DCBL Bailiffs Debt Letter – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about a DCBL Bailiffs Debt Letter? Maybe you’re scared that a bailiff might come to your home or take your things.

It’s a scary situation, but you’re not alone. Every month, over 170,000 people come to our website for advice on debt problems just like yours.

In this article, we will help you understand:

- How to check if the debt they say you owe is really yours.

- What steps you can take if you do owe the debt.

- How to deal with the DCBL Bailiffs in a calm, smart way.

- Your options if you can’t pay the debt.

Citizens Advice estimate households have around £18.9 billion in unpaid bills like council tax and utilities1. So, it’s common to be concerned about debt and its consequences. Our team knows how you feel.

We will use our knowledge to help you make the best choices about your DCBL Bailiffs Debt Letter. So, take a deep breath and read on.

Why Are DCBL Contacting You?

DCBL will be contacting you because you owe money to one of their clients. They chase the debt for their clients for fixed fees.

They could be contacting you at different stages of the debt collection process.

For example, they may contact you to inform you of the debt and ask you to pay, or they could visit you at home with a court enforcement notice asking you to pay.

Do You Really Owe DCBL Bailiffs?

Sometimes debt collection companies can make mistakes or get the wrong person.

You need to ensure you really do owe the debt. To do this, send DCBL a prove the debt letter asking for evidence that you owe the money.

This is a simple letter asking for the proof that you owe their client money, such as a utility bill agreement or defaulted payments on your council tax.

This letter should be sent when no proof is sent in the original communication, even when you know you owe the money.

Sending a letter can buy you additional time to think and if they don’t provide proof of the debt, there is no obligation to pay (keep all your letters sent and received in case it goes to court!).

We have ready-made templates you can use on this guide!

At this stage, you may also want to look for free debt advice from a UK debt charity.

Your Rights When Dealing with Bailiffs

If you’re dealing with DCBL bailiffs, it’s crucial to understand your rights. This way, you’ll prevent unfair treatment and other unpleasant situations.

We’ve put together this table that explains what bailiffs can and can’t do. For more information, be sure to read our detailed guide.

| Bailiffs Can | But They Can’t |

|---|---|

| Call and visit your home multiple times, any day of the week. | Visit your workplace (if you are not self-employed) |

| Take items from your home. These items have to be considered ‘luxury’. | Take essential items from your home. This includes beds, clothing, and work equipment. |

| Use ANPR technology and DVLA information to locate your car and take it. | Enter your home without permission unless they have a warrant to force entry for a CCJ. |

| Peacefully enter your property. | Harass or threaten you. |

| Issue notices to those who owe a debt. | Take items that belong to someone else. However, they may be able to seize jointly owned property. |

| Offer to conduct a Virtual Controlled Goods Agreement (rather than in-person). This will typically be offered to vulnerable people. | Sell goods they have seized at auction until seven clear days have passed. |

Do You Have to Pay DCBL Enforcement?

You might have to pay DCBL if you really owe the debt, but there are times and situations when you don’t have to pay.

Even if you do need to cough up, there are methods to pay on your own terms.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

DCBL Bailiffs Proved the Debt, What Now?

If DCBL doesn’t prove the debt you have no obligation to pay unless their client gets a court order making you pay.

If they do prove the debt, you should pay it off to avoid legal action.

Our financial expert, Janine Marsh, advises: If a bailiff has proven you owe money and you don’t have cash to hand, you’re within your rights to suggest a payment plan.

It’s not a guarantee, but many will accept this as it’s easier than repossession.

You should get the help of debt charities to help you work out what you can afford to pay and other options available to you.

A repayment plan with DCBL is not the only way to get out of debt in an affordable way.

If you ignore them and they get a CCJ for the debt, taking control of goods that belong to you is a real possibility. These would then be sold to pay off the money owed.

» TAKE ACTION NOW: Fill out the short debt form

What should you do if you receive a DCBL final reminder?

The best thing to do here is not to ignore the situation.

Now that your debt has been proven, you need to follow the legal obligations after debt validation. Generally, this means paying.

They do not have the power to issue a CCJ, but this doesn’t mean that DCBL won’t apply for one to retrieve the money owed to them.

If you’re struggling to pay, there are many free debt charities such as:

- Citizens Advice Bureau (CAB) you can expect the very best help and support in dealing with your debt problems. The skilled and experienced advisors will give you their expert guidance on debt matters.

- StepChange provides free online debt advice and will help you to take charge of your debt.

It’s important to remember that your credit rating may be affected by the debt management route you take, so consider your options carefully. We go through different debt solutions below.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

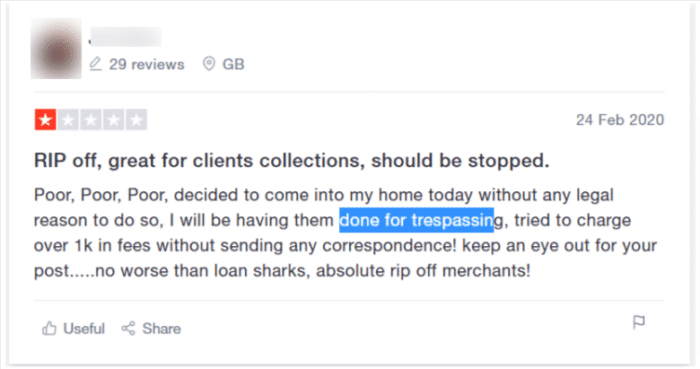

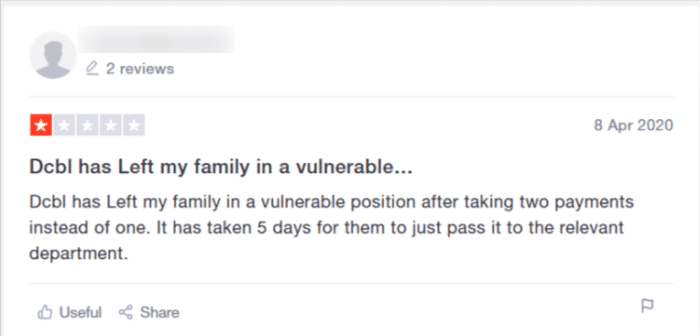

What are reviewers saying about DCBL?

The reviews of DCBL are some of the best in the business, with a 4.7 on Trustpilot.

We would say that these reviews seem to be driven mainly by people recovering debt, not by people who are being chased for debt.

If you filter the reviews then some of the truth comes out.

There seem to be quite a few reviews of disgruntled people and unfair practices.

Our advice would be to keep your wits about you when dealing with this company. Check your bank account and any fees that they may be adding.

Direct Collection Bailiffs Ltd (DCBL) Contact Details

If you have any questions, or you’re looking for the DCBL email address or phone number, we’ve put their contact details in the table below.

| Website: | https://dcbltd.com/ |

| Phone number for complaints: | 0203 298 0201 |

| Email address for complaints: | [email protected] |

| Address: |

London Regional Office Solar House, 915 High Road, North Finchley, London, N12 8QJ T: 0203 613 1604 North West Regional Office Direct House, Greenwood Drive, Manor Park, Runcorn, Cheshire, WA7 1UG T: 01606 361 585 Midlands Regional Office Colmore Plaza, 20 Colmore Circus, Queensway, Birmingham, B4 6AT T: 0121 581 0957 Scotland Regional Office Barn Cliuth Business Centre, Town Head Street, Hamilton, ML3 7DP T: 0141 326 0228 Wales Regional Office Sophia House, 28 Cathedral Road, Cardiff, CF11 9LJ T: 0292 060 7141 |

References

Schedule 12, Tribunals, Courts and Enforcements Act, 2007

Part 1, Regulation 10, Certification of enforcement agents, 2014.