Debt Relief Order Register – Are Your Debt Details Public?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re worried about your Debt Relief Order (DRO) details being public, you’re in the right place. This article is here to help.

Every month, over 170,000 people visit our website looking for guidance on debt issues, just like this one. You’re not alone in your worries.

We understand that having your DRO details available to everyone might feel uncomfortable and even a bit scary. That’s why, in this article, we’ll cover:

- What a Debt Relief Order (DRO) is.

- How you can check your DRO.

- If a DRO is a public record.

- How to stop your name from being added to the DRO register.

- How long a DRO stays on your credit report.

Members of our team have been through the same process. We know firsthand how you might be feeling right now. So, let’s learn more together about how to handle your DRO.

Is a DRO a public record?

Yes, the Electronic Individual Insolvency Register is a public register which can be accessed by anyone who wishes to search it. However, it’s highly unlikely that friends, family or work colleagues are ever going to look at this public register.

You can view it by visiting this UK Government page.

The Debt Relief Order register can be informative. For example, you can use it to remind yourself of when your DRO ends and your debt will be written off.

Can you stop your name from being added to the DRO register?

There is one situation where you can possibly prevent your name from being recorded on the Insolvency Register.

If the publication of your name on the register would place you or someone in your household in danger of violence, then you can ask the court to stop your name from being recorded.

» TAKE ACTION NOW: Fill out the short debt form

How long does it take for your name to be added to the DRO register?

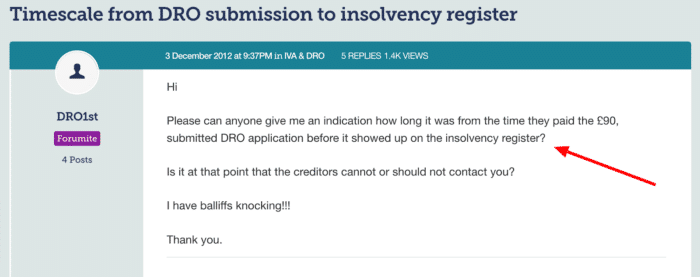

This is a common question, especially on online forums like this one:

Your name is added to the register as soon as it’s approved. Approval times can vary but are often between one and two weeks.

How long does a DRO stay on the insolvency register?

Your record of using a Debt Relief Order gets added to the Insolvency Register as soon as it’s approved and will remain on the DRO register for three months after it has ended.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Does a DRO appear on your credit file?

Yes, a DRO is recorded on our credit report and can have a negative impact on your ability to open a bank account and borrow money.

How to prove your DRO has ended

Another useful aspect of the DRO register is that it can be utilised to prove your DRO has ended. You can print a copy of the DRO record within the three-month period after it has ended.

The record will be removed from the register after three months, so you should do this even if you don’t currently need proof the DRO ended.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Search for people with additional DRO restrictions

If you don’t keep to the terms of using a DRO or bankruptcy, you can be placed under further restrictions, such as a Debt Relief Restrictions Order (DRRO). There is a separate public register that lists people who are subject to these additional restrictions.

Need more DRO information?

We have lots more important information to share with you about Debt Relief Orders. Learn more about DROs by visiting our main Debt Relief Order page.

All our content is made free and easy to understand without a finance degree.