The Cheapest Car Insurance For Drink Drivers –

The information in this article is for editorial purposes only and not intended as financial advice.

The information in this article is for editorial purposes only and not intended as financial advice.

“Are you seeking affordable car insurance after a drink driving ban? This article will guide you on how to find the best possible deal. We understand your worries, especially as over 9,300 people come to us every month with the same problem. It’s hard to find cheap car insurance after a ban, but we’re here to help.

In this article, you’ll learn:

- The reasons for a drink driving ban.

- The impact of a ban on your car insurance.

- The difference between a driving disqualification and a revoked licence.

- Tips to find affordable insurance after a ban.

- The risks of not telling your insurer about your ban.

We know it’s tough to deal with high insurance costs after a ban. But remember, it’s very important to be honest with your insurer about your past. If you’re not, you could face even bigger problems. With the correct advice, you can find a good deal on car insurance, even with a ban. Let’s explore this subject together and help you find a solution.”

How can I get cheaper insurance after a drink driving ban?

Here is a step-by-step guide to help you with the general steps involved:

- Identify a list of cars in the “insurance group 1”, or at least within groups 1 – 10

- Find models on online retailers like Auto Trader

- Enter the number plate into a car insurance group checker

- The average price it provides should be doubled

- Repeat with a few different models within the suggested insurance groups to find the cheapest car insurance after a drink driving ban

Cheap car insurance for drink drivers

Cheap car insurance for drink drivers in the UK can first be identified by their insurance group. All cars belong to insurance groups that insurance companies use to determine how much they will charge.

Using tools like the car insurance group checker will allow you to find out how much the insurance will cost. They do this by allowing you to enter your number plate to give you an idea of the price range.

When companies decide what group to place a vehicle into, they look at the following factors:

- The car’s security level. An alarm and high-tech door locks reduce the insurance costs

- The quality of the bumper makes the car more or less safe from collision, which also determines the price.

- Larger engines and high-performance cars are perceived as higher risk

- The more expensive the parts are for replacement, the more it will cost the insurer to fix your car. So they’ll charge you more

- How long it takes to acquire replacement parts can lower the price if they are quickly replaceable

When your personal details are added into one of the following comparison sites, you will find ideas of who can offer you the cheapest deals:

| Insurance for Drink Driving Convictions to research with your personal details | |

| Popular Comparison Websites | https://www.confused.com/car-insurance/drink-driver https://www.comparethemarket.com/car-insurance/content/drink-driving-laws-and-insurance/ |

| Less Known Providers | https://www.quotezone.co.uk/convicted-driver-insurance/drink-driving |

Some of the individual insurers include:

- One Sure Insurance

- Pol Plan Insurance

- Insurance Revolution

Disclaimer

Please get the advice of an expert before making a final decision. Compare the examples given here, each has its downsides that accompany the lower prices so these need to be weighed up on a person-by-person basis.

So, finding the cheapest company to insure your car, starts with finding the cheapest car to insure.

» TAKE ACTION NOW: Find the best insurance for drivers with points

How long does a drink driving ban stay on your licence?

Depending on the particulars involved in the incident, the conviction can last anywhere between 4 to 11 years. This varies depending on whether you provided a sample if you were driving at the time you were spotted or stationary, past convictions, and your level of honesty and compliance throughout the conviction process.

How do you get away with disqualified driving?

Whilst lying to avoid punishment is not legal or advised, the charges could be dropped if there is proof available that you were not driving at the time of the arrest, you had a legitimate reason to be behind the wheel – such as a medical emergency, or you have an acceptable reason to believe you were no disqualified at the time the conviction process began.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

What is the cheapest car to insure after a ban?

Cars within the insurance groups from 1 – 10 are the vehicles that will be the cheapest to insure. Cars within group one are the cheapest to insure because they are at the least risk of being stolen, damaged, or involved in an accident.

For the average person, these cars are around £579 per year to insure. For drivers with convictions like yours who generally pay over double this premium, expect to pay over £1,158 per annum.

Cars that fall within group one include:

- Volkswagen Up

- Vauxhall Corsa hatchback

- Skoda Citigo

- Fiat Panda

- Chevrolet Spark

- Citroen C1

- Nissan Micra

- Smart ForFour

How much does insurance go up after a driving ban?

Insurance rates more than double after being banned from driving after a conviction.

Find better convicted driver insurance deals

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

How much does a drink driving course reduce the ban

The “Drink Drive Rehabilitation Scheme” can lead to a reduction of up to 25% from the total length of the driving ban. So a ban of 24 months could be potentially reduced to 18 months, which might be considered by some to be a worthwhile investment. The awareness and education the course provides will hold value in itself too.

Drink Driving – Concerns about the future

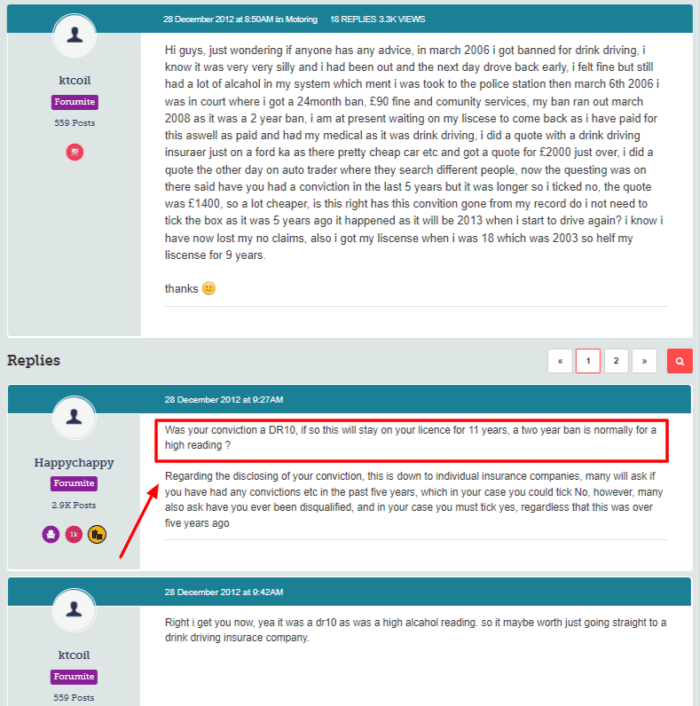

Image src: https://forums.moneysavingexpert.com/discussion/4361519/drink-driving-ban-over