t pay?

If you’re having financial problems and can’t pay the debt back to Central Debt Recovery Unit Debt Collectors, you should be honest with them about your situation.

You may be able to pause the debt for a period of time until your financial situation improves. If you can pay even a little, that will be beneficial.

Why are they continuing to contact you?

It is important to understand how debt collection agencies like Central Debt Recovery Unit Debt Collectors work, if you have any chance of working out why they do what they do.

Incentives

The advisers who are contacting you will usually receive some sort of incentive based on how much debt they recover. This is why they are so keen to get hold of you and will often phone you up continuously until they finally reach you.

When you understand this, it can give you a better perspective on why they keep contacting you, and it may make you more likely to speak to them.

It’s their job

If you owe the money, you should pay it back and the advisers contacting you are only doing their job. However, they should not harass you. This includes incessant phone calls, emails, letters or even text messages in some cases.

If they do this, they could be in breach of the FCA guidelines. You can tell the agent that you will report them to the Financial Ombudsman if they are breaching the regulations.

You can contact the Financial Ombudsman by phone on 0800 023 4567 or 0300 123 9123

Agency tactics

Debt collection agents can go from one extreme to another. They may start off in a pleasant manner, but if you can’t afford to make payments, they may soon change their attitude.

It is important to stand up for yourself, and not get too upset by debt management companies. If you feel you are being treated unfairly though, you can use this online complaint form to report them.

Speaking to other people

Debt collection companies such as Central Debt Recovery Unit Debt Collectors, should not speak to other people about your debt. This breaks regulations and privacy laws. If they do this, you can speak to the Financial Ombudsman on 0800 023 4567 or 0300 123 9123

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

When you can’t afford to pay it back

If you want to write off the debt, you can enter into an Individual Voluntary Arrangement (IVA). With this, you can reach an agreement to pay a one-off sum or monthly payments and the remainder of the debt will be written off.

You will not be able to get access to credit for a period of time while you’re in this arrangement, usually five years.

Will It Affect My Credit Score?

Yes, debt collectors like Central Debt Recovery Unit can affect your credit score, but not in the way that many people think.

Once you have missed a few payments or defaulted on an account – which negatively impacts your credit score, too – your debt might be sold to these collectors, it will appear as a second collection account on your credit file, and the original entry may be marked as ‘sold’ which doesn’t look good!

If they don’t add a second entry to your credit file, the entry for your original debt can be changed to add the debt collection company’s information.

While it is unlikely that they will do this for smaller debts, they have the legal right to.

These collection accounts will negatively impact your credit. They are visible for 6 years and will impact your ability to get credit or use some credit products during this time.

This is because companies use your credit file to see if you are a ‘high-risk’ customer – someone who might have difficulty paying their bills on time. If you continue not paying until you have a CCJ against you, you have had such trouble paying back your debt that someone had to go to court about it.

Understandably, companies are going to be reluctant to give you credit!

After 6 years, it is no longer visible on your credit report, and you should find it easier to get credit again.

You also need to be aware that any debt solutions that you use will also be visible on your credit file for 6 years, and your credit score may be affected. However, once these 6 years are over, your debt solution will no longer be visible, and you may find it easier to get credit again.

What else do you need to know

There have been many warnings from government and professional bodies about debt collection agencies and unacceptable behaviour.

You should not refuse to pay debt if you owe it, but you can agree to pay a specific amount that you can afford each month. If you are being bullied by the debt management company, you can report them to the Financial Ombudsman, who may take thier license.

How do I make a complaint?

Janine, our financial expert, explained that while debt collectors can visit your home for payments, they cannot come to your workplace, act threateningly, force payment, or discuss your finances with others. If they violate these rules, you can complain.

Make your first complaint to Central Debt Recovery so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, Central Debt Recovery may be fined. You could even be owed compensation.

Central Debt Recovery Unit Contact Details:

| Company Name: | Metropolitan Collection Services Ltd |

| Other Names: | Central Debt Recovery Unit, Payment Services Bureau |

| Address: | PO Box 5338, Coventry District Service Centre Binley Business Park, Harry Weston Road, Coventry CV3 9FR |

| Contact Number: | 0345 609 0545 |

| Fax: | 0121 4552997 |

| Number they call from: | 08456031256 |