What Does Undischarged Bankrupt Mean? Quick Answer

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you feeling worried about your debts and wondering about bankruptcy? Many people feel the same way. In fact, over 170,000 people visit our website each month looking for guidance on debt solutions.

Our aim is to answer your questions and make you feel better about this tricky situation. That’s why, in this guide, we’ll explain:

- What bankruptcy really means

- How someone can become bankrupt

- How to figure out if bankruptcy is the right choice for you

- What it costs to apply for bankruptcy

- How bankruptcy can change your life and your credit file

We understand how hard it is to deal with debt; some of us have been there too. But remember, there’s always a way to solve every problem, even debt.

We’re here to help you understand your choices and feel more confident about your future.

What is an undischarged bankruptcy?

An undischarged bankruptcy is when your bankruptcy is still ongoing. In this situation, you are known as an “undischarged bankrupt” and you will have to continue to abide by any restrictions placed on you. You will still be required to make monthly payments during this stage as well.

In simple terms, if you have an undischarged bankruptcy, you are not yet free from your debts.

What is undischarged bankrupt and how long does it last?

Most people are an undischarged bankrupt for the standard 12 month period and are then discharged.

This happens in most cases – but not all.

Some remain undischarged for longer, usually because they did not comply with the restrictions placed on them by the Official Receiver. The Official Receiver will ask the court for a delayed discharge, also known as Suspension of Discharge.

The court can then issue a Bankruptcy Restriction Order (BRO) for a period between two and 15 years. This is quite rare and is only used when the debtor has been involved in fraudulent or reckless behaviour.

Can an undischarged bankrupt borrow money?

If you have an undischarged bankruptcy, the law states you cannot borrow more money. This is for your own financial protection.

Once you have been discharged, there are no legal limits on how much credit you can apply for. However, it will be extremely difficult for any person with a recent bankruptcy on their credit file to manage to convince creditors to lend them money. They will search your file before offering you a loan or credit card.

If you want to search your own credit history, you can do so for free online using the website of a credit reference agency. There may be a fee if you don’t cancel a free trial.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can undischarged bankrupts leave the country?

Undischarged bankrupts in England, Wales and Scotland can leave the country as long as it does not affect their ability to meet any repayments. But if you have an undischarged bankruptcy in Northern Ireland, you need to submit a special request to go abroad called a Leave of the Court.

You can ask for a Leave of the Court by contacting your Official Receiver. If you get this permission, there are additional conditions, such as informing the Official Receiver of your overseas address every two weeks (if applicable).

Are there any other options?

Deciding how to tackle your debt is a very personal decision and you certainly can’t get the answer through a simple blog post.

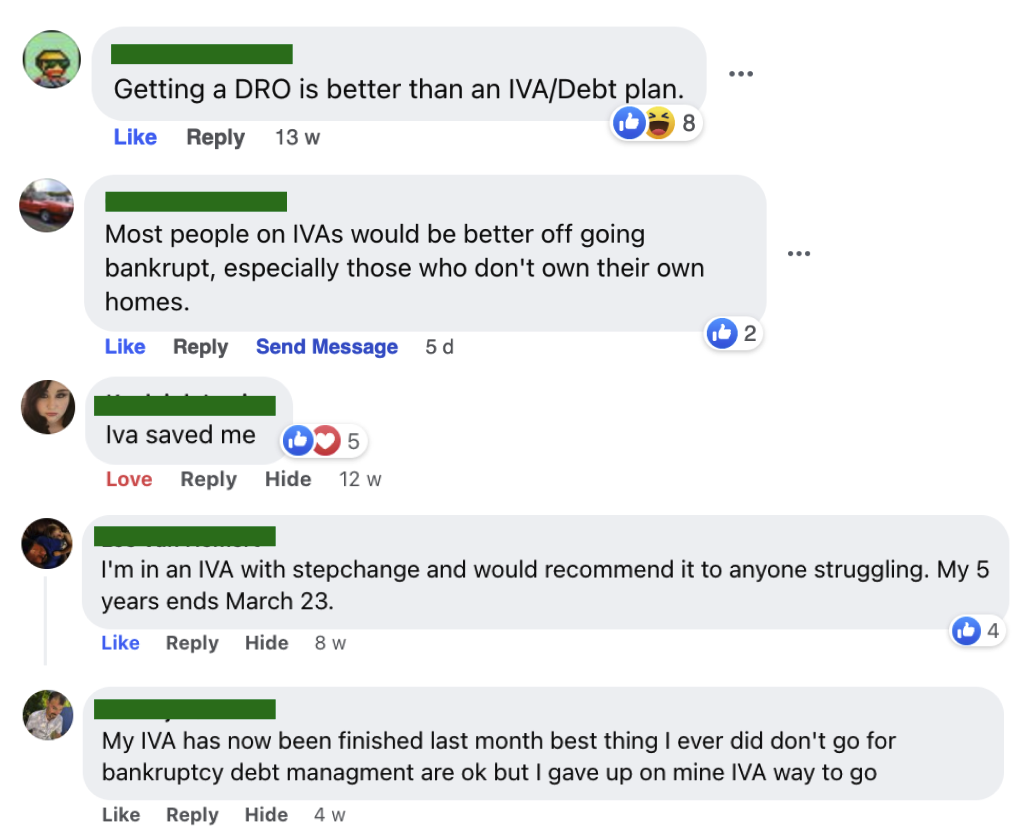

It’s made worse by the strong opinions you’ll often find online.

The best option is to get help from a debt expert to find out all your options and see which is right for you.

I’ve partnered with The Debt Advice Service and you can access their expert support by filling out the short form below.

Get help from The Debt Advice Service.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can an undischarged bankrupt be a company director?

If your bankruptcy has not been discharged, you cannot become a company director – and you cannot manage or promote a limited company business. You may be able to apply to the court for an exemption. You can begin your own business or side hustle later. Although you may not get any business loans to support you.

Other bankruptcy process FAQs

Are you an undischarged bankrupt?

We’ve covered the key details of undischarged bankruptcy and answered the most common questions.

For further support, reach out to a registered charity or read our other blog posts. Our website is packed with answers to common bankruptcy queries.