Will I be Punished for Not Telling Insurance About Ban?

The information in this article is for editorial purposes only and not intended as financial advice.

The information in this article is for editorial purposes only and not intended as financial advice.

Are you worried about getting car insurance after a driving ban? You’re not alone. Each month, over 9,300 people visit our website for advice on finding insurance as a convicted driver.

This article will help you understand:

- Why you might get a driving ban.

- How a ban can change your car insurance.

- The difference between disqualification and a revoked licence.

- How to find cheap insurance even with a ban.

- What happens if you don’t tell your insurer about your ban.

The Guardian reports that each year in the UK, around 1.2 million people face the challenge of securing car insurance because mainstream insurers typically refuse coverage to those with unspent convictions.1

I know this can be concerning, but we’re here to help. With the right information and advice, you can find a good deal on car insurance, even with a ban.

Why Are You Given a Driving Ban?

The rules for when a ban is given and when one isn’t, are very clear-cut.

Even so, it can be hard to understand why you were banned in some cases if the original conviction didn’t result in an immediate ban.

Let’s look at the two scenarios that could lead to a ban.

- You are convicted of a serious offence, such as drink driving, and you are banned as a result of this conviction.

- You are convicted for an offence, resulting in additional penalty points being added to your licence. The result is that you now have enough penalty points to trigger a driving ban.

It is the latter scenario that can be difficult to understand. Every time you are given penalty points, they also have an expiry date. Keeping track of current penalty points and how long they have to run can be confusing.

You Must Tell Your Insurer about Unspent Convictions and Bans

You are legally obliged to inform your insurance firm about driving convictions and bans when asked. Generally, there will be a place on the application form to add this information.

You do not have to tell them about spent convictions, even though some insurers ask this question, in an attempt to learn more about your undisclosed driving history.

As we already know, the cost of insurance for disqualified or convicted drivers can be quite high, depending on your circumstances.

Often, something as simple as the date you give for the conviction can have a major impact on the cost of your insurance.

» TAKE ACTION NOW: Find the best insurance for drivers with points

It is tempting to juggle dates to try and get cheaper insurance.

After all, you simply wrote the date down wrong, didn’t you? A simple mistake right? Wrong.

Even if you mistakenly provide the wrong information when applying for insurance, your insurance policy will be invalid.

If you are subsequently caught driving on an invalid policy, you will likely face a further conviction for driving without insurance.

The legal system and courts are not stupid, and playing the “I made a simple mistake” card isn’t going to cut it as a defence.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

Will Your Insurance Be More Expensive After a Driving Ban?

In general, yes, your insurance costs will be more expensive after a ban.

For example, if you are issued a fixed penalty notice for speeding, convicted and given penalty points that trigger a ban. Your insurer would then see you as high-risk.

But why the greatly increased cost of insurance?

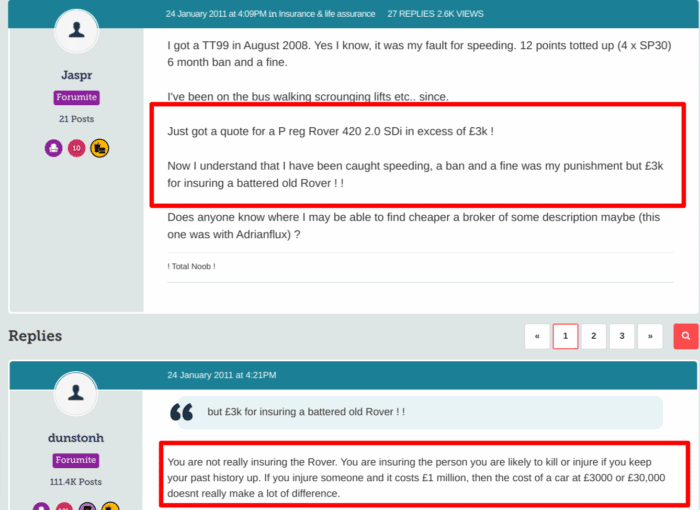

Well, it isn’t you and your vehicle that the firm is insuring, although it is easy to get tricked into thinking this is how it works.

Instead, the insurer is underwriting your liability to others.

And the ban tells the insurer that you are more likely to injure others or damage property than a diver who has not been convicted.

Convicted Driver Insurance Reduction

I understand how frustrating it can be to face high insurance costs due to a mistake, especially when you’re struggling with money.

That’s why I’ve prepared this table that provides different tips to help you reduce insurance rates.

| How to Reduce Insurance Rates | Keep in Mind… |

|---|---|

| Choose Your Car Wisely | Consider age, engine, insurance group & price. The lower the group, the lower the premium. A high-powered & fast car, or cheap car with less value come with a higher risk, which means a higher premium. |

| Ensure Car Safety & Security | Park in a driveway or locked garage. Use safety technology. |

| Add a Named Driver | Adding an experienced driver with a good claims history, such as a parent, can lower your insurance premium by reducing the perceived risk. |

| Drive Fewer Miles | Reduced mileage = Reduced risk. |

| Complete a Rehabilitation Course |

Third-Party Only – the bare minimum; as required by law Comprehensive – provides full coverage and may include personal accident and medical expenses coverage Third Party, Fire & Theft – TPO cover and also insures against damage to other vehicles and injuries to others in accidents where you’re at fault, accidental fires or arson, stolen vehicles |

| Determine the Cover Level You Need |

Third-Party Only – the bare minimum; as required by law. Comprehensive – provides full coverage and may include personal accident and medical expenses coverage. Third Party, Fire & Theft – TPO cover and also insures against damage to other vehicles and injuries to others in accidents where you’re at fault, accidental fires or arson, stolen vehicles. |

| Compare Policies and Opt Out of Extras | Get quotes tailored to your specific convictions and needs. Optional extras like excess protection, legal cover, breakdown, windscreen, and gadget cover are nice to have but come with added costs. |

| Increase Your Excess | Raising the amount of excess (upfront payment for any claim; the rest to be paid by the insurer) on your policy can lower your insurance premium. |

Is Disqualification the Same as a Revoked Licence?

No, a driving ban or disqualification is a form of punishment.

However, your licence can be revoked for completely honest reasons. For example, if you have a current health condition that means you are unfit to drive.

You have done nothing wrong, and your licence would be returned once you are well again.

Find better convicted driver insurance deals

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

Are Bans for Accrued Penalty Points Different?

OK, now we need to try and explain succinctly, how the penalty point system works.

Once you hit a total of 12 penalty points on your licence, you will be automatically banned from driving.

How long this ban lasts will vary, as shown below.

- You will be banned for 6 months initially.

- If you are subsequently banned again within three years of the original ban, you will be banned for a year this time.

- If you then go on to be banned again within the next three years, this time the ban will last for two years.

Very few people fail to up their game after the first ban. However, if you do get banned for the fourth time, you would very likely lose your licence for good.

Get Comparative Quotes – Lots of Them

If you are trying to find cheap insurance as a banned or convicted driver, then shopping around a range of insurers is vital.

Not all insurers calculate risk in the same way.

Therefore, quotes can differ widely across insurers. It may take some time, but it will pay to get as many comparative quotes as you can, to find the cheapest.

Find a Good Insurance Comparison Site

A way to cut some corners when getting competitive quotes is to use a vehicle insurance comparison site.

You enter your driver details once, including the info about bans and convictions. The site then queries a range of insurers and gives you the results so you can pick the cheapest.

Getting More Help

If you want more help and advice about getting insurance after a ban, you can try talking to your current insurer, they will know all of the facts.

You can also pop into your local Citizens Advice Bureau for some help.