Conexus Recovery Debt – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

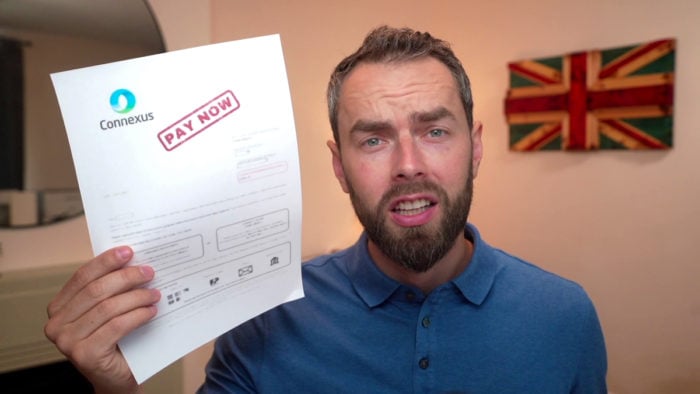

Receiving a surprise letter from a debt collector, like Conexus Recovery, can be a real worry. But don’t panic! You’re not alone. Each month, over 170,000 people come to our website for advice on solving their debt problems.

We know that you might be feeling confused about where the debt came from or worried about if you can afford to pay it. This guide is here to help.

Our experts have a lot of experience with Conexus and other debt collectors. We will answer all your questions, such as:

- Should you pay Conexus Recovery Debt?

- Can Conexus Recovery & Field Services take you to court?

- How can you stop debt letters from Conexus Recovery & Field Services?

- What if you can’t afford to pay Conexus Recovery?

- Will Conexus Recovery affect your credit score?

We will also give you details about different ways you can manage your debt, like a Debt Management Plan (DMP), Individual Voluntary Arrangement (IVA), Trust Deed, Debt Relief Order (DRO), Bankruptcy, and Sequestration.

We understand how tough dealing with debt can be, as research shows 64% of UK adults find interactions with current debt collectors stressful1. But remember, you’re not alone, and there are always options to help you. So, let’s get started!

Did you receive a Conexus Recovery letter?

Conexus might try to contact you in different ways, but they’ll almost certainly try to collect the money by sending you a letter. This is known as a letter before action, and it’s a prerequisite if they want to take you to court.

The letter demands payment or states you’ll be taken to court. It may also suggest they’ll visit you at home (remember they’re not bailiffs!). To better understand the differences between bailiffs and debt collectors, please check out the table below.

| Category | Debt Collectors | Bailiffs |

|---|---|---|

| Bank Account Access | Access your bank account – but only after a CCJ has been secured and not complied with. |

After the creditor has taken you to court over missed payments, bailiffs/creditors can apply for a third-party debt order to freeze and take control of a bank account. |

| Leniency | Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | If you tell them immediately that you are a vulnerable person, they must treat you with greater consideration and give you more time to respond to any contact. |

| Re-Selling Debt | Sell your debt if they are unable to collect payment from you. | Call and visit multiple times – there isn’t a set limit on how often they may contact you. If they can’t take any goods to sell or enter your property, they might return with a warrant and force entry to your property. |

| Visiting Your Home | Conduct home visits (on rare occasions) and knock on your door. | Conduct home visits and can enter without your permission as long as all of the correct legal steps have been taken. |

| Contact Hours | Contact you by phone or mail. They’re allowed to call whenever they see reasonable without constituting harassment, usually between 8 am and 9 pm. | Can visit your home anytime between 6 am and 9 pm (unless they have a court order that states otherwise). |

| Permission To Take Belongings | They cannot take anything from your home. They may only ask you to make a payment. | Take goods from inside and outside of your home once all legal steps have been taken. However, they cannot take essential items for domestic living or work purposes. |

| Court Actions | Threaten to take you to court by suing you for payment on a debt. | Can apply to the court to get permission to use ‘reasonable force’ to enter a home, which could mean breaking in. They have to give details to the court about how they will secure the property afterwards. |

It can be intimidating and scary to receive one of these letters. So, you probably have one burning question…

Request proof of the debt instead

Debt collection companies are supposed to supply you with proof you owe the debt when they request payment. But most of the time, they ask for the money without sending the evidence.

The type of proof they should be sending you is a copy of your signed contract or credit agreement which you have not kept to. This may need to be accompanied by evidence of your payment defaults or arrears.

You are allowed to request this proof before paying. If they supply the proof, you should probably pay or risk being taken to court. If they don’t supply the proof, you have no reason to pay until they do.

If you’re taken to court for not paying but previously asked for proof, you should tell the judge. They may rule in your favour if they know that your request for proof wasn’t acknowledged.

This is why I always recommend responding to debt collectors – even just to question the debt’s validity. Remember, you have the right to request proof of the debt. They have to prove it, or they can’t charge you.

» TAKE ACTION NOW: Fill out the short debt form

Should you pay?

You don’t have to pay Conexus Recovery straight away after receiving one of their debt letters. There is something you can try to get out of paying or will simply buy you some extra time to find the money.

Of course, you can always pay the debt if you believe you owe it and wish to pay. But it’s worth reading on even if you currently plan on paying.

Can They take me to court?

Conexus Recovery and Field Services may advise their client to take you to court if you don’t pay. Whether their client will or won’t take you to court will be their own decision rather than Conexus Debt Recovery’s decision. It’s important not to assume they won’t.

The average unsecured debt has increased by 25% year-on-year, rising to £13,9412, and it’s safe to assume that a considerable amount of this debt is settled in court.

Will Conexus Recovery affect my credit score?

Yes, debt collectors can affect your credit score, but not in the way that many people think.

Once you have missed a few payments or defaulted on an account – which negatively impacts your credit score, too – your debt might be sold to these collectors, it will appear as a second collection account on your credit file, and the original entry may be marked as ‘sold’ which doesn’t look good!

If they don’t add a second entry to your credit file, the entry for your original debt can be changed to add the debt collection company’s information.

While it is unlikely that they will do this for smaller debts, they have the legal right to.

These collection accounts will negatively impact your credit. They are visible for 6 years and will impact your ability to get credit or use some credit products during this time.

This is because companies use your credit file to see if you are a ‘high-risk’ customer – someone who might have difficulty paying their bills on time. If you continue not paying until you have a CCJ against you, you have had such trouble paying back your debt that someone had to go to court about it.

Understandably, companies are going to be reluctant to give you credit!

After 6 years, it is no longer visible on your credit report, and you should find it easier to get credit again.

You also need to be aware that any debt solutions that you use will also be visible on your credit file for 6 years, and your credit score may be affected. However, once these 6 years are over, your debt solution will no longer be visible, and you may find it easier to get credit again.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What Happens If I Don’t Pay My Debts?

We’ve all wondered – what exactly will happen if you stop paying off your debts? Well, the answer is a whole lot of bother.

- Your creditor will send you reminders and then demands to get you to pay any missed payments

- If you don’t pay, your account will default

- If you still don’t pay your debts, your creditor can choose to sell your debt to a debt collection agency or employ an agency to chase you for the missed payments. This is where Conexus Recovery will come in.

- If you don’t pay the collectors, your creditor or the collection agency might be able to take legal action against you to get their money back. Legal action usually starts with a CCJ.

What if I can’t afford to pay?

If you can’t afford to pay Conexus Recovery, or know that paying would put you in extreme financial hardship, you could consider a debt solution.

There are several different debt solutions available in the UK, so I recommend speaking to a debt charity as soon as possible. Their advisors will be able to look at your finances in detail and help you work out which debt solution will work best for you.

I have linked a few charities that offer these advisory services for free below.

Debt Management Plan (DMP)

A DMP is an informal debt solution that lets you pay off your debts via a single monthly payment.

Because it is informal, it is not legally binding so you are not tied into a DMP for a minimum number of payments.

Individual Voluntary Arrangement (IVA)

An IVA is a formal agreement between you and your creditors. You agree to pay a monthly sum that is distributed amongst your debts, and your creditors agree not to contact you during your IVA.

IVAs typically last for 5 or 6 years, and any outstanding debt is wiped off when it ends.

Keep in mind that IVAs are not suitable for everyone. You need to owe several thousand pounds to more than one creditor to be eligible. You also need to demonstrate that you have some disposable income every month.

Trust Deed

IVAs are not available in Scotland. Instead, you will need to opt for a Trust Deed.

Trust Deeds work in the same way as an IVA – you pay an agreed sum each month that is shared amongst your creditors, they can’t contact you, and any leftover debt at the end of your Trust Deed term is written off.

Debt Relief Order (DRO)

A DRO is a good option for those facing financial hardship with no assets and little income.

For 12 months, you make no payments, but your creditors freeze your interest and don’t contact you.

If your finances haven’t improved during this year, you may be able to write off your unsecured debts.

Bankruptcy

If you have debts but no realistic possibility of ever paying them off, you may need to declare bankruptcy.

Bankruptcy has an unfair stigma attached to it as it may be your only way of getting a financial fresh start. That said, it is a serious financial situation that should not be taken lightly.

Sequestration

Sequestration is the Scottish version of bankruptcy.

If you have little income and no valuable assets, you may be able to apply for a minimal asset process bankruptcy (MAP). A MAP is a quicker, cheaper, and more straightforward version of sequestration, so worth considering.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How can I stop debt letters from them?

Asking Conexus Recovery to prove the debt might stop them from writing any more letters. If they can’t find the proof they may stop writing to you. Or they may have realised that they were chasing the wrong person. The only other way to stop Conexus Recovery debt letters is to pay the debt or agree on a payment plan – if possible.

Conexus Recovery & Field Services Contact Details

| Address: |

UK Office Atria, Spa Road, Bolton BL1 4AG NI Office Foyle House, Duncreggan Road, Derry/Londonderry BT48 0AB |

| Opening hours: |

Mon – Fri: 9:00 – 18:00 Saturday: 9:00 – 13:00 |

| Phone: | (02870) 348400 / +353 (74) 9712516 |

| Email: | [email protected] |

| Website: | https://www.conexus-services.com/ |