What is a Good Clearscore Affordability Score out of 100?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you wondering what is a Clearscore affordability score and how it impacts your ability to get credit? You’ve come to the right place! Each month, over 170,000 people visit our site looking for advice on these tricky topics.

In this article, we’ll explain:

- What a Clearscore affordability score is and why it matters

- How to find out what your Clearscore affordability score is.

- What we consider a good Clearscore affordability score.

- How you can improve your Clearscore affordability score.

- The benefits of having a high Clearscore affordability score.

Navigating financial difficulties can be quite challenging, and it’s common to feel unsure about seeking help. In fact, Citizens Advice revealed that 60% of adults facing financial difficulties hesitate to seek assistance.1

If that’s your case, don’t worry. We are here to help you on your journey to a better understanding of your finances.

How Can You Find Out What Your Clearscore Affordability Score Is?

When assessing the accuracy of Clearscore, it’s important to mention that the affordability score is calculated based on your spending habits.

Therefore, you have to link your bank account to Clearscore to get this new indicator working correctly. Don’t worry, you are free to unlink them whenever you wish.

Once you link your bank accounts, Clearscore will have access to the following data:

- Your basic account details such as account number and sort code.

- The history of incoming and outgoing transactions.

- A list of all the bills you pay.

- Details of any account benefits or special features (such as an overdraft facility).

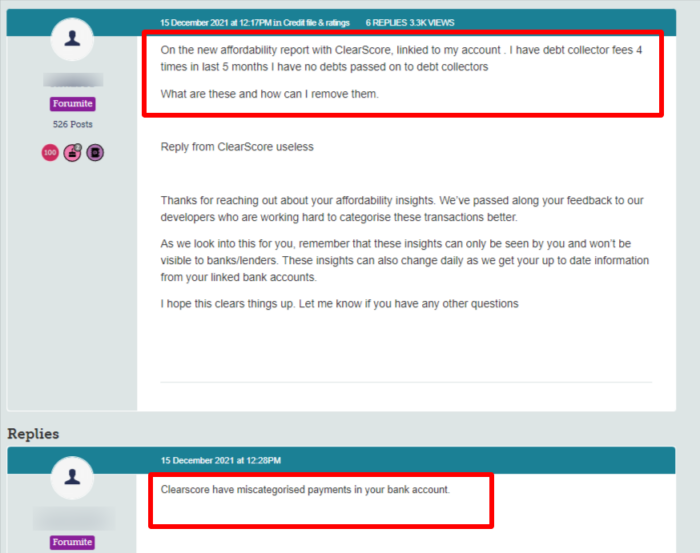

Linking only lasts 90 days, and you will be asked if you want to keep the accounts linked after the 90 days is up. Clearscore isn’t perfect, and it has been known to get the categorization of transactions wrong from time to time.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What Is the Clearscore Affordability Score?

Most people know what their credit score is used for, in general terms.

Positive indicators such as paying off debts can raise your credit score. Negative indicators, for example, as a debt collection agency such as Lowell Financial or Cabot Financial taking legal action against you can lower it.

But your credit score isn’t everything.

The Clearscore affordability score is another indicator of how likely you are to be granted new credit.

This new indicator combines with your credit score, to give you an overview of how lenders will view you, when you apply for dress credit with them.

The affordability score takes into account your bank balances, your daily spending habits, and your monthly disposable income, to provide a clearer picture of how much of a risk you are seen by lenders.

Affordability score is also predictive in nature, looking at how you are currently spending, and how your spending has been trending, to give you an indication of how likely it is you will be granted credit in the future.

» TAKE ACTION NOW: Fill out the short debt form

What Is a Good Clearscore Affordability Score?

The affordability score is a scale from 0 to 100. With 0 being the lowest, and 100 being the highest.

Your score will depend on a number of factors, as we covered previously.

So what is a good score? Obviously, the higher the better. But any score over 80 is regarded as good.

Please remember though, that the affordability score is not the same as your credit score. It is a prediction of how likely it is you will be successful when applying for new credit.

Not every lender evaluates risk in the same way, and your affordability score is just an indicator, not a guarantee you will be approved for credit.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How Can You Raise Your Clearscore Affordability Score?

The idea behind the affordability score is to give you an insight into how lenders will see you, when you apply for credit such as a loan or credit card.

As we have mentioned, the affordability score is predictive and based on the last few months spending history of your bank accounts.

There are a number of factors that come into play when calculating the affordability score, as we have covered, below.

- Linking your bank accounts to Clearscore has a positive impact.

- Buy now pay later credit can have a negative impact.

- When you transfer money out of your bank accounts, or you go overdrawn, this would have a negative impact.

- The higher your account balance, the better the impact it will have on your score.

- Short-term debt such as payday loans would have a negative impact.

- If you spend more than you receive in a month, this would be a negative.

- If you have more money left at the end of the month than you spent, this would be a positive thing.

- If you use your bank account to fund online gambling websites, this would be a negative.

- If your income goes up in the months, this would have a positive impact.

Budget Advice

As mentioned earlier, your spending habits can impact your affordability score. That’s why I’ve put together this table that provides ten simple budget advice that will help you manage your finances effectively.

| Budgeting Advice | How You Can Lower Your Expenses |

|---|---|

| Arrange a Debt Repayment Plan | To negotiate, contact your creditors via phone, email, or letter to explain your financial situation, and offer to pay an amount you can afford. |

| Save on Utility Bills | Compare energy providers to find a cheaper deal. Use energy-efficient appliances. Reduce water usage with low-flow fixtures. |

| Save on Groceries | Shop with a list to avoid impulse buys. Buy store brands instead of name brands. Look for sales and use coupons. |

| Cut Back on Non-Essentials | This includes dining out, entertainment, subscriptions, and luxury items. Look for free or low-cost entertainment options and cook meals at home. |

| Transportation Costs | If possible, use public transportation, carpool, or consider biking to work. If you own a car, maintain it regularly to avoid costly repairs. |

| Negotiate Bills | Contact service providers (like phone, internet, and cable) to negotiate a lower rate or switch to a cheaper plan. |

| Consolidate Debts | If you have multiple debts, consider a debt consolidation loan or a balance transfer credit card (with caution) to lower interest rates. |

| Sell a Financed Car | When you sell a financed vehicle, the proceeds can be used to pay off the remaining loan balance. |

| Use Cash Instead of Credit | To avoid accumulating more debt, use cash or a debit card for your purchases. |

| Seek Professional Advice | If you’re struggling, consider contacting a debt advice service like StepChange or National Debtline. They offer free, confidential advice. |

What Are the Benefits of Having a High Clearscore Affordability Score?

You affordability score is a useful indicator of how likely you are to be accepted for new credit. You can see this through the reports and dashboard provided by Clearscore.

You can learn:

- How lenders see you as a risk before you apply for credit.

- Get insights and advice on how to improve your chances of being accepted for credit.

- Find credit offers that are compatible with your credit score and affordability score.

However, you must remember that the affordability score is not 100% dependable.

It is just a prediction of the level of risk you pose lenders, based on the data from your bank accounts. Your credit score and what is credit report? are still the main two things that will have an impact on your ability to get credit.