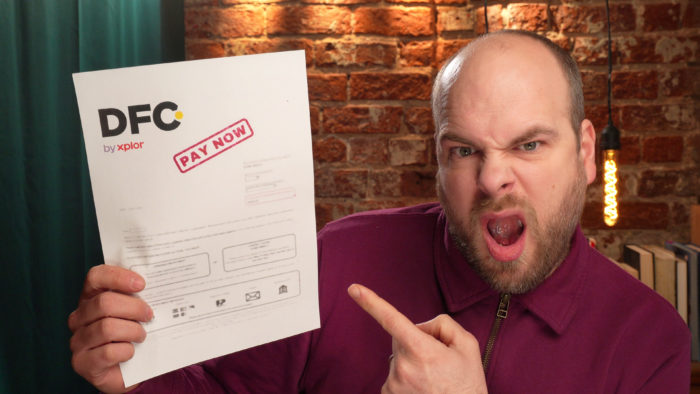

Debit Finance Collections Plc (DFC) – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you received a surprising letter from Debit Finance Collections Plc (DFC)? You’ve come to the right place. Each month, over 170,000 people visit our website looking for information about debt problems.

In this friendly guide, we will help you understand:

- Why is Debit Finance taking money from your account?

- What happens if you don’t pay DFC and your options when it comes to paying.

- How to cancel a debit on finance and if a finance company can take money from your bank account.

- How to write off debt legally and how debt write-off works.

Our team knows about these situations, as some of us have even been chased by debt collectors like DFC. Not to mention that research shows that 64% of people in the UK feel stressed when dealing with debt collectors.1

We understand how you feel and are ready to help. Our goal is to provide you with clear, useful information to help you make the best choice for your situation.

Why are They Taking Money from Your Account?

DFC explain that if they have taken money from your account, it is because they actually process payments for leisure centres and gyms.

They do this across the whole of the United Kingdom.

It might be that you have actually cancelled your membership and you are still having money withdrawn from your account.

You can actually contact either DFC or the facility that you signed up with about this. It might be a communication error between both parties in some cases.

Debt Finance Solutions do say that they want you to email them or the gym directly before cancellation too.

So, is money being taken even after you have cancelled? Not sending them a message before you stop paying might be why they are still taking money from your account.

It might sound like something small, but the average unsecured debt has increased by 25% year-on-year, rising to £13,9412, which means that even sheer forgetfulness, such as failing to cancel a gym membership, is contributing to overall debt growth in the country.

What Does It Mean on a Bank Statement?

If you see the wording “debt finance” on your bank statement, it means that: when a business lends money from a provider – which might be a bank, building society or a financial institution, they use the money to fund their activities.

This is also known as debt funding or debt financing.

This information might help you come up with some ideas about why this is showing up in your bank account.

It might also be that DFC has taken money on behalf of a gym or leisure centre that you are a member of.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can They Take Your Money?

Yes, they can do this with a third-party debt order.

This actually allows the organisation you owe money, to obtain it from the person that actually has the money in their account.

That place is more often than not the building society or the bank where you are holding your money.

» TAKE ACTION NOW: Fill out the short debt form

What are your options when it comes to paying?

Firstly, you can get informed on how debt write-off works in general

An Individual Voluntary Arrangement is a personal arrangement you make between yourself and DFC that can reduce your monthly payments, split them up into smaller chunks, or reduce the total amount owed

For some people, bankruptcy becomes an option to look at when the sum off all their debts grow to a certain point.

It is important to state at this point that the solution is dependent on your own situation.

Seeking the help of a professional who can assess what is best for your individual circumstance is always advised before making such an important decision.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How do you cancel it?

Firstly, gather the information you need, including the name of the company that is taking the money, your bank details, and any other company with think might be involved in the transaction.

Then, you can think about some of the following options

| Methods for cancelling a direct debit on finance | |

| Method One | Contact the business that provided the products or services, using a letter template, email or phone call, asking them to cancel the automatic withdrawal on their side. |

| Method Two | Contact the intermediary who is collecting the money for the above business you made a purchase from. |

| Method Three | Cancel the direct debit from inside your own bank account, or by contacting your bank. |

There are of course both positive and negative consequences that can come from the above, so think through what might be best for your own unique set of circumstances.

What Happens if You Don’t Pay?

Although things can change after a six-year period of unpaid debt in some instances, there is more to it sometimes.

These companies might escalate unpaid debts to small claims court if they are unable to contact you via letters, emails, calls and knocking on your door.

We always recommend responding to debt collectors – even just to question the debt’s validity. You have the right to request proof of the debt. They have to prove it, or they can’t charge you.

Can You Refuse to Pay?

When a direct debt has been set up to automatically take payments out of your, you can not refuse this, but you can cancel it so that no future money is taken.

You can also request a refund if you believe this money was taken by accident.