Deed of Assignment of Debt – Everything You Need to Know

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you facing a ‘deed of assignment of debt’? Are you worried about a debt collector knocking on your door?

You’re in the right place. Each month, over 170,000 people visit our site looking for guidance on debt issues, just like this one.

In this article, we’ll explain:

- What a ‘deed of assignment’ is

- What it means for your debts

- Different types of assignment

- Why companies sell their debts

- Ways to handle your debt situation

We know how scary it can be when debt collectors get involved; some of our team have faced similar situations. We’re here to help you understand your situation and make the best choices.

Deed of Assignment of Debt – the basics

Being in debt is confusing enough as it is. And it can get even more complicated when you get a letter through the door from a company you may never have heard of demanding (often in quite a strongly-worded way) that you make your payments to them instead.

What’s going on, you might ask yourself?

At the end of the day, the creditor will want the money that you owe back.

However, sometimes when an account falls into arrears, they won’t have the capabilities or resources to claim it back. This is when the original company you owe money might ‘assign’ your debt.

What is a Deed of Assignment of Debt?

This is notice that tells you that you now owe a debt collection agency or another collection service the money you originally owed to the creditor.

Instead of paying the company you might have originally owed money to, you now owe a third party company.

A deed of assignment of debt is a legal document alerting you of the transfer of ownership of your debt to another person. The right to receive payment from the debt you owe is transferred over to this new party as well.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What does it mean?

A deed of assignment of debt is used to transfer or sell the right to recover a debt.

Without a deed of assignment of debt, the two companies are not able to do this – you need a written transfer document.

Once the transfer document, or deed of assignment of debt, has been signed by the assignee (the party transferring the debt) and the party receiving the debt (assignor), they must give notice to the debtor (the person that owes the company the sum of money).

Notice must be given within 7 days of assigning the debt. Unless someone gives notice to the debtor, then the new owner of the debt can’t enforce the debt by suing in court.

Is there more than one type of assignment?

Confusingly, there are actually two different sorts of assignment that a creditor can make. These are Legal and Equitable.

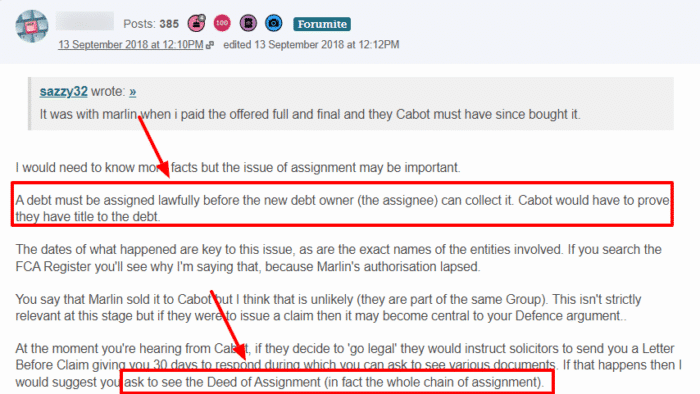

Both types of assignment fall under the Law of Property Act 1925, and both require the creditor to inform you of the change in writing – this is known as a notice of assignment of debt.

1. Legal Assignment

Legal assignment of debt gives the company who are purchasing the debt the power to enforce it.

Basically it means that you make payments to this company instead of the original creditor, and they can send you letters and make calls to your home.

2. Equitable

If a debt is an equitable assignment, only the amount you owe is transferred, and the original creditor will still retain the original rights and responsibilities.

The purchasing company will not be able to enforce the debt either.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Why do companies sell their debts?

A deed of assignment of debt can be a real headache, as you now have another layer of money owed. You will probably rightly ask yourself – why? And how can they sell it?

It may seem strange and confusing, but it’s actually completely legal for them to sell your debt. When you sign a credit agreement, there is almost always a clause in fine print that states that the original creditor has the power to assign their rights to a third party.

As you have signed this agreement, they don’t actually need to ask for your permission to assign your debt.

This also means that you cannot dispute it or make a complaint about it either. The only exception to this rule is if you have given evidence of mental health issues.

» TAKE ACTION NOW: Fill out the short debt form

What are the next steps?

So that’s the basics about a Deed of Assignment of Debt. But what does this mean for you?

If your creditor passes one of your debts onto a third party company or debt collection agency, it will be officially noted that this new company is now responsible for collection.

You will be able to see this change on your credit report, and any defaults will also be registered in their name too.

While it certainly adds another layer of confusion to proceedings and you may be unsure of what’s going on when you find out about a deed of assignment of debt, it can occasionally be a bit of a blessing in disguise.

You may find it much easier dealing with the new company, as they could be more flexible when it comes to discussing interest and additional charges.

There is also the likelihood that these companies actually specialise in collecting debts, and so know how to approach you as the customer with more tact and delicacy than the original creditor.