For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

In 2023, many people are looking for ways to legally write off their debt. This can be a tough time but don’t worry – we understand your concerns about the effects of writing off debt and how to do it, and we’re here to help.

Each month, over 170,000 people visit this site for guidance on debt solutions, and we’re here for you too. In this article, we’ll share:

- What it means to write off debt.

- If you can legally write off your debt.

- How to start a debt write-off plan.

- Ways the government can help.

- The impact of writing off debt on your credit rating.

We know how it feels to be chased by debt, as some of our team members have faced the same worries. Let’s work together to find the best way to handle your debt in 2023.

What does it mean to write off a debt?

Writing off debt means the debt no longer exists and you don’t need to pay the debt back. This can be known as writing it off or sometimes “wiping the debt”.

Can you legally write off debt?

Yes, there are legal ways to write off some types of debt. Your ability to write off your debts will depend on your personal circumstances and the type of debts you have.

Is it possible to write off my unsecured debts?

Yes, it’s possible in some cases to write off unsecured debts depending on your financial circumstances, including personal loans, credit cards and household bills.

Debt write-off is easier on unsecured debt than secured debt. Many secured debts cannot be written off. You may also struggle to write off some tax debts.

How does debt write-off work?

The two most common methods used to write off outstanding debts and arrears are:

- Using formal debt solutions which write off all or some of the debt

- Making a lump sum debt settlement offer worth less than the overall debt

- Using legislation that states the debt has become too old to be enforced, and then asking for the debt to be written off (automatically written off in Scotland!)

There is also a possibility of getting debt written off by asking the creditor to write off the debt when you’re experiencing serious financial hardship.

All of these methods to write off debt will be explained throughout the rest of this guide.

Which debt solutions write off debts?

A Debt Relief Order, Individual Voluntary Arrangement and bankruptcy are all formal debt solutions which can be used to write off either all or some of your debts.

#1: Debt Relief Order

A Debt Relief Order can be used when you have unsecured debts and little disposable income to keep up with monthly payments. You must not own a property or have significant assets to use a Debt Relief Order.

So, how does a DRO work? Once approved all creditors cannot contact you for one year. This means they cannot ask for payment or cannot take further action against you. If your finances don’t improve by the end of the year, all debts under the DRO are 100% written off.

DROs are suitable if you want to write off credit card debts, personal loans, household bill arrears and other unsecured credit like credit card debt.

» TAKE ACTION NOW: Fill out the short debt form

#2: Individual Voluntary Arrangement

An Individual Voluntary Arrangement (IVA) is a formal agreement to one monthly payment toward your debts for five or six years. At the end of the IVA, all remaining debt is written off. Thus, an IVA can write off some of your debt but it won’t write off all of your debt.

You might want to consider an IVA if you have multiple significant debts and a regular monthly income, typically from employment.

#3: Bankruptcy

Bankruptcy is a last-resort debt solution which can be beneficial to people with significant debts that they have no way of repaying in a reasonable time. Bankruptcy will allow you to write off all your debts and start with a clean slate.

However, there are many cons of bankruptcy that you need to be aware of before choosing this method. A DRO is considered a softer form of bankruptcy and might be more suitable.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Who qualifies for debt write-off?

The criteria to use a legally-binding agreement to write off debt changes depending on the debt solution.

For example, a DRO requires you to have a maximum of £75 of disposable income each month, whereas an IVA will usually require you to pay more than £75 to pay this to creditors each month.

How can I get started with a debt write-off plan?

To use a debt solution to write off some or all of your debt, you first need to assess which debt solution you are suitable to use – if any. This is best done with professional debt advice.

You should do this by contacting a debt charity and using the free debt advice on offer. The debt adviser will tell you which of the several debt solutions you could use to get out of debt, some of which may help you write off debt legally.

Most debt charities will even help you set up formal debt solutions and negotiate with creditors on your behalf.

Can the government write off my debt?

The government introduced debt solutions that can help people write off debt through new legal frameworks, including DROs and IVAs. The government has also created legislation that can help you write off idle debt after so many years – more on this shortly.

But other than these contributions, the government doesn’t directly help individuals to write off their debt.

Is an IVA debt solution an official government scheme?

The government created the legal framework to allow IVAs to be used by debtors to help them out of debt. But IVAs are not a government scheme or initiative.

You may sometimes find IVA services advertised by debt management companies as “government schemes” or “government-backed”.

This is misleading.

A debt management company is a commercial business that makes profits from helping debtors set up IVAs and get out of debt. They sometimes market their services as backed by the government, which isn’t true. These companies have no affiliation with the government.

How long before a debt is written off?

If certain types of debts aren’t paid or acknowledged in writing after so many years – and there is no court order made already for the debtor to pay – the debt could become unenforceable in court.

This is known as a statute-barred debt, which will never have to be paid because it cannot be legally enforced.

The length of time it takes for the debt to be unenforceable differs depending on the type of debt. HMRC debt, for example, remains enforceable for a lot longer than other unsecured debts.

A comprehensive explanation can be found in my statute-barred debt guide.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Is a debt written off after 6 years?

Yes, most debts that can become statute-barred in England and Wales will do so after six years. There are some exceptions. The time limit starts from the “cause of action”, which is usually when the creditor can take further action due to missed payments.

However, remember that statute barred isn’t the same as having the debt written off.

When a debt is statute-barred after six years, no legal action can be taken against the debtor. The debt still exists, but it doesn’t have to be paid.

When does debt get written off in Scotland?

In Scotland, most debts become too old to be enforced after five years. And the debt is automatically written off because it no longer exists. This is an important difference from the rules in the rest of the UK.

There are again some exceptions. For example, council tax arrears don’t become too old to be collected until after 20 years. This isn’t the case in England and Wales.

Can I ask my creditors to write off my debts?

Yes, you can ask creditors to write off your debts. This is best done by sending a polite letter explaining why you’re asking for the debt to be written off and your general financial situation.

But keep in mind that this is quite rare. Creditors are understandably reluctant to write off debts that they are owed!

Instead, you could offer to pay what you can in a lump sum and ask your creditor to write off the rest. You could even offer an alternative repayment plan.

Negotiating with creditors can feel scary so being aware of your rights can help!

You might find that your creditors are more willing to write off some of your debt if you have no realistic possibility of paying it off.

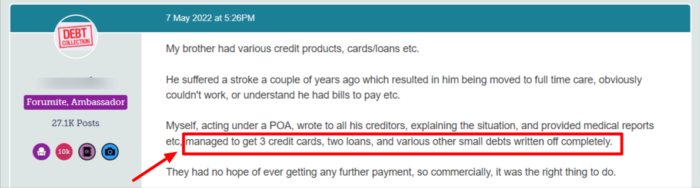

In this example, someone’s brother sadly had a stroke. His family were able to write off some of his debt by explaining to his creditors that he could never pay them back now.

Can you get a debt written off if you’re terminally ill?

If you have a terminal illness and are unable to repay debts, you can ask the creditor to write off the debt due to your illness. Sometimes they’ll agree due to these difficult and exceptional circumstances, but keep in mind that they’re not obligated to write off the debt.

Can you get debt written off due to mental health?

You can ask your creditor to write off the debt due to your mental health issues, but they’re not obligated to write off your debt. You may need to provide a more convincing argument, such as explaining why you’ll never be able to repay the debt in the near future.

Another way you might be able to get out of paying your debt is through a composition order.

What is a composition order?

A composition order is issued by a judge to write off some of your outstanding debt if you cannot be expected to repay the debt in a reasonable time. Composition orders are only possible when you have applied for an administration order.

So, what is an administration order? It’s a type of debt solution you can use when you have two or more debts valued below £5,000 and have already been issued with a County Court Judgment (CCJ) to pay the debt. The administration order sets up a monthly payment to pay off the debt based on your current financial situation.

If a judge believes you won’t clear the debt via the administration order within three years, they can provide you with a composition order to write off some of the debt.

Keep in mind that composition orders are quite rare. This is because you have to do quite a bit of work to get one. At the very least you need to show a judge that your creditors have tried to get you to pay them what you owe but you can’t afford it.

How is a composition order made?

A composition order can only be made by a district judge.

But you can apply for the composition order at the same time you apply for the administration order. Or court staff can refer the case to a judge to consider a composition order.

Composition orders can also be made at a later date at an administration order review. You can request a review yourself.

Who can get a composition order?

You can get a composition order if you’re going to be using or are already using an administration order to repay debts but won’t be able to repay within three years. You’re more likely to get a composition order if you’re:

- Elderly

- Disabled

- Sick

- A single parent

- Don’t own a home

Can the creditors object to a composition order?

Yes, creditors can object to an application for a composition order, and if they do, a hearing will be scheduled. But it remains the judge’s decision.

Does writing off debt affect your credit rating?

Many of the methods used to write off some or all of your debt will negatively affect your credit record and reduce your credit score.

Lenders will be able to see that you didn’t repay creditors as originally agreed within your credit history. This often means that they will be reluctant to lend you further credit in the future. However, it’s not impossible to improve and repair your credit file.

Can I borrow money after a debt write-off?

As I have talked about above, writing off your debts can lower your credit score.

This is because your credit file or report will say that you have not paid off all of your debts. This will stay on your credit report for 6 years and you will find it difficult to secure credit during this time.

Keep in mind that this does not mean that it is impossible to secure credit, just that it will be harder than it was before. You may also find that your interest rates or upfront payments are higher.

There are some products that are designed for people with bad credit, including credit cards. It might be a good idea to speak to a debt charity and discuss your finances before you open another line of credit.

Can you write off student debt?

Depending on what type of student loan plan, your outstanding student debt is written off 25 or 30 years after they were first due.

Keep in mind that you’re never obligated to make payments towards your student debt if you are earning money that is below the stated income threshold.

More information can be found in our student debt write off article.

Are there alternatives to debt write off?

If you have tried talking to your creditors and they don’t want to write off any of your debt, you may need to look at a debt solution.

There are several debt solutions available and so I recommend that you do your research to find out which one will work best for you.

Debt Relief Order (DRO)

A DRO works best for people with debt but little monthly disposable income. They last for a year and your debts can be wiped out after this time if your financial situation hasn’t improved.

One of the key benefits of a DRO – other than the possibility of some of your debt being wiped out! – is that your creditors can’t contact you.

Individual Voluntary Arrangement (IVA)

An IVA is a legally binding agreement between you and your creditors.

You will need to pay an agreed sum every month that gets distributed amongst your creditors by your Insolvency Practitioner (IP). You will make these payments for the duration of your IVA which is usually five years.

Once your IVA has finished, any remaining debt is written off.

Trust Deed

A trust deed is the Scottish equivalent of an IVA in England and Wales.

You can opt for this debt solution if you live in Scotland and have more than £5,000 of debt.

You agree on a set monthly payment that is then distributed amongst your creditors. Once you have paid for an agreed period of time, any leftover debt is written off.

Debt Consolidation

If you have multiple debts with different creditors, you might be able to merge them into one single debt. This means that there is only one single debt payment to keep track of!

Debt consolidation could save you money in the future as interest on a debt consolidation loan can be surprisingly low.

Debt Management Plan (DMP)

A DMP is an informal debt solution.

In a DMP, you agree with your creditor on a repayment schedule that is affordable for you. You can also negotiate with your creditors to reduce or freeze any interest that you are paying on your debts.

Debt Arrangement Scheme (DAS)

Another option for people living in Scotland is a DAS.

Under the terms of your DAS, you could apply for a Debt Payment Programme (DPP). A DPP and DAS are similar to a DRO because your creditors can’t contact you while you are taking part in the scheme.

Bankruptcy

Bankruptcy is a serious financial situation but it could be your best option if what you owe is more than the total value of your belongings.

If you are thinking about applying for bankruptcy, you need to get financial advice.

Don’t hesitate to contact a debt charity for help! They will be able to offer free and tailored financial advice and debt counselling.

Where can I get debt advice?

There are several organisations in the UK that offer free debt or financial advice. I always recommend contacting someone if you feel like you are struggling to take control of your debts and finances.

Can I go to jail for debt?

You cannot be sent to prison for non-repayment of most debts. This was common practice over a century ago, but nowadays you won’t be sent to prison for unpaid debts.