Debt Repayment Tracker – Free Downloadable Spreadsheet

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re finding it hard to pay off your debts and need help sorting out your finances, this is the place for you. Your search for a ‘debt spreadsheet’ has brought you to our Debt Repayment Tracker – a free, easy-to-use tool that can be your best friend in managing your repayments.

We know that paying back debt is a big task, but with the right tools, it can become simpler. Over 170,000 people visit our website each month to understand different debt solutions. You’re not alone.

In this article, we’ll explain:

- What a Debt Repayment Tracker is and how it can help you.

- How to use our free downloadable spreadsheet.

- The types of debts you can track with it.

- The benefits of using a Debt Repayment Tracker.

- Where to get advice on your debts if you need it.

Our team knows what it feels like to be in debt; some of us have been there too. We have used tools like the Debt Repayment Tracker and found them to be very helpful.

Ready to learn more about how you can manage your debts more effectively? Let’s get started.

Why Do I Struggle to Pay Off Debt?

From my experience, people struggle to pay off debt for two main reasons.

Either because you were approved for credit that you should not have been given which is your lender’s fault, or because life happens and gets in the way of making your repayments.

However, lack of motivation or organisation definitely makes the issue worse! Keeping up with your payments to your lender each month can be tricky if you have lots to manage. It can also be quite demoralising if you owe a larger debt and it just doesn’t feel like your repayments are making a dent in it.

If this is a problem for you, you might benefit from a debt repayment tracker.

What Is a Debt Repayment Tracker?

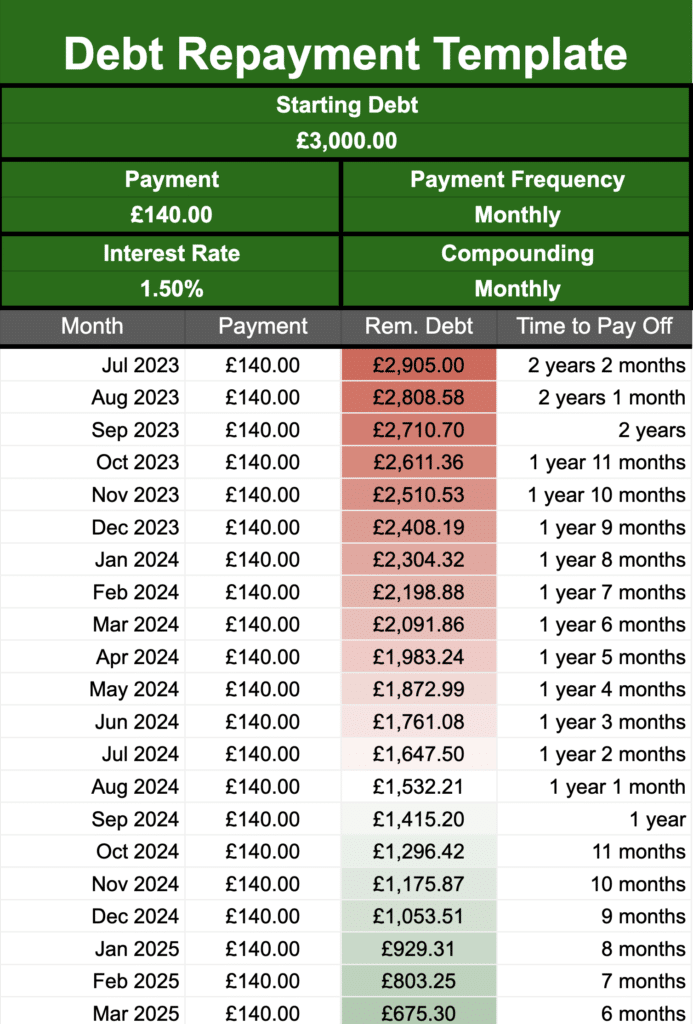

A debt repayment tracker is a resource that plans out all your debt repayments until the debt has been completely repaid. You can enter the amount of money you owe, as well as the amount of interest you pay, and then calculate monthly or weekly payments until you pay off the debt.

Debt repayment trackers could be used for a few months or many years, depending on your personal circumstances.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What Debts Can I Track?

You can track as many or as few of your debts as you like with this tracker. But I do have some tips to make sure that you are getting the most out of it!

You might find it helpful to look at the different types of debt that you have and only include some of them on the tracker. This is because debts are dealt with in different ways.

If you default on a secured loan, where you have named something as collateral in your agreement, then your creditor can take that asset away to cover the remainder of your debt.

But your creditor will need to go through a debt collection agency or even the courts if you default on an unsecured loan. This is because you have not agreed that your creditor can take something to sell to cover your remaining debt.

Most debt solutions can only be applied to unsecured loans. So, with this in mind, you might find it easier to separate unsecured and secured debt and open two separate trackers.

Using this tracker is a great idea if you have opted for a debt solution that consolidates all of your unsecured debts. Once your debts are consolidated, you make one monthly payment that is then distributed amongst your creditors.

My debt tracker can be a great visual aid to help keep you aware of how well your repayment system is going!

If you have student loans from the Student Loans Company (SLC) then you may not want to include this information in your debt tracker either.

This is because student loan repayments are taken out of your pay automatically with your taxes. It is all done automatically so you might find that you don’t need to track it at all!

» TAKE ACTION NOW: Fill out the short debt form

But track your debt however you want!

This is your debt tracker and you may find that there are benefits to tracking all of your debts in one go.

Having a single tracker with all of your debt information will give you a more holistic view of your finances. This can help you budget a bit better in the future.

Being aware of your overall financial situation is the single greatest way of keeping up repayments and avoiding unnecessary debt in the future.

The Benefits of a Debt Repayment Tracker

But, what’s the point of this?

The benefits of a debt repayment tracker are simple. You can use it to visualise a path out of your debt, which can often be a hard thing to do if you plan on making repayments for a long time. It can be a source of information and motivation to keep making those repayments, and just as important, prioritising repayments.

If you are stressed or anxious about your debt, a debt repayment tracker could instil some calm and confidence into your situation.

Are Debt Repayment Trackers Easy to Use?

Debt repayment tracker spreadsheets are super easy to use.

All you have to do is enter the details of your debt, including how much you owe, how often you pay, the interest rate you pay and your monthly repayment amount. Don’t worry about having to make complex calculations based on the interest – the debt tracker will do the maths for you!

You can then keep it on your computer or pin it up to show how far you have come after making repayments.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Where Can I Get Advice On My Debts?

Remember that a debt tracker is just one tool that you can use to help you keep on track of your debt.

If you ever feel overwhelmed or that you aren’t in control of your finances any more I recommend that you talk to a specialist.

There are several organisations in the UK that offer free individual debt advice. Many of these organisations can help you take a realistic look at your debt and work out what debt solution will work best for you.

Discover Our Free Debt Repayment Tracker Spreadsheet Here!

MoneyNerd is offering everyone the chance to download my free debt tracker spreadsheet. We’ve already made the tracker with the correct formulas, so you only have to enter your personal debtor information. My tracker even comes with a colour code to show when you are nearing the middle and end of the debt repayment plan – for extra motivation.

Take a look at my free resource now and use it for free! Click the button below: