Discharged Bankrupt Travel Overseas – Is It Possible?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you in debt and curious about bankruptcy? This is a common worry, and you’re not alone. In fact, over 170,000 people visit our site each month to understand different debt solutions.

We’re here to help make things clear. In this guide, we’ll focus on:

- What a bankruptcy order means

- How you can apply for one

- What happens after you apply

- The effects it might have on your daily life

- Your ability to travel after being declared bankrupt

We understand your concerns; some of us have been there too. We know that debt can be scary, but remember, there is always a way out.

We’re here to help you understand if bankruptcy is the right choice for you and how it can affect your life, including your ability to travel. Let’s get started!

Can you go on holiday if you go bankrupt?

Technically, you can go on holiday – including travel abroad – if you have been made bankrupt in England, Wales or Scotland.

But you might struggle to save up the money within your designated budget to pay for a holiday. During your bankruptcy, you’ll be given little money within your budget to save. It’s unlikely you will be able to save the full cost of a holiday while you live under these restrictions.

Can you go abroad when bankrupt in Northern Ireland?

There are different rules in Northern Ireland which prevent you from travelling abroad while you’re an undischarged bankrupt. It might still be possible, but you’ll need to tell your Official Receiver about your hopes of travelling abroad and apply for a “Leave of the Court” to allow it.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can you go on holiday when bankrupt if someone else pays?

Yes, if you’re bankrupt in England, Wales or Scotland and someone else is offering to pay for your holiday then you can go.

This is the more likely scenario as it would be hard to save for a holiday while living under bankruptcy restrictions.

What if you already booked a holiday abroad before going bankrupt?

Yes, if you had already paid for your holiday in full before going bankrupt then there is nothing stopping you from going abroad. Unless you’re bankrupt in Northern Ireland, in which case you’ll need permission to leave the country.

» TAKE ACTION NOW: Fill out the short debt form

Should you tell your OR you’re going abroad?

You’re not usually obligated to tell your Official Receiver that you’re going on holiday unless you’re going to be away for an extended period. You might choose to tell them anyway and provide proof about how the trip was funded or proof that someone else paid.

How does a UK bankruptcy affect foreign property and assets?

In the case of UK bankruptcy, all the debtor’s assets are considered assets that can be included within the bankruptcy, which includes property abroad.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can a discharged bankrupt travel overseas?

Yes, a discharged bankrupt can travel overseas.

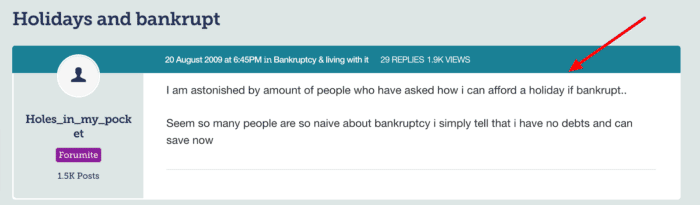

One forum user has outlined their experience of this situation:

Source: https://forums.moneysavingexpert.com/discussion/1894981/holidays-and-bankrupt

As the forum poster explains, it’s more likely that you have the ability to save and fund a holiday abroad after you’ve been discharged and can save more of your money without worrying about debts.

But you should still be conscious of any ongoing financial commitments, such as an Income Payments Agreement.

What are the common bankruptcy restrictions?

While you’re an undischarged bankrupt, you won’t be able to:

- Apply for credit of £500+ without informing the creditor that you’ve gone bankrupt

- Work in a position to set up or run a company without court permission

- Work in some professions

You’ll also need to provide timely updates to the Official Receiver about your income and any changes to your situation. Failure to keep the Official Receiver up to date or ignoring restrictions can have serious consequences.

Learn more about bankruptcy with MoneyNerd

We have multiple pages and guides dedicated to navigating bankruptcy. Find out more about this method of insolvency as a debt solution and answers to the most common bankruptcy questions now. We recommend starting your search on our bankruptcy ultimate guide page.