Am I Entitled to My Husband’s Pension if We Separate? How Much?

Are you worried about how your money might be affected in a divorce? Are you looking for answers to questions, such as ‘Am I entitled to my husband’s pension if we separate?’ You’re not alone in your search. In fact, more than 8,700 people come to our website each month for guidance on this very issue.

We understand your concerns and are here to help you navigate through this challenging time. We know how daunting it can be to face financial fears whilst dealing with a separation.

In this article, we’ll cover:

- How to protect your money during a separation.

- The importance of declaring assets in a divorce.

- The definition of matrimonial assets and how they are divided.

- The rules around pension division in a divorce.

- The ways to secure your fair share.

Our team is made up of individuals who have personally experienced divorce. They can relate to your situation and are committed to providing the best advice to help you safeguard your finances.

So, let’s dive in and explore how to protect your finances during a divorce in the UK.

How to save money on divorce fees

How to save money on divorce fees

Divorces are hard to handle, but the financial repercussions can make a bad situation feel even worse.

The solution? Understanding your next steps and exactly how much they’ll cost.

For only £5, JustAnswer offers a trial chat with an experienced divorce solicitor. They can help you navigate the process and save you from costly face-to-face lawyer fees.

Chat below to get started with JustAnswer

Am I entitled to my husband’s pension if we separate?

Yes, you could be entitled to a portion of your ex-spouse’s pension if you get divorced. A pension is considered a matrimonial asset that must be considered as part of splitting assets and finances.

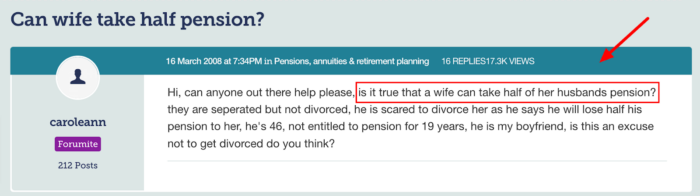

This is quite a common question, especially on online forums like this example:

Source: https://forums.moneysavingexpert.com/discussion/802523/can-wife-take-half-pension

One of the reasons that you may be entitled to some of your husband’s pension as part of a divorce is that you may have sacrificed your career within the marriage and, therefore, your own pension. This is common if you were a stay-at-home mum and looked after the children in the marriage while your husband progressed in their career.

Of course, it works the other way around as well. A stay-at-home dad could be entitled to their wife’s pension as part of a divorce, too. How a pension and other assets are divided is typically stated and agreed upon through the signing of a Financial Consent Order.

Does this include State Pension?

Your basic State Pension can’t be shared if your marriage or civil partnership ends. However, divorced couples can use their former spouse or civil partner’s National Insurance contributions to increase their basic State Pension if they reached State Pension age before 6 April 2016. This won’t reduce the amount of State Pension the other person gets.

If you have an additional State Pension, the court could order that this be shared between you.

A new State Pension system was introduced in April 2016, so anyone reaching their State Pension age after this date will be paid the ‘new’ State Pension. This can’t be shared if your marriage or civil partnership ends.

However, if you have a ‘protected payment’, the court could order that this is shared between you. A protected payment is an extra payment you might get on top of the full State Pension, typically because your entitlement under the old rules was higher.

You lose these rights if you remarry or enter another civil partnership before reaching your State Pension age.

Worried About Divorce Finances?

Divorce can be complicated, especially when it comes to navigating the cost. One small error could lead to serious consequences.

But, the support of a good solicitor can help you to understand your next steps.

For a £5 trial, JustAnswer’s online divorce solicitors can help you understand your rights and guide you towards the best financial solution for you.

In partnership with Just Answer.

How much of my husband’s pension can I claim in divorce?

The division of a pension will be based on personal circumstances. There are no fixed percentages when splitting matrimonial assets as part of a divorce.

Most people think the split has to be 50/50, but this isn’t always true. A 50% split is usually the starting point of negotiations, but the division of assets and finances just needs to be considered fair.

That being said, the length of a marriage is one of the factors that need to be considered. If the couple were married for a long time, a 50/50 split may be deemed the fairest outcome.

Consulting a pension advisor can be a good idea, especially when large pension assets are involved.

» TAKE ACTION NOW: Get legal support from JustAnswer

What is the formal process for agreeing how assets should be separated?

Once the divorcing couple has agreed on how assets and finances will be divided, the agreement is put into writing in a financial settlement. Only in Scotland is the financial settlement enough to make the agreement legally binding and ensure a clean break.

But in England and Wales, the financial settlement isn’t enough. It needs to be followed up with a Consent Order, which relays this information and is signed by a judge. A judge is only obligated to sign the Consent Order if he or she feels that the agreement is fair to both people.

A solicitor will usually be needed to prepare and submit the Consent Order to the court. This is why people who do a DIY divorce in England and Wales without legal services are at risk. What they agree isn’t binding, and one party could make a claim after the divorce.

Even though there is no financial aid for a divorce solicitor in England and Wales, there is financial aid to help with mediation services and a Consent Order when you’re on a low income.

Join thousands of others who got legal help for a £5 trial

Getting the support of a Solicitor can take a huge weight off your mind.

Reviews shown are for JustAnswer.

Can my divorced wife claim my pension if we never used a Consent Order?

If you live in England and Wales and got divorced without a Consent Order, your wife could claim a portion of the pension even after the divorce is finalised.

There is a well-known case whereby an ex-wife claimed a significant sum of money from their ex-husband 23 years after the divorce. The ex-husband had become extremely successful and wealthy, and she won a case in the Supreme Court for a life-changing sum of money.

Divorce Doesn’t Mean Financial Ruin

Legal advice can make all the difference when navigating the financial aspects of divorce, and affordable help is within reach.

Normally, the cheapest solicitors in the UK will put you back at least £130 per hour.

But, for a £5 trial, a divorce solicitor from JustAnswer can review your situation and provide personalised guidance. It’s a no-brainer!

Try it below.

In partnership with Just Answer.