What Happens if You Don’t Pay a CCJ after 6 Years?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you wondering what happens if you don’t pay a CCJ after 6 years? You’ve come to the right place for answers. Every month, over 170,000 people visit our website for advice on debt and credit.

In this article, we’ll explain:

- What a CCJ is and how it can affect you.

- What can happen if you don’t pay a CCJ after 6 years.

- How a CCJ can change your credit report.

- What you can do if you have a CCJ.

- How you may be able to write off some debt.

We know it’s not easy dealing with a CCJ, and it’s common to feel unsure about seeking help. In fact, Citizens Advice revealed that 60% of adults facing financial difficulties hesitate to seek assistance.1

If that’s your case, don’t worry — you’re not alone. We’re here to help guide you through the process and help you find a way to clear your debt.

How Do I Know If I Have a CCJ?

What Happens if I Don’t Pay?

Debt Solutions Comparison

Dealing with debt can be challenging. But don’t worry, there are different debt solutions available that can help you ease your worries.

These are:

| Debt Solution | Description | Formality | Debt Type | Debt Range | Legally Binding | Impact on Credit Score | Asset Risk | Monthly Payment | Duration | Creditor Agreement Required |

|---|---|---|---|---|---|---|---|---|---|---|

| Debt Management Plan (DMP) | Agreement to pay back non-priority debts in one monthly payment. | Informal | Non-priority debts | Any amount |

No | Yes | No | Varies | Varies (until debt is paid) | No (but creditors must be informed) |

| Individual Voluntary Arrangement (IVA) | Agreement to pay back all or part of your debts over a set period. | Formal | All or part of debts | Usually over £10,000 | Yes | Yes | Possible | Fixed | Fixed period, usually 5-6 years | Yes (75% by debt value must agree) |

| Debt Relief Order (DRO) | Freezes debt for a year and be potentially written off. | Formal | Non-priority debts | <£20,000 debt | Yes | Yes | No | None during freeze | 12 months | No (court approval needed) |

| Bankruptcy | Legal status for those who cannot repay debts, potentially writes off debts. | Formal | Unmanageable debts | Any amount, typically high debt | Yes | Yes | High | None during bankruptcy | Usually 12 months, then discharge | No (court process) |

| Consolidation Loan | Taking out a new loan to pay off all existing debts. | – | Multiple debts | Based on loan amount | Varies | Yes | Depends on loan type | Fixed | Depends on loan terms | No |

| Payment Holiday | Temporary relief or reduced payments offered by creditors. | – |

short-term financial difficulties | Any | No | Yes | Low | Reduced or paused payments | Break of up to 6 or 12 months, depending on circumstances, payment history, and creditor’s policy. | No |

| Informal Negotiation | Direct negotiation with creditors for reduced payments or extended terms. | – | All debts | Any | No | Possible | No | Negotiable | Until agreement terms are met | No |

| Statutory Debt Repayment Plan (SDRP) | Plan to repay debts over a reasonable time, with protections from creditor action. | Formal | All debts | Varies | Yes | Yes | No | Fixed | Varies, based on ability to pay | Yes |

| Equity Release | Homeowners release equity from their home to pay off debts. | – |

Debts of homeowners, typically older individuals aged 55+ | Varies and depends on property value | Yes | Yes | Asset (home) is used as collateral | Varies | 8-10 weeks timeframe from application to fund disbursement. Lifetime; repaid on house sale/death. | No |

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can You Go to Prison for Not Paying?

What Happens if I Don’t Pay a CCJ After 6 years?

» TAKE ACTION NOW: Fill out the short debt form

What Happens to the Judgment That Were Issued After 6 Years?

Can I Set Aside My CCJ?

In some cases, you can set aside your CCJ.

This will remove it from the Register of Orders Judgements and Fines and your credit file.

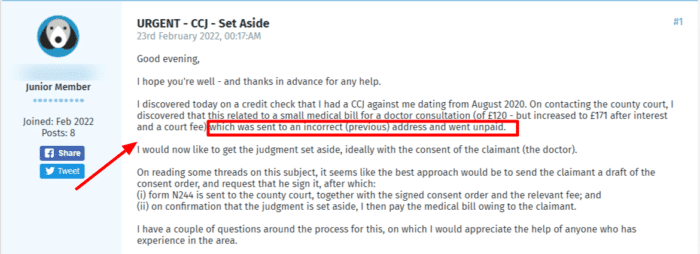

If your CCJ is a default judgement, where you couldn’t defend or acknowledge your creditor’s claims, you can apply to have it set aside.

You can also apply for it to be set aside if you couldn’t or didn’t attend the hearing if you had a good reason for your absence. Good reasons for non-attendance could be that your claim form was sent to the wrong address or that you weren’t given a month to pay off your debt.

Misdelivery of letters is quite common!

If you can show the court that you can successfully defend your creditor’s claims, you can have the CCJ set aside by issuing an N244 form.

You will also need to provide a draft defence and a witness statement.

If your application to set aside your CCJ is successful, it will be removed from the register immediately.

Will It Affect My Job?

Any CCJs will be visible on your credit report.

Fortunately, it’s not standard practice for employers to do credit checks on any prospective employees.

However, some roles will require a ‘fit and proper’ test. This includes most jobs in the financial services sector, legal professions, and some other career paths.

You will need to have a good credit history to pass this test.

Can I Rent if I Have One?

Unfortunately, you may find it difficult to find a rental property if you have an active CCJ. This is because CCJs are visible on public registers so your applications may be turned down.

Keep in mind that if your CCJ is more than 6 years old, it is not on your credit file so your prospective landlord can’t turn you down on this basis alone.

How do I Get Rid of a CCJ Without Paying?

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can Bailiffs Force Entry?

How Do I Prevent A CCJ?

Don’t want a CCJ? The easiest way to avoid one is to keep up with your debt repayments.

But this isn’t always possible!

If you can’t make your debt repayments, you can negotiate with your creditors to get a new payment plan. If your creditor agrees to a new payment plan, they can’t get a CCJ against you until they apply for legal enforcement measures.

Keep in mind that your creditors are under no obligation to accept your requests. If they don’t, the CCJ is not stopped!